Hedge funds always have an aura of exclusivity around them, but in 2025, they are becoming one of the key priorities of accredited investors who grew tired of traditional portfolios. Due to the ongoing volatility of the stock market and the inflationary pressures, investors are increasingly seeking to diversify investments in alternatives (in terms of both the risk-adjusted returns and access to strategies that cannot be realized in the public markets).

Hedge funds are among these options, which have a high level of flexibility. They are meant to seek returns in both rising and falling markets and employ methods such as short selling, leverage, and derivatives that are eschewed by mutual funds in general. Although such funds are not accessible to all investors, the accredited ones or those observing income or net worth standards are increasingly investing in them, particularly those platforms where improved transparency and access are available.

This primer decomposes the hedge funds' operation, the type of people that invest, their strategies, and their comparison to those of the privately owned companies (P), venture capital (V), and common assets. As an institutional investor, family office, or high-net-worth individual exploring the field, it is a fact that you should be cognizant of hedge funds in the development of a risk-adjusted, contemporary portfolio.

A hedge fund utilizes a variety of tactics to produce active returns for its investors. In contrast, mutual funds typically aim to either match or modestly exceed a benchmark, distinguishing them from hedge funds. Hedge funds seek absolute returns—to make money independent of the direction of the markets.

They have the freedom to:

A majority of hedge funds are available exclusively to accredited investors or institutions because of their intricate composition.

|

Feature |

Hedge Funds |

Mutual Funds |

|

Investors |

Accredited investors, institutions |

General Public |

|

Regulation |

Light (under SEC exemptions) