The crypto market is going to new heights, but the question remains: what do you do when you require cash and you are unwilling to sell your bought Bitcoin or Ethereum? You are not. In January 2025, it was reported that 28 percent of adults in the United States own cryptocurrencies, and 67 percent of those who currently hold crypto are looking to purchase additional assets. Most holders are in a similar predicament of whether to sell their assets or miss opportunities.

Cryptocurrency loans solve this problem. Instead of selling out on your crypto and having to lose out on any value growth in the future, you can borrow against it. This strategy will enable you to be in a position in the market and yet be liquid.

Here, you will learn how crypto loans work, why they are superior to selling, and where to find the sites with the best terms. As well, we are to comment on the risks, tax consequences, and help you decide if borrowing against crypto is suitable in the given case.

A cryptocurrency loan allows you to obtain funds, typically in fiat currency or stablecoins, while using your digital assets as security. Think of it like a secured loan from a traditional bank, except your Bitcoin or Ethereum backs the loan instead of your house or car.

Here’s how crypto loans differ from conventional lending:

Selling crypto to get cash generates three big issues that borrowing resolves.

Steer clear of capital gains taxes when you sell crypto for a profit, the profits are taxable. With Bitcoin prices possibly hitting $150,000 to $185,000 in 2025, tax bills for the profit could be steep. Taking out a loan using your cryptocurrency is not considered a taxable event, allowing you to keep a larger portion of your assets.

Hold your long-term position—most crypto owners feel that their holdings will keep on appreciating in the long run. Selling makes you have to time the market exactly or lose out on subsequent gains. Borrowing allows you to access cash without selling.

Manage market volatility more effectively, as crypto markets are fast-moving. Selling during a momentary dip locks in losses, but borrowing provides you with the ability to sit tight and wait for improved market conditions. You can pay back the loan when prices stabilize or you have alternative sources of revenue.

This approach suits Bitcoin holders best who treat their crypto as a long-term value store instead of money that should be spent.

