When it comes to cryptocurrency, margin trading is the practice of taking out a loan to purchase more on your trade. You make a down payment, instead of paying in entirety, out of your own funds, as collateral, and use the rest on loan. This allows you to increase returns in case the market acts to your benefit. Yet, it increases losses as fast as it creates them.

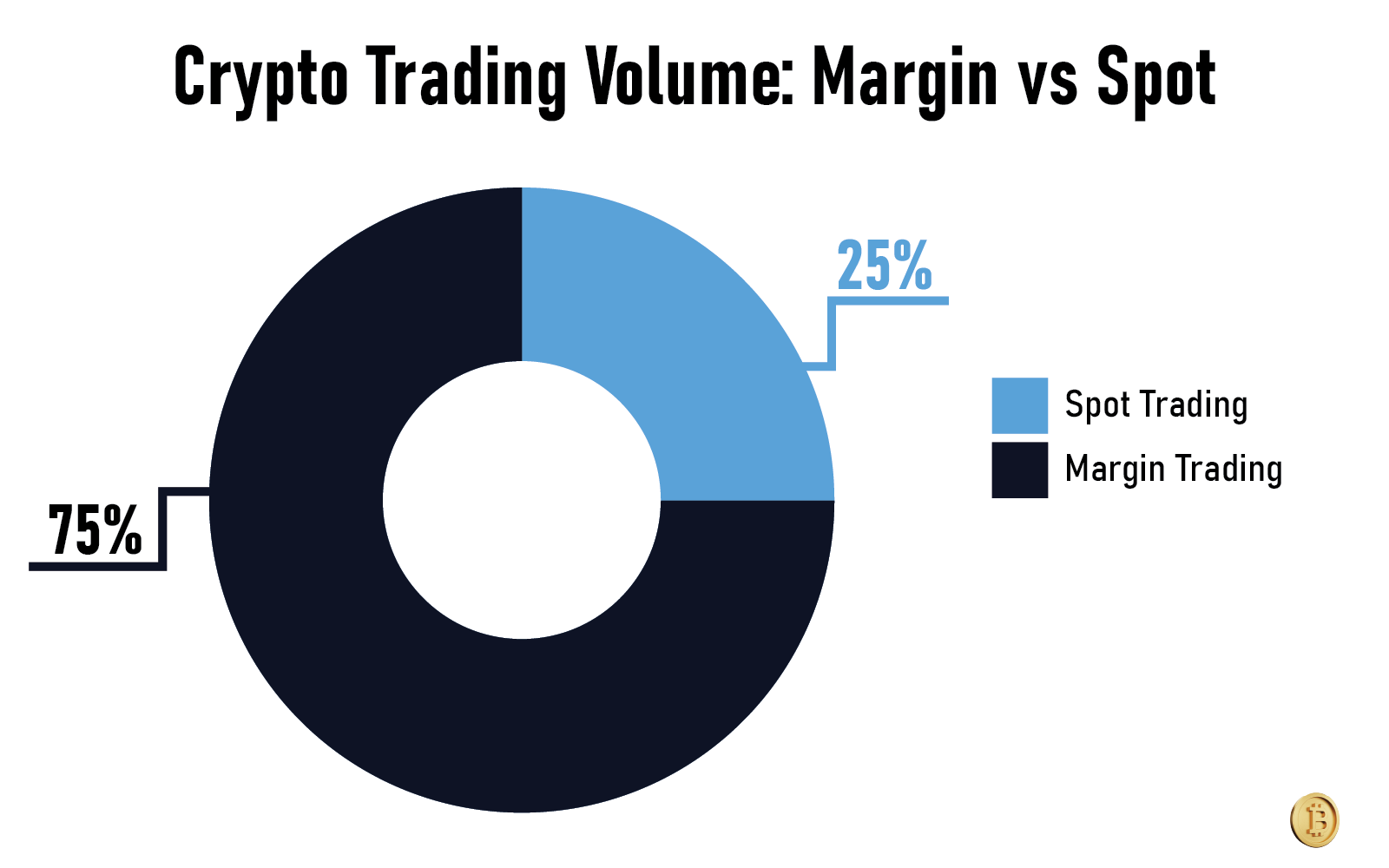

In crypto markets, leveraged trading has been booming over the last couple of years. The level of crypto margin trading in 2025 alone has always exceeded 70 percent of the overall trade on popular platforms such as Binance, Bybit, and OKX. Margin tools are now a daily tactic used by many traders as they desire to achieve quicker results and gain wider exposure in the market.

What makes margin trading so tempting?

