Cryptocurrency markets rely on cryptocurrency exchanges for their support. These are portals through which traders trade, purchase, and exchange coins and tokens such as Bitcoin, Ethereum, stablecoins, and numerous new tokens. Exchanges are essential in that, without them, there would be no price discovery in crypto markets and no liquidity.

The crypto user base globally reached over 470 million individuals by mid-2025, as per industry estimates, and the United States remains among the biggest markets for trade activity. Crypto trading platforms are responsible for a mean trade volume in excess of $90 billion on a daily basis, and it gets fractured among centralized platforms (CEXs), e.g., Coinbase, and decentralized platforms (DEXs), e.g., Uniswap. Such bifurcation depicts how various kinds of exchanges will determine crypto adoption growth in the future.

Centralized vs. decentralized exchanges are a choice, not a preference, for American investors. Everything from the storage of assets to security, regulatory issues, and user-friendly crypto purchases by dollars all depend on it. Centralized ones lead in liquidity and access, and decentralized ones in privacy and control.

Here, we'll present the two main types of cryptocurrency exchanges, CEX and DEX, how they operate, their pros and cons, and what American traders need to know before making a decision. After that, you'll be well equipped with which type of platform works best with you and how well you fit into a style and degree of risk.

A cryptocurrency exchange is a website that provides individuals with a marketplace in which they can purchase, sell, and trade electronic money. These websites link sellers and buyers, establish market orders via demand and supply, and offer infrastructure to maintain crypto markets' liquidity. Without exchanges, it would be practically impossible for traders and investors to obtain coins such as Bitcoin, Ethereum, or stablecoins in an efficient manner.

Consider a crypto exchange as a stock exchange, but designed for virtual currencies. Rather than exchanging shares in companies, users trade cryptocurrencies or trade them in for fiat currency like the U.S. dollar. The overwhelming majority of crypto exchanges also offer resources such as trading charts, order books, and secure storage in the form of a wallet in order to facilitate dealings.

As of mid-2025, crypto exchanges handle in total billions of dollars worth of trading activity on a day-to-day basis, and are therefore among the busiest financial platforms on Earth. The activity is a combination of individual retail traders and institutional investors entering the exchanges in a bid to gain exposure to digital assets.

