Automation has sneaked into a lot of contemporary finance, and crypto trading is no different. What began with rudimentary exchange APIs has evolved to full-fledged ecosystems of trading bots that trade strategies quickly than a human can. Of these tools, the Telegram trading bots have found a niche for themselves. They benefit from the speed of automation combined with the usability of a messaging app that many traders already use every day.

In 2025, Telegram had over 900 million monthly users, and crypto channels are still among the most active. Trading bots constructed within Telegram capitalize on these users by allowing traders to handle portfolios, duplicate trades, and set automated strategies without ever exiting the application. Applications such as Banana Gun, Maestro, and Unibot have demonstrated how rapidly bot use can grow, with some processing billions of dollars in trading volume in 2024 alone.

For the individual investor, this is significant. A Telegram crypto bot can perform mundane tasks such as placing buy and sell orders, monitoring market movement, and even notifying you of price action in real time. Meanwhile, the emergence of these bots has created a new set of questions: How do trading bots really work? Are trading bots secure? And what are the dangers that must be avoided prior to using them?

This guide will break it all down. You’ll learn how crypto trading bots function, why Telegram has become their home base, what features matter most, and how to use them safely.

Fundamentally, trading bots are computer programs that trade for you automatically. In cryptocurrency, they directly connect to exchanges via APIs so they can trade, sell, or modify positions according to your instructions. Rather than spending all day gazing at charts, you can leave an algorithm to perform drudge work and respond to price movements in real time.