But there’s a catch. High volatility, especially in altcoins, means small price movements can trigger major losses. Just a 10% move against you can destroy your position in a trade with 10x leverage.

Margin trading opens the door to bigger potential gains, but it also means amplified risk. That's a double-edged sword in erratic markets like cryptocurrency.

When you want to borrow money to make a bigger trade, you put that money down as collateral. Think of it as your skin in the game.

Two primary types of margins need to be understood:

To open a leveraged position, you will need this sum of money. It's a percentage of the total trade size. The initial margin needed is reduced as leverage increases.

You need to maintain this minimum balance in your margin account in order to prevent liquidation. Due to market losses, the platform might close your position or issue a margin call if your equity drops below this threshold.

Take the example of wanting to initiate a $5,000 trade with $1,000 in your Bitcoin account. If you’re trading with 5x leverage, you can use your $1,000 as initial margin and borrow the remaining $4,000.

|

Trade Size |

Your Funds (Initial Margin) |

Borrowed Funds |

Leverage |

|

$5,000 |

$1,000 |

$4,000 |

5x |

The important thing is to understand that your margin is not a fee. It’s collateral held by the platform to cover potential losses. You make money on the entire $5,000 if the market moves in your favor. But if it drops too far, you risk losing your entire $1,000—or more, depending on the platform’s rules.

At its core, margin trading in crypto means borrowing money from a platform or other users to open larger positions than you could with just your own funds.

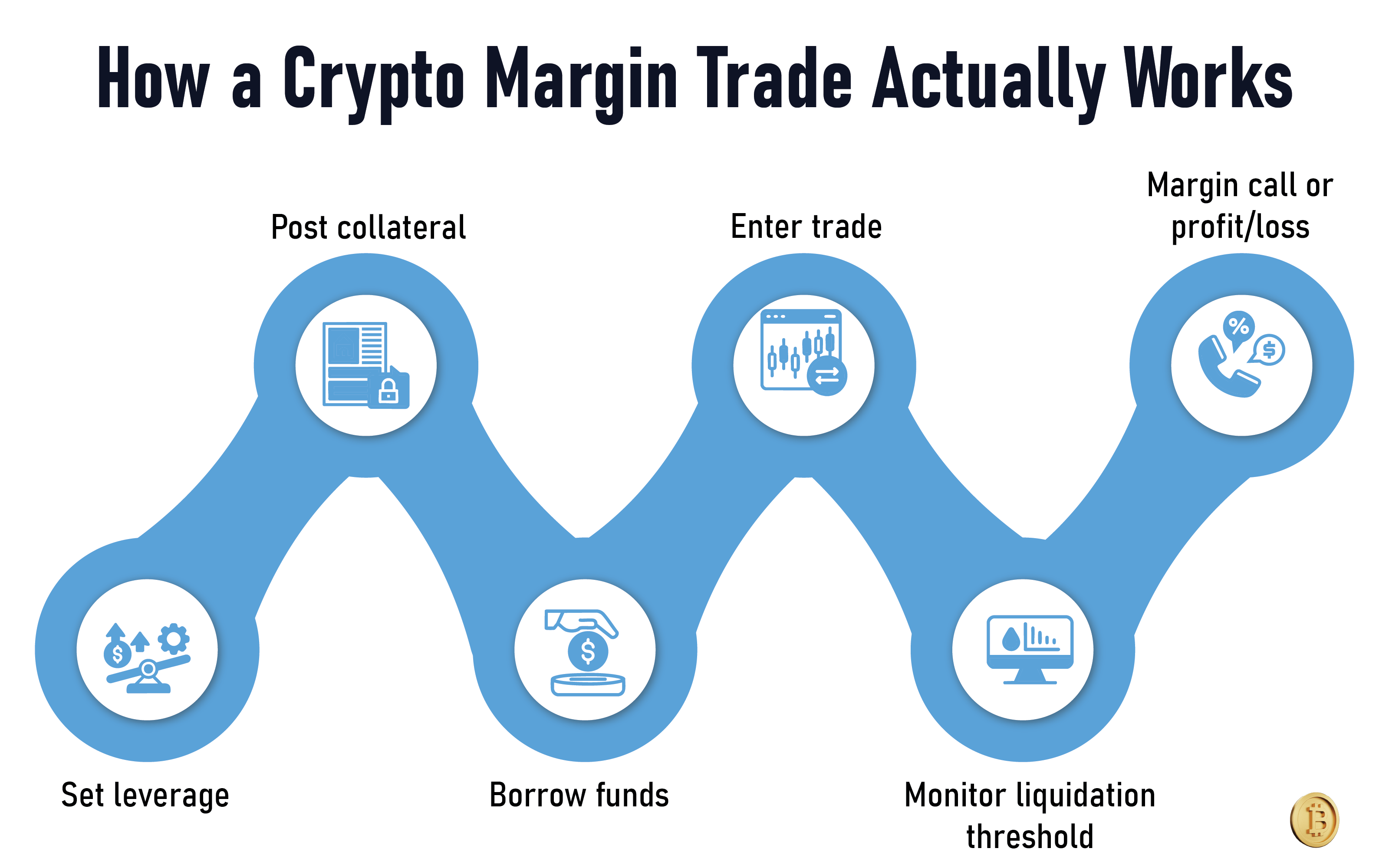

Here’s how the process typically works:

Most platforms let you pick how much leverage to use—like 2x, 5x, or even 10x. Your initial margin will be smaller, but your risk will be higher as leverage increases.

This collateral backs the loan. If your trade moves against you, the platform can liquidate part or all of your position to cover the loss.

With leverage, your platform lends you the remaining capital needed to open the full trade size. Some platforms fund this from a lending pool made up of other users.

Every leveraged trade has a liquidation price. If the asset’s price hits that point, your position is automatically closed to prevent further losses. This happens fast in crypto because of high volatility.

A margin call, which is essentially a warning, will be issued to you if your trade begins to lose value and your margin drops below the maintenance level. You either need to add more funds, or the platform will start closing your position.

In crypto, prices can swing fast. A 10% drop in a 10x leveraged long position could liquidate your account entirely.

|

Term |

What It Means |

|

Leverage |

Ratio of borrowed funds to your own capital |

|

Collateral |

Your margin, used to secure the borrowed funds |

|

Liquidation Price |

Price at which your position gets force-closed |

|

Margin Call |

Warning that you need to add more funds |

Margin trading can be useful, but without careful monitoring, it can also wipe you out in minutes. Always know where your liquidation level is, and don’t take on more leverage than you’re prepared to lose.

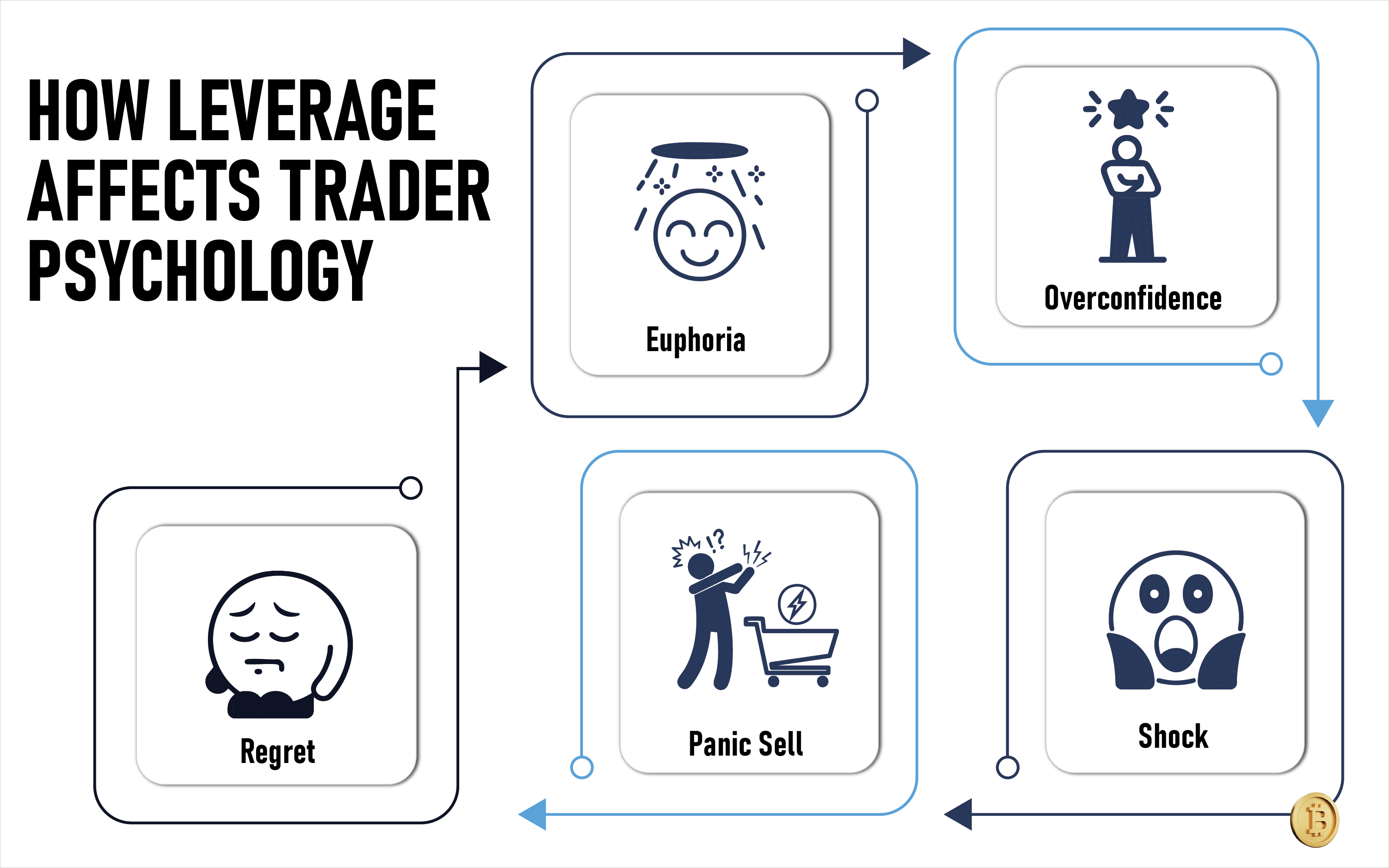

Margin trading isn’t just about numbers. Trading is a mental game that many traders lose.

Using leverage can shift your mindset. It makes small price movements feel bigger. Gains feel more exciting. Losses feel more painful. And in crypto, where price swings are constant, emotions can spiral quickly.

Here’s how it plays out:

A few winning trades with high leverage, and you start to feel invincible. You increase position sizes, take riskier bets, and stop thinking about the downside. That’s usually when the market turns.

A 50% loss occurs when a 5% move goes against you on 10x leverage. That kind of hit can trigger panic selling or revenge trading—both driven by emotion, not logic.

Successful margin traders don’t just have good strategies. They know how to control impulses, manage fear, and stay consistent even after a string of losses.

Margin trading is a mental struggle as much as a technical one. Without strong emotional discipline, leverage can backfire fast.

If you’re not mentally prepared for the stress that comes with leveraged trading, it’s better to start small or stay on the sidelines until you are.

The practice of margin trading is not suitable for everyone. But to some traders, it is a tool that they make frequent use of because it can be used in a good manner.

Crypto markets are dynamic and volatile because they are open 24 hours. That is why they appeal to traders who are interested in activity rather than sitting and holding something. Put gearing into the equation, and the opportunity (and risk) increases all the more.

The reason it is appealing is as follows:

Margin enables you to magnify small fluctuations in prices. To a day trader or scalper, this may spell larger TP-based trades. With a 10x leverage, even a 1 percent move results in a 10 percent profit on the right side.

With no margin, the only time you can make money is on a price increase. You can be short through leverage and bet against the prices coming down. It is particularly profitable when the market corrects or is reeling.

Most major crypto exchanges offer round-the-clock trading with deep liquidity. That makes it easier to enter and exit leveraged positions at any time of day, anywhere in the world.

Some experienced investors use margin not to gamble, but to hedge. For example, if you’re holding a large amount of Bitcoin but expect short-term volatility, you could use a small short margin position to offset risk.

In the right hands, margin is a powerful tool for hedging exposure or amplifying small market moves. In the wrong hands, it’s financial gasoline near an open flame.

|

Trader Type |

Why Margin Appeals |

|

Day Traders |

Amplify quick trades and short-term gains |

|

Swing Traders |

Leverage trends without tying up full capital |

|

Hedgers |

Offset portfolio risk in volatile conditions |

|

Experienced speculators |

Make directional bets with controlled risk |

Margin is attractive because it multiplies what’s possible. But it also multiplies your mistakes. That’s why it’s popular with traders who are comfortable taking on calculated risk, not just chasing big wins.

Margin trading sounds exciting, but many people dive in with half-baked assumptions. Let’s clear up some of the most common myths before they turn into costly mistakes.

Not true. Most major exchanges let anyone with an account start margin trading. But that doesn’t mean it’s a good idea to jump in without understanding the risks. Margin is accessible, but that doesn’t make it easy.

Technically, yes, higher leverage boosts potential returns. But it also shortens the distance to liquidation. You can profit ten times from a 10x trade or lose all of your money with a mere 10% move in the opposite direction. Higher leverage means higher risk, not guaranteed profit.