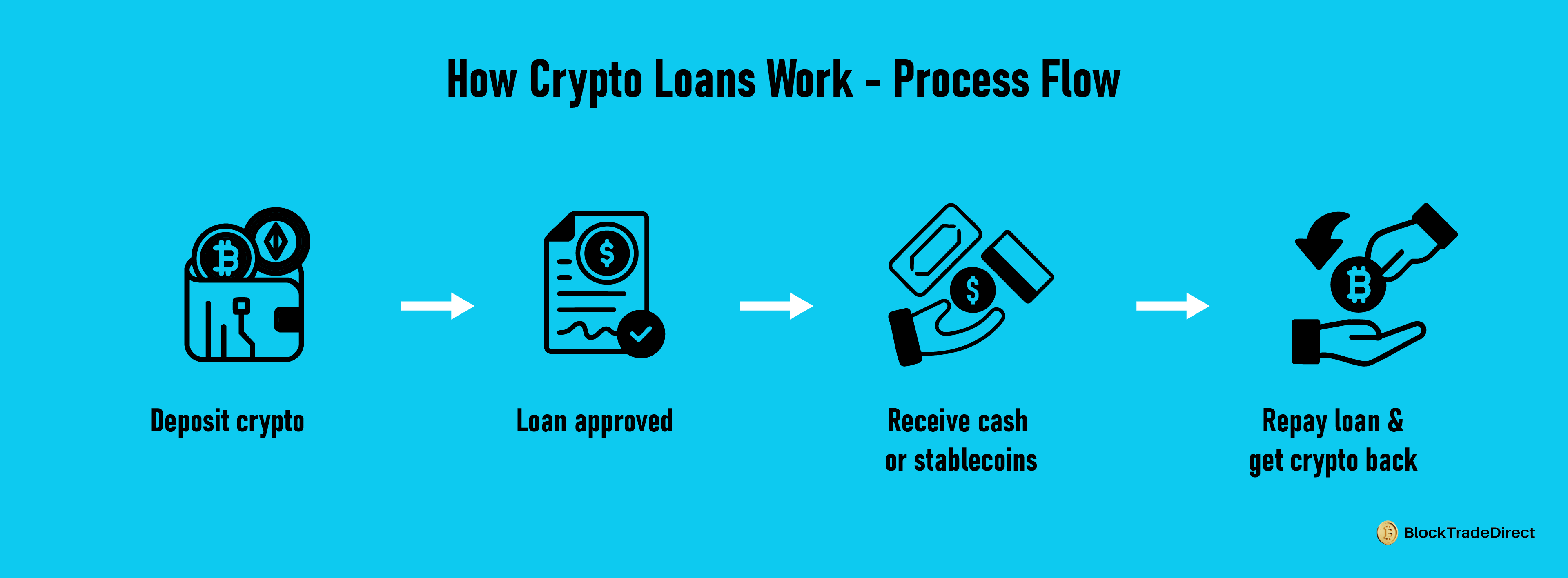

Obtaining a crypto loan is as easy as five simple steps:

1. Select your lending platform: Compare platforms on the basis of interest rates, accepted cryptocurrencies, loan-to-value rates, and security measures. Some popular ones include Aave, Nexo, and conventional platforms venturing into crypto.

2. Move your cryptocurrency: Send your crypto to the wallet or smart contract associated with the platform. This will be your collateral. The majority of platforms ask you to deposit a lot more than you are looking to borrow.

3. Choose the amount you wish to borrow and the duration of the loan. Today's Bitcoin loan interest rates begin slightly more than 1%, but different cryptocurrencies will have varying interest rates.

4. Get your funds: The site transfers stablecoins such as USDC or USDT to your wallet or makes a deposit in fiat currency into your bank account.

5. Manage your position: Keep an eye on your collateral value and loan-to-value ratio. Top up collateral if necessary to prevent liquidation.

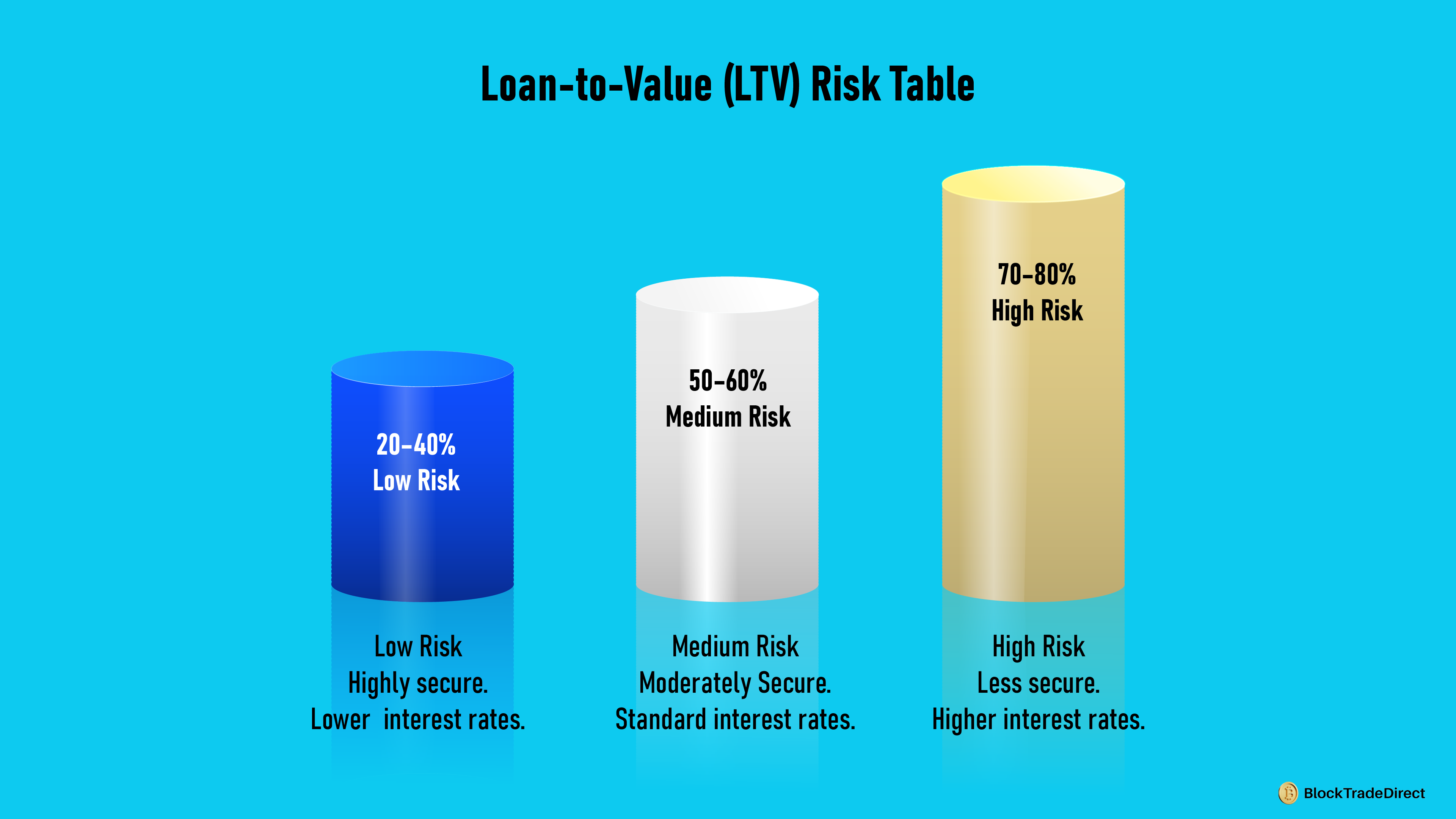

LTV refers to the proportion of the value of your collateral that you are eligible to borrow. Common ratios:

|

LTV |

Risk Level |

Notes |

|

20 - 40% |

Low |

Less risk of liquidation if prices drop |

|

50 - 60% |

Medium |

Balanced borrowing power vs. safety |

|

70 - 80% |

High |

Higher risk of liquidation during volatility |

Example: If Bitcoin is trading at $80,000 and the LTV limit is 50%, posting 1 BTC as collateral lets you borrow up to $40,000. If the price of BTC experiences a significant drop and your loan-to-value (LTV) ratio surpasses the platform’s limit, some of your collateral could be liquidated to ensure the loan is covered.

Pro Tip: Choose an LTV that gives you a buffer against market swings. In volatile markets, a conservative LTV can prevent forced liquidation.

By following these steps and monitoring your collateral, you can tap into crypto’s value without selling it—and without missing potential upside.

The majority of the sites offer loan-to-value (LTV) in a span of between 25 and 75 percent. Assume that you place your $10,000 Bitcoin with a Loan to Value (LTV) of 50 percent. Then you may borrow up to 5,000, with a 50 percent LTV. Some of the locations offer high levels of loans to value as high as 90 percent, but these come along with greater liquidation risk.

The reason is that the lower the LTV levels, the more it is a protection against market fluctuation, and the more collateral it requires, where there is a specified loan amount.

Some types of cryptocurrencies cannot be used as collateral. Lending platforms usually accept established cryptocurrencies like Bitcoin, Ethereum, and the most popular altcoins. Older or safer tokens will either not be accepted or require additional collateral. Your biggest risk is with liquidation levels. As soon as the value of your collateral falls to some level, it will automatically be liquidated by the platform in order to pay off the loan. This protects lenders but will penalize borrowers in a market crash.

What occurs in a market decline:

Over-collateralization insulates you - Most profitable crypto borrowers put 150% to 200% of the loan value as collateral. This buffer can endure standard market fluctuations without initiating liquidation.

The crypto crash in 2022 was a hard lesson for many borrowers about liquidation risk. Platforms that were supposed to be secure instantly sold huge amounts of collateral when prices collapsed rapidly.