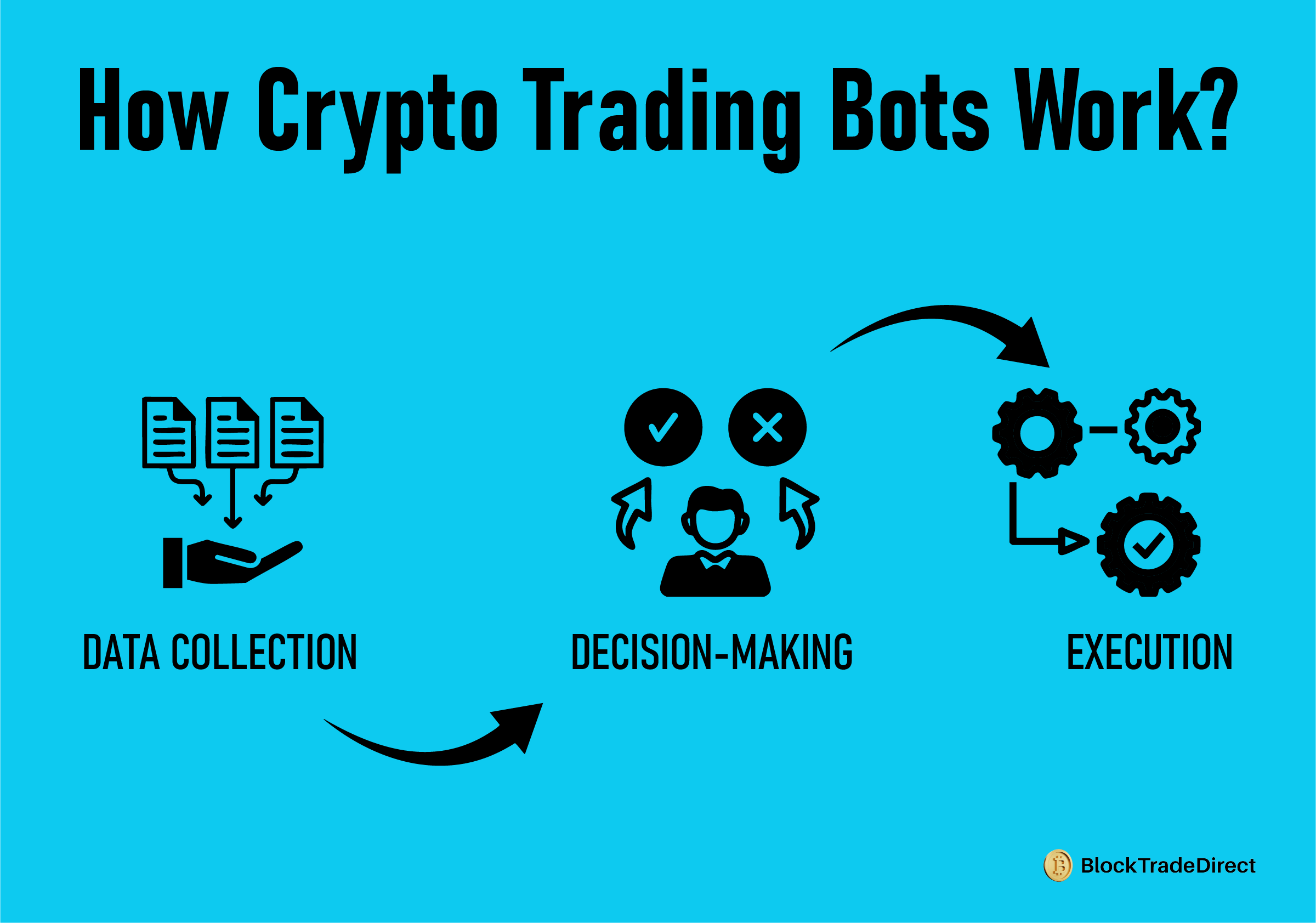

A crypto trading bot operates in three primary steps:

This agility and reliability make them formidable, particularly in the 24/7 crypto economy where chances tend to come and go swiftly.