This depends on the platform. Some exchanges offer isolated margin, which limits losses to your initial margin. Others offer cross margin, where losses can eat into your entire account balance. If the platform doesn’t have negative balance protection, you could end up owing more than you deposited.

Sometimes you get a margin call. Sometimes you don’t. Liquidation can be near-instant, especially in fast-moving markets. Relying on alerts is risky—monitor your positions closely.

It doesn’t. Every platform has its own rules around leverage limits, margin types, interest rates, and liquidation procedures. Read the terms. Know the margin model (isolated vs. cross). Understand the risks before committing funds.

Don’t rely on myths or assumptions. Read the fine print. Know your platform’s policy. Ask these questions before placing your first trade:

Margin trading offers an opportunity, but only if you understand the full picture. Guesswork can be expensive.

Trading crypto on margin might feel fast and high-stakes, but the IRS still wants its cut, whether you win or lose.

Let’s break down how taxes work when it comes to margin trading in the U.S.

Any profit you make from closing a margin trade is taxable. It doesn’t matter that you borrowed funds—the IRS taxes the full gain, not just the part that came from your original money.

When you borrow funds to trade, some platforms charge an interest fee. In certain cases, this interest can be deducted as an investment expense. The catch? You must itemize deductions, and the expense must meet IRS requirements. If the margin trade is classified as investment activity, not personal or speculative, it may qualify.

If your position is liquidated and you lose money, you may be able to write it off as a normal capital loss. Gains can be deducted from your taxable income (up to $3,000 annually, with the remainder carried forward).

Example:

You use margin to long Ethereum.

Your total gain is $2,000 ($12,000 - $10,000), and that full $2,000 is taxable, even though only $2,000 was your own money.

Whether you profit or get liquidated, Uncle Sam still wants a piece. Margin trades are taxable—don’t get caught unprepared.

Margin trading isn’t just risky. It’s unforgiving. If you’re not prepared, it can drain your funds faster than you think. So the question isn’t just “Can you margin trade?”—it’s “Should you?”

If you’re still figuring out how wallets, order books, or candlesticks work, margin adds a layer of complexity you don’t need yet.

Trading without stop-losses or risk controls is already dangerous. On margin, it’s financial roulette.

If losing your margin deposit would seriously impact your finances, don’t use leverage. You should never use funds that you cannot afford to lose when engaging in margin trading.

If you tend to chase losses, get overconfident after wins, or act impulsively during volatility, margin magnifies those emotional swings.

If you’ve been trading crypto for a while, understand technical analysis, and know how to set stop-losses, margin can offer flexibility and speed.

Long-term investors sometimes use margin to hedge downside risk during short-term corrections without selling core holdings.

Many exchanges offer practice or demo modes. Smart traders use them to simulate margin scenarios before going live.

Margin trading isn’t about guts—it’s about control. You need a clear system, defined risk limits, and the discipline to follow through.

What, then, is margin trading in crypto?

Essentially, it is a means of borrowing funds with which to magnify your trade. That leverage comes in handy to magnify profits, yet it can also vaporize your account if you are not cautious.

The fact that margin trading is only a tool does not change the fact that it is a good or bad thing. It is the way you use it.

When you play like it is a gamble, then you will receive a punishment. When you think about it in a disciplined, planned, and risk-controlled way, it can provide you with more flexibility and options in rapidly changing markets.

Prior to putting yourself into a margin position, you must identify the following questions:

Margin is your friend as long as it aligns with your strategy (not the other way around).

Start small. Train in demo mode. Be interested in capital preservation rather than returns. And why not keep in mind that in the matters of trading, sheer survival can be the greatest victory?

Borrowing money from a platform to boost your buying or selling power is known as margin trading in cryptocurrency. A portion of the trade value, referred to as the margin, is borrowed, with the remaining amount being pledged as collateral. This allows you to amplify potential gains, but also increases risk, since losses are magnified too.

To open a leveraged position, you must deposit a certain amount of money, known as the margin. There are two main types:

Initial margin: The sum of money needed up front to initiate a trade

Maintenance margin: The absolute minimum needed to keep liquidation from happening

If your balance drops below the maintenance level, your position can be force-closed by the platform.

Yes, it’s possible—depending on the platform. Some exchanges offer protection that limits losses to your initial margin. Others don’t. If your platform doesn’t have negative balance protection, a sharp market move could leave you owing more than your deposit. Always check your platform’s margin policy.

Generally, no. Margin trading adds a layer of risk and complexity that’s hard to manage without experience. Beginners are more likely to make emotional decisions and skip risk management, or misunderstand how leverage works. It’s better to learn with spot trading first and only move to margin once you have a strategy in place.