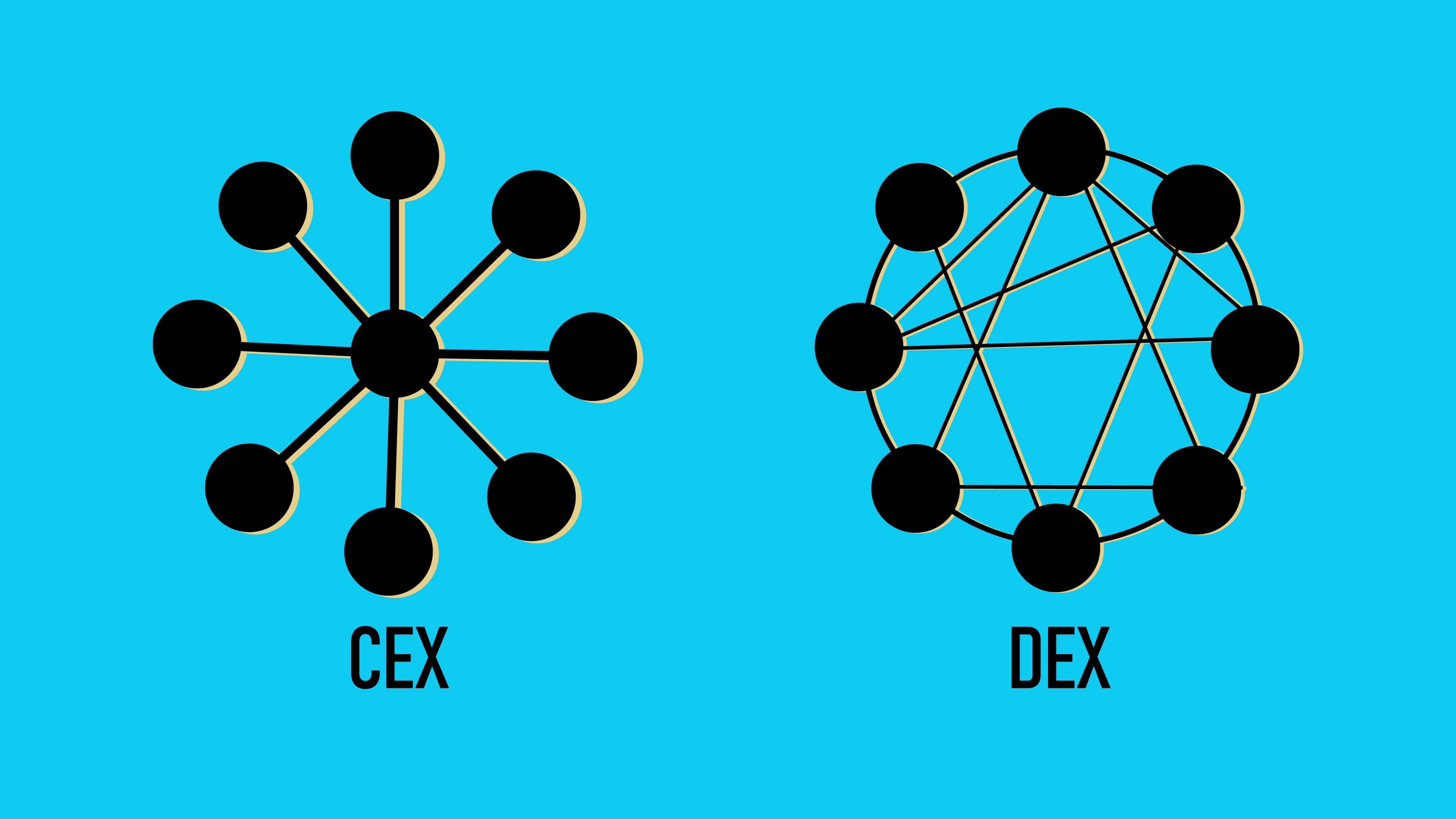

There are two general kinds of cryptocurrency exchangers:

Each has its advantages and disadvantages, and that is why it is necessary to be aware of the differences. It can assist American investors in making informed security, regulatory, and long-term decisions by knowing how both the DEXs and the CEXs operate.

If you are a starter, refer to our guide on crypto trading among U.S. investors.