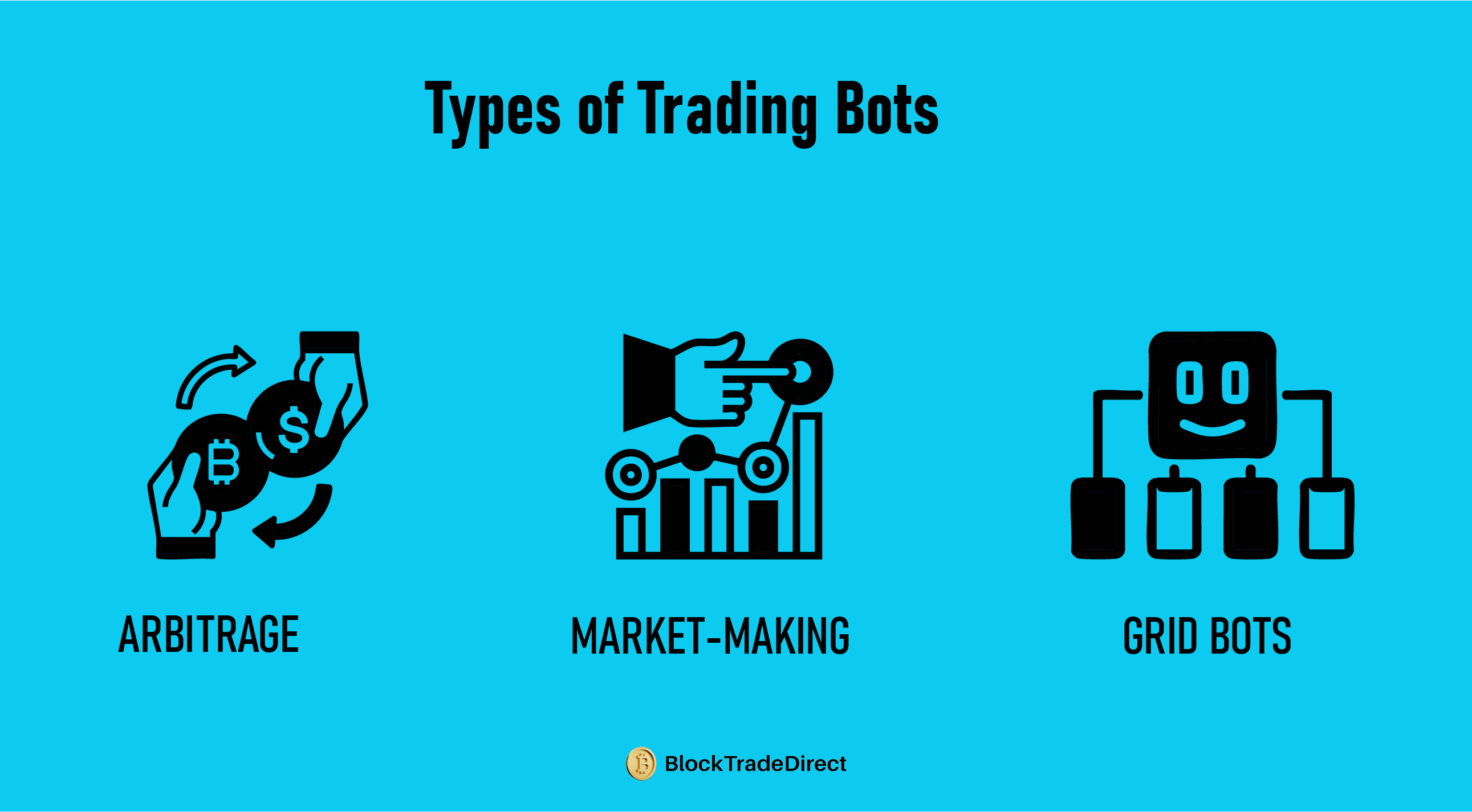

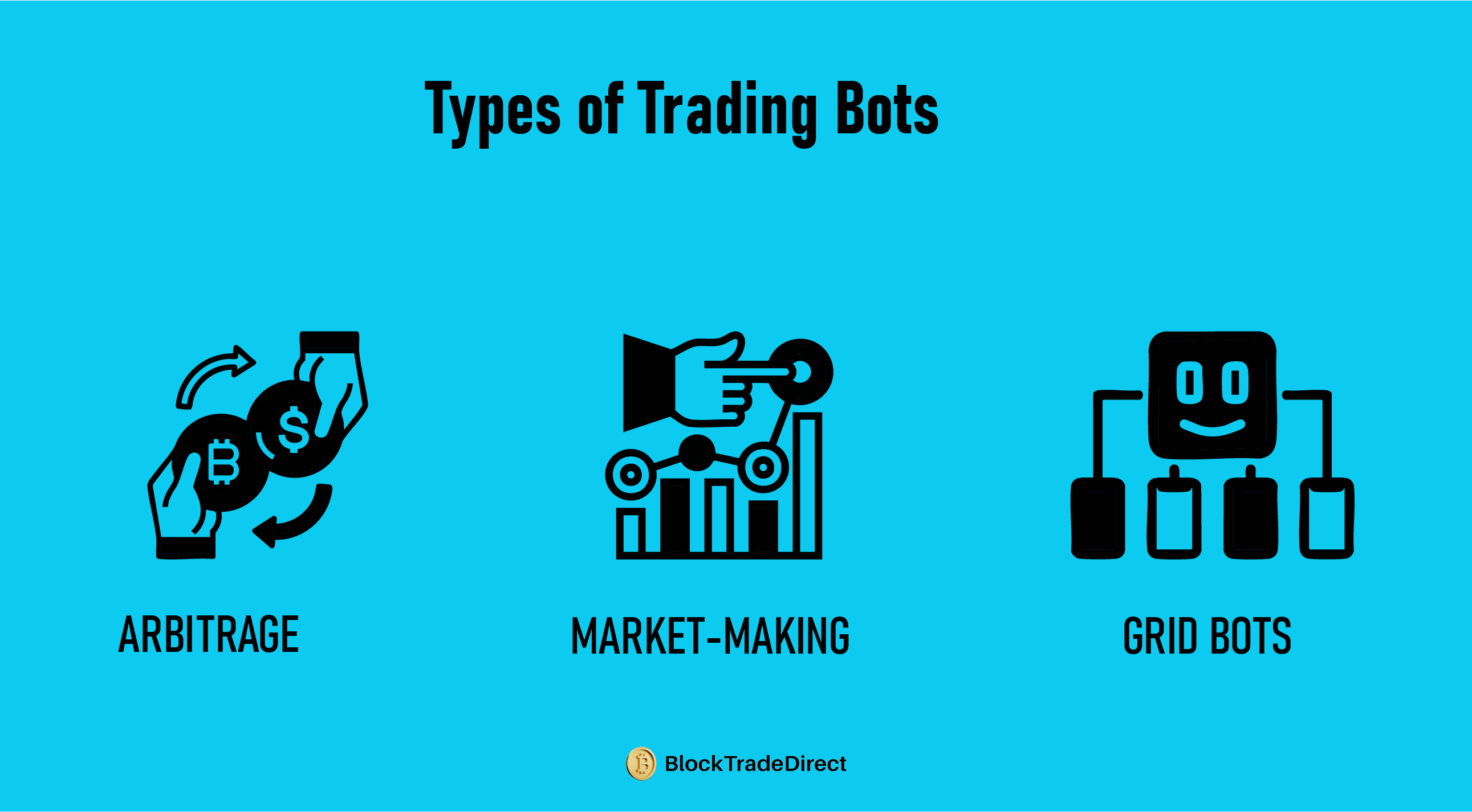

Not all bots are created for the same task. Some of the most popular ones are:

|

Type of Bot |

How it Works |

Example Use Case |

|

Arbitrage Bots |

Exploit price differences between exchanges |

Buy Bitcoin at a lower price on one exchange and sell it higher price on another |

|

Market-Making Bots |

Continuously place buy and sell orders to provide liquidity |

Earn small profits on spreads in high-volume tokens |

|

Trend-Following Bots |

Trade based on momentum indicators like moving averages |

Ride uptrends by buying early and selling when momentum fades |

|

Grid Bots |

Place orders at set price intervals |

Capture gains in sideways markets by buying low and selling high repeatedly |

By 2025, it's projected that more than 65% of crypto trading on leading centralized exchanges is automated to some degree on a daily basis. This indicates that trading robots aren't specialized tools anymore—they're now becoming the norm for retail and professional traders alike.

If you've ever spent any amount of time in crypto circles, you understand Telegram is where the majority of the action resides. From project announcements to trading groups, it's the application of choice for live discussion. That same ecosystem has lent itself to becoming the natural fit for trading bots.

Telegram has an open API that developers can use to create bots within chats directly. That is, a trader doesn't have to multi-task with multiple apps or log in to exchanges—buy, sell, or monitor prices within a Telegram window. It's quick, easy, and integrated into behavior traders are already accustomed to.

Some of the principal benefits are:

A number of bots have topped the market in the last two years, with some achieving mainstream use. Some of the most popular ones include:

|

Bot |

Known For |

Key Feature |

|

Unibot |