Cryptocurrency borrowing (as opposed to borrowing against crypto) has other purposes and operates differently. When you borrow crypto outright, you get tokens that you have to pay back later, usually with interest.

Typical use cases are:

This is a distinct difference from crypto borrowing because you're working with the cryptocurrency itself and not using it as collateral for stablecoins or fiat. The risks and rewards are different, and it usually takes more advanced trading understanding.

The landscape of crypto lending was revolutionized after a series of high-profile platform collapses in 2022. Here’s a summary of what has endured and what is gaining popularity:

Decentralized platforms such as Aave provide transparency in the form of smart contracts. Aave yields range from around 1% to 3% currently, and you have greater control over assets. You must be knowledgeable about DeFi mechanics and gas fees, though.

Centralized platforms have friendly interfaces and customer support. Nexo offers up to 16% APR on deposits and instant loans, but you're leaving a company in charge of your collateral.

Legacy financial institutions are venturing into crypto lending. They tend to have greater regulatory compliance and insurance, but perhaps lower returns or higher requirements.

What to consider when selecting:

Emerging trends in 2025 include integrated crypto banking services and platforms that combine lending with other financial products. The value of the cryptocurrency market currently stands at around $44.29 billion, with projections indicating it could reach approximately $64.41 billion by 2029, leading to increased involvement from institutional investors.

Crypto taxation gets complicated, but borrowing generally works in your favor compared to selling.

Taking out a loan is not considered taxable—you're not incurring a tax liability when you borrow against your cryptocurrency. You're not selling anything and have not realized gains, so the IRS doesn't treat it as income.

Liquidation invokes taxes—if your collateral was liquidated because its value went down, that forced liquidation is a taxable event. You'll be paying capital gains on any gains from the original purchase price.

Interest payments may be tax-deductible if you invest the borrowed money, but check with a tax expert for special cases.

Record keeping is important—keep a record of the collateral values, loan balances, interest payments, and any liquidation events. Accurate records make tax filing a lot simpler and also enable you to correctly calculate gains and losses.

The tax benefit of borrowing over selling increases as your crypto grows in value. An individual who purchased Bitcoin for $20,000 and borrows against it at $100,000 incurs instant taxes on $80,000 of profit.

Crypto loans are ideal for certain circumstances but may not be the best fit for everyone.

Think about borrowing if:

Avoid borrowing if:

Who gains the most from crypto loans? Long-term holders who require short-term liquidity, traders who prefer to hold positions while being able to access capital, and companies that operate with crypto but require fiat for their needs.

The plan works best if you have other means of income to repay the loan and add collateral when necessary. Avoid placing all your financial security on crypto loan plans.

Cryptocurrency loans provide a compelling means to gain access to liquidity without giving up your long-term crypto positions. They prevent you from paying capital gains tax, keep your investment exposure, and are flexible during turbulent market periods.

But these are real risks. Liquidation causes you to sell crypto at the worst moments, and over-leveraging increases the loss when the markets are falling.

Success with cryptocurrency loans depends on:

The crypto lending market keeps growing, with new platforms and products entering the market on a regular basis. Keep updated on regulatory shifts, platform developments, and market conditions that may influence your strategy for borrowing.

Used responsibly, crypto loans can enable you to release liquidity without abandoning your belief in the long-term prospects of digital assets.

A cryptocurrency loan takes your digital holdings as collateral to raise cash, in most cases, stablecoins or fiat cash. You deposit crypto in excess of the amount of the loan and get borrowed funds with interest paid until the principal is repaid.

Select a lending platform, deposit your crypto as collateral, establish loan terms, and be issued stablecoins or fiat currency. The procedure normally takes hours, not days. Keep track of your collateral value to prevent liquidation.

Yes, Bitcoin is accepted widely as collateral on most crypto lending platforms. It's usually favored due to its relative price stability among other cryptocurrencies and high liquidity in the event of liquidation.

No, borrowing from crypto is not a taxable event since you have not sold your assets or realized gains. But if your collateral is liquidated by the market, that involuntary sale is taxable.