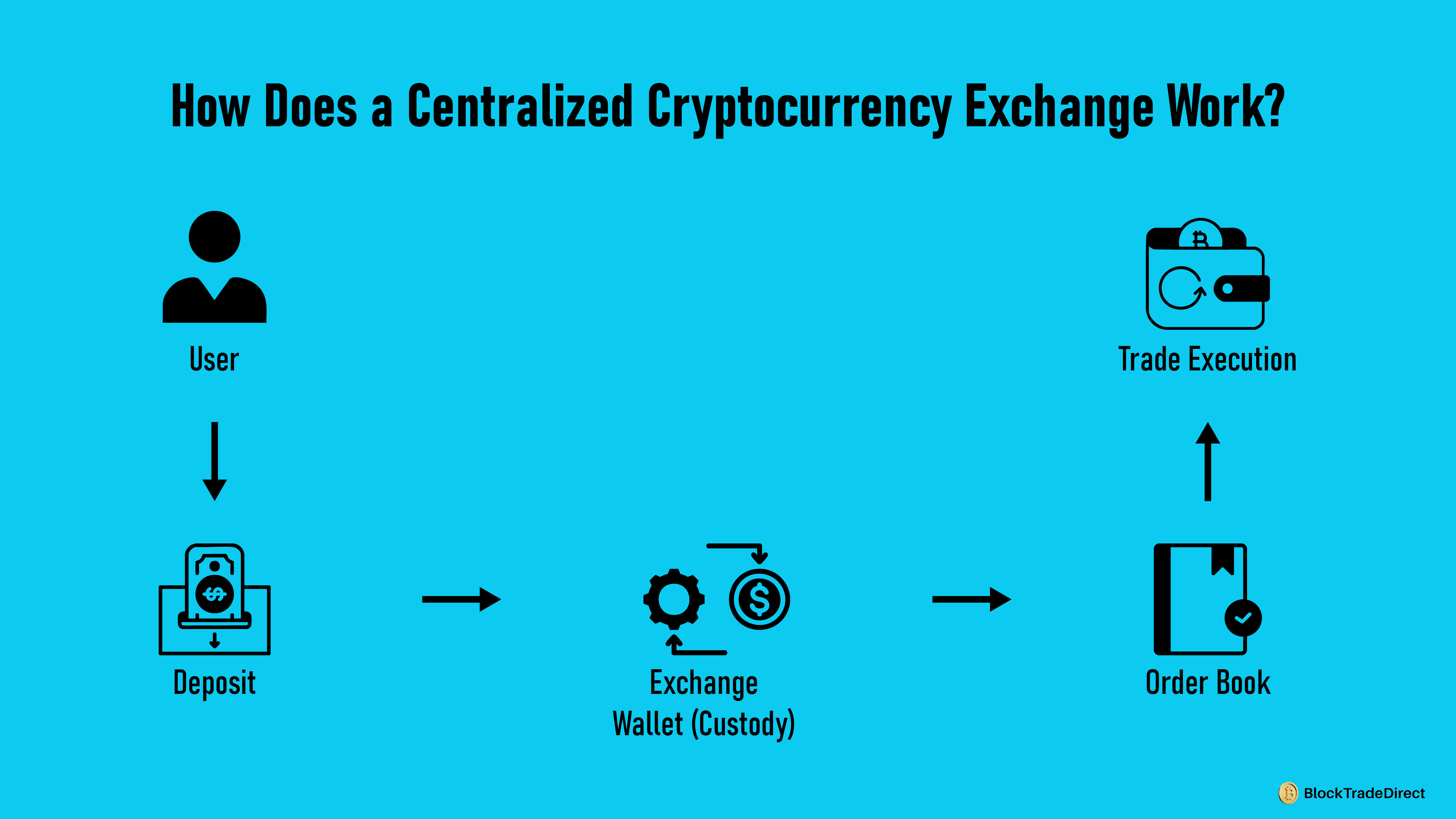

A centralized cryptocurrency exchange, or CEX, is a business-run platform that matches buyers and sellers. Rather than directly trading with someone, order book sites are utilized by users, and the platform matches orders through its software. Some popular ones in the United States are Coinbase, Binance.US, and Kraken.

As of 2025, centralized platforms are still handling over 70% of worldwide crypto trading volume and thus remain the most popular entry point among investors. Centralized platforms offer the comfort of classical financial services in the form of user-friendly interfaces, customer support, and fiat on-ramps, through which investors can convert their dollars into crypto.

Centralized exchanges are dependent on a few essential elements:

Centralized venues remain the favorite among first-time entrants and institutions lured by convenience and depth of markets. The trade-offs in regulatory and custody, however, are compelling experienced traders to look at decentralized venues.

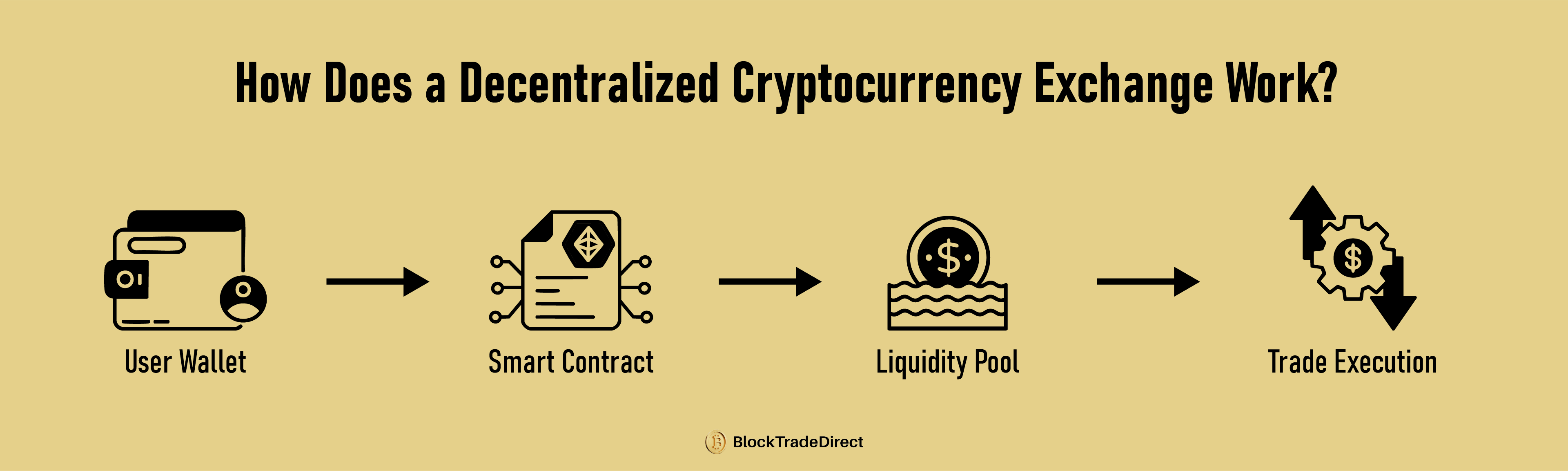

A decentralized crypto exchange, or DEX, is a person-to-person trading platform that does not depend on a central authority. Instead of counting on a company to manage transactions, exchanges happen directly by individuals through smart contracts on the blockchain. Some popular ones are Uniswap, PancakeSwap, and Curve.

As of mid-2025, DEXs contribute to close to 25–30% of worldwide crypto trading volume, a sharp increase from fewer than 10% in the previous five years. Their adoption is driven by the need for privacy, transparency, and user authority in response to well-publicized centralized exchange breakdowns.

Unlike CEXs, DEXs do not use traditional order books. They rely on blockchain technology to handle transactions automatically. The main components include:

The emergence of DEXs is part of a larger decentralizing trend in finance. Following the kinds of centralized exchange failures that occurred with FTX and regulatory actions, investors are generally attracted to platforms on which they retain possession of their funds. Indeed, total value locked (TVL) in decentralized exchanges reached well over $90 billion in mid-2025, demonstrating widespread faith in the model.