One of the earliest big Telegram trading bots |

Fast swaps for Ethereum tokens |

|

Banana Gun |

Huge user base in 2024–25 |

Copy trading and advanced order types |

|

Maestro |

Popular among retail traders |

Snipe new token launches instantly |

|

ChaiGPT Bot |

AI-powered assistant |

Combines market analysis with trading execution |

Cumulatively, these bots handled billions of dollars' worth of transactions in 2024, and usage continues to expand through 2025 as more and more traders seek speed and ease.

In contrast to independent platforms, Telegram bots combine social interaction and execution all in one. Traders can make strategy decisions in a group chat and then carry out trades through the same interface. That mix of community along with automation is what's driving Telegram's bot trading supremacy now.

Not every Telegram crypto bot is created equal. Some are built with strong security and useful tools, while others are rushed projects or outright scams. Before trusting any bot with your funds, it’s worth knowing what separates the reliable ones from the risky ones.

This is the biggest concern for most traders. A good Telegram trading bot should:

If a bot is requesting complete control of your exchange account, that's a red flag.

The top bots don't need coding knowledge. They should have the following features:

A good crypto bot Telegram platform should enable you to customize strategies according to your trading style. Examples are:

Numerous Telegram channels integrate bots in-built. For instance, you may be part of a trading telegram group where the bot sends signals, and with one click, you could replicate the trade. Such integration of community and automation is among the reasons bots have propagated so quickly.

Tip: When trying out a new bot, start with small amounts to ensure it works effectively. If it works as intended and security appears good, you can go large-scale.