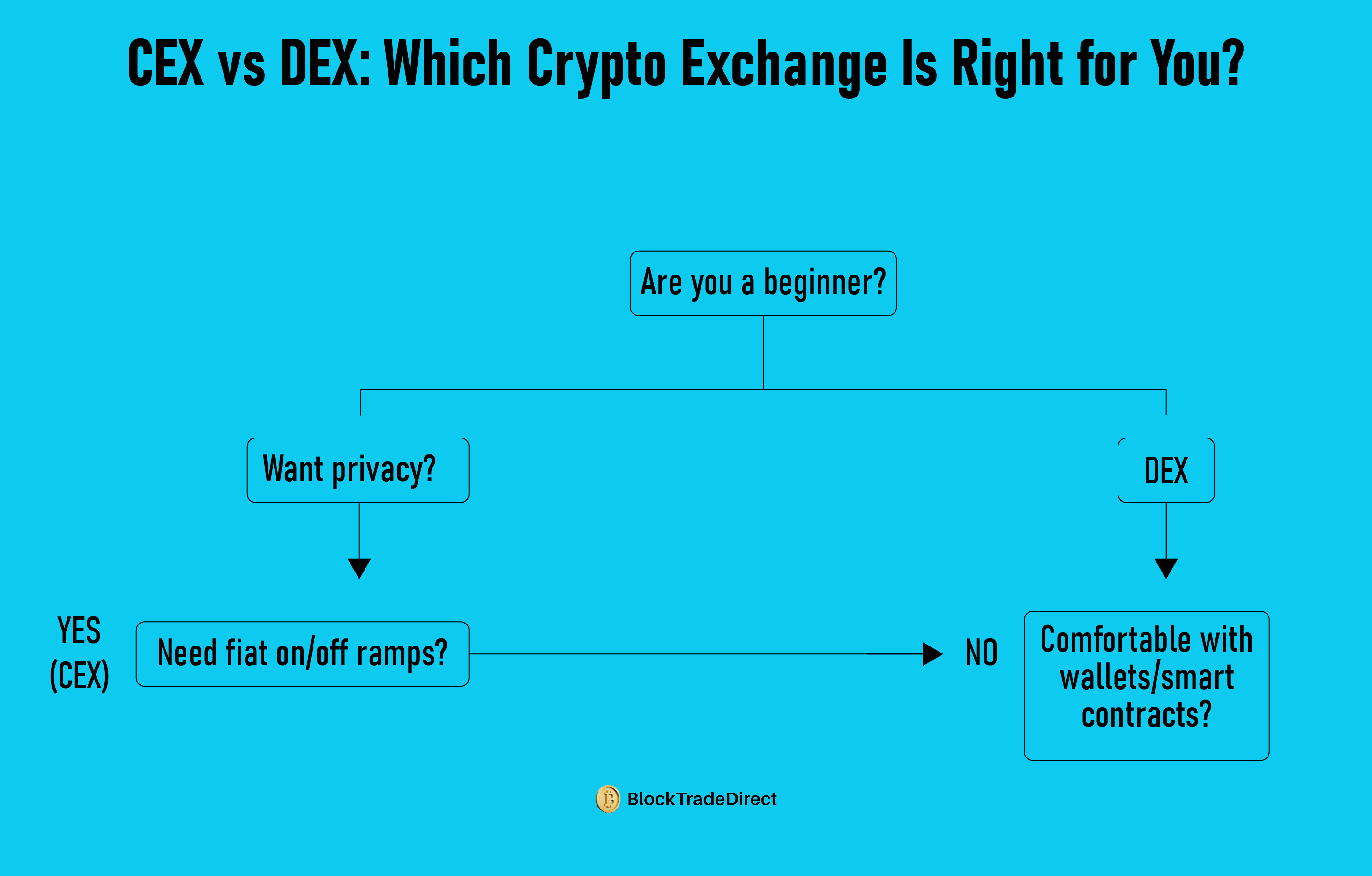

In the case of American traders, whether or not to choose a DEX usually depends on the amount of risk and tech-savviness. Decentralized ones are usually a preference if privacy and self-control are a priority, or centralized if a user is a novice.

Centralized and decentralized exchanges are identical in what they do, enabling crypto trading, but they work in a fundamentally different way. Key differences include asset custody, liquidity, regulation, and user interface.

These differences affect, in the case of U.S. investors, not merely convenience, but security, compliance, and risk exposure.

|

Features |

Centralized Exchange (CEX) |

Decentralized Exchange (DEX) |

|

Custody of Assets |

Exchange controls user funds; private keys held by the platform |

Users keep control of their private keys |

|

Liquidity |

High liquidity; easier to trade large amounts |

Lower liquidity varies by token and pool |

|

User Experience |

Beginner-friendly, customer support, and mobile apps |

Complex for beginners; requires wallet setup |

|

Transaction Speed |

Fast order matching through exchange servers |

Dependent on the blockchain network speed |

|

Regulation |

Subject to U.S. laws, SEC, FinCEN, and IRS oversight |

Limited regulation; harder for authorities to enforce |

|

KYC/AML |

Mandatory identity verification |

Typically, no KYC, allowing anonymous trading |

|

Security Risks |

Hacks, bankruptcies, mismanagement (custody risk) |

Smart contract bugs, liquidity pool exploits |

|

Fiat On/Off Ramps |

Direct conversion between USD and crypto |

Rarely available; usually requires CEX for fiat |

|

Fees |

Trading and withdrawal fees vary by platform |

Network gas fees plus swap fees in liquidity pools |

|

Innovation |

Tokens listed after regulatory vetting |

New tokens often debut here first |

None is completely superior. All depends on trading targets, how risk-tolerant you are, and whether or not you prioritize convenience or decentralization.

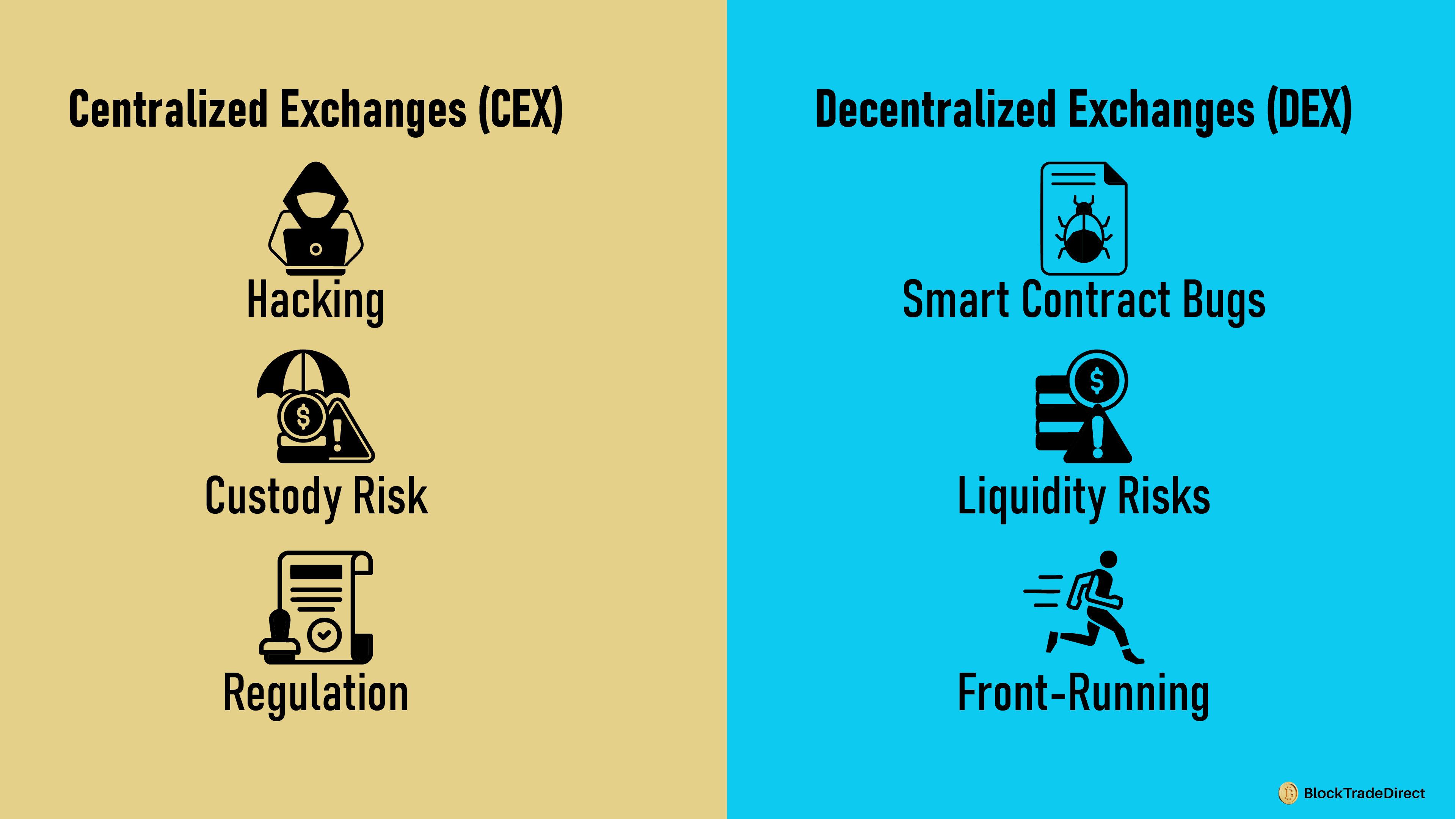

Security remains the most significant concern among crypto traders in 2025. Hacks, scams, and smart contract breaches have stolen billions of assets in the past decade. Centralized and decentralized exchanges are trying to provide a safe trading platform, but are faced with threats that are qualitatively and significantly different.