Bots can simplify life, but they're not riskless. In addition to market volatility, you also have to keep an eye out for security risks and scams directed at Telegram bot users.

They have the potential to be effective, but only when used correctly. A bot in and of itself isn't harmful—what is dangerous is how it's implemented and who created it. In 2025, crypto-related scams on Telegram increased by almost 30% from 2023, much of that associated with phony bots.

If you choose to use a crypto bot Telegram tool, remember these guidelines:

A good bot should seem open. If it seems secretive or in a hurry, trust your gut and leave.

It's typically easier to set up a Telegram trading bot than people think. The majority of the effort boils down to linking your exchange account and selecting a strategy compatible with your trading style.

Partially free bots with limited functionality and bots with a subscription or small fees per trade exist. Here's a brief comparison:

|

Option |

Pros |

Cons |

Best For |

|

Free Bots |

Easy entry, no upfront cost |

Limited features, often slower support |

Beginners testing the waters |

|

Paid Bots |

Advanced strategies, better security, faster execution |

Subscription cost or trade fee |

Serious traders who want customization |

Most top bots support major exchanges directly:

If you’re just starting, a good approach is to pick one exchange you’re already comfortable with and link it to a beginner-friendly bot.

Trading bots have moved from being niche tools to becoming a core part of how the crypto market operates. Looking ahead, their role is only going to expand as technology and regulation catch up with demand.

In 2025, more bots are integrating artificial intelligence to analyze patterns, process news sentiment, and adapt strategies in real time. Unlike simple rule-based bots, AI-driven tools can adjust to shifting market conditions without manual input. This makes them especially attractive in volatile markets where static strategies often fail.

Bots are no longer confined to centralized exchanges. Numerous Telegram cryptocurrency bots now integrate with DeFi protocols, allowing traders to automate swaps, liquidity provision, or yield farming. Cross-platform bots handling both CEX and DEX activity are becoming the norm, providing users with an integrated means of executing strategies across ecosystems.

Regulators are taking notice. In 2024, the EU and America launched talks on how to define automated crypto trading, with draft regulations in 2026. If it follows the trajectory of conventional finance, bots will be subject to transparency requirements and security audits. That could be good for traders in terms of fewer scam projects, but less pleasant in terms of tightened onboarding.

By the second half of 2025, experts count more than 70% of crypto high-frequency trading as already automated, with retail usage of Telegram bots still on the rise. As bots mature to merge AI insights, community support, and multi-exchange support, they'll most probably transition from optional tools to a standard approach for anyone trading at scale.

Telegram trading bots have rapidly transitioned from an experiment to a mainstream component of crypto investing. They offer investors speed, convenience, and functionality that were once the province of pros. But they require vigilance as well. The same attributes that enable them to be potent—API access, automation, and community integration—also make them tempting targets for fraudsters.

If you want to utilize a crypto bot on a Telegram platform, the best practice is to begin modestly, test cautiously, and never provide a single permission more than required. Provided you take the necessary precautions, bots can save your time, implement strategies more reliably, and respond to a market that never closes.

As trading is redesigned by AI and automation, bots will just keep on getting more mainstream. Getting familiar with how they function now sets you ahead tomorrow.

Next step: Investigate reputable tools, use a trading guide, and research popular cryptocurrencies that such bots will be designed to trade.

A crypto trading bot is a computer program that employs algorithms to make trades on your behalf automatically. Rather than getting engaged in buying or selling yourself, the bot gets connected to an exchange using API keys and executes rules or strategies you have predetermined.

They can, but only if used judiciously. Safe bots never request withdrawal permissions, are supported by genuine communities, and possess clear track records. The greatest dangers are presented by scam bots on Telegram that impersonate well-known names. Always test with small amounts.

Most trading bots operate as separate platforms or desktop applications. A Telegram crypto bot operates within the Telegram application, where you can initiate trades, send alerts, or replicate strategies using chat commands. It's quicker and more engaging, but with added security implications.

Verify security (API key limiting), user-friendliness, customization, and community standing. If a bot has good user feedback, active support, and listings with large exchanges such as Binance or Coinbase, it's generally a safer bet.