Neither CEX nor DEX is safer than a basic property. Rather, it presents various risks:

For U.S. traders, a blended approach is common, using CEXs for fiat on-ramps and liquidity, then moving funds to DEXs or self-custody wallets for long-term storage.

For more practical tips, check out our guide on safe crypto trading in the USA.

Cryptocurrency regulation in the United States is complex and continues to evolve in 2025. Centralized and decentralized exchanges face very different levels of oversight, which shapes how investors interact with them.

Centralized platforms operate under the same legal framework as traditional financial institutions. Key points include:

This heavy oversight increases compliance costs but provides investors with stronger consumer protections and clear recourse in case of disputes.

Decentralized exchanges exist in a regulatory gray area. Because DEXs operate without a central authority or corporate entity, U.S. regulators face challenges enforcing compliance. Key characteristics:

For U.S. traders, centralized exchanges offer compliance and investor protections but come with strict identity checks and reporting obligations. DEXs provide greater freedom and anonymity, but with fewer safeguards if something goes wrong.

With so many options available in 2025, deciding between a centralized exchange (CEX) and a decentralized exchange (DEX) depends on your trading goals, experience level, and risk tolerance. There isn’t a single best platform for everyone; each model serves different types of investors.

Many U.S. traders combine both. A common strategy is to use a centralized exchange for buying crypto with dollars, then transfer assets to a DEX or a private wallet for trading and long-term storage. This approach balances convenience with control.

Choosing between CEX and DEX comes down to what matters most to you, whether that’s compliance and ease of use or privacy and control. Evaluate your goals before committing, and remember that risk management should always guide your decision.

For more guidance, check out our detailed resource on protecting your crypto investments.

Centralized and decentralized exchanges each play a vital role in today’s crypto market. Centralized platforms dominate in liquidity, regulation, and user experience, making them the first choice for most newcomers and institutions. Decentralized platforms are growing quickly, offering privacy, transparency, and direct asset ownership for traders who value control.

The truth is, there is no one-size-fits-all answer. A centralized exchange might be best if you’re just starting out or need seamless access to U.S. dollars. A decentralized exchange could be the better choice if you want full custody of your crypto and access to tokens before they hit mainstream platforms. Many investors end up using both, taking advantage of the strengths of each.

Whichever path you choose, always prioritize security. Research platforms before depositing funds, use hardware wallets for long-term storage, and stay updated on regulations that affect U.S. traders.

Smart crypto trading is less about choosing the “perfect” platform and more about managing risks wisely. Always remember: protecting your assets should come before chasing profits.

The key difference is custody. Centralized exchanges hold user funds and act as intermediaries, while decentralized exchanges let users trade directly from their wallets through smart contracts.

Neither is absolutely safer. CEXs are regulated and offer institutional-grade security but carry custody risks if the platform is hacked or mismanaged. DEXs give users full control of their assets but face smart contract vulnerabilities and liquidity risks.

Yes, U.S. traders can access DEXs since they are open-source and globally accessible. However, because they operate in a regulatory gray area, users do not have the same legal protections they would get from regulated centralized platforms.

Most DEXs do not require KYC verification, allowing anonymous trading. This is one of their main appeals, but also a reason regulators are paying closer attention to decentralized platforms.

DEXs eliminate the risk of losing funds to an exchange collapse since users keep their private keys. However, they introduce new risks such as smart contract bugs and lower liquidity. Safety depends on the platform, the user’s security practices, and the type of assets being traded.

For centralized exchanges, check if the platform is registered with FinCEN and complies with SEC and IRS rules. Look for licensing requirements like New York’s BitLicense. For DEXs, research the project’s code audits, developer reputation, and community trust before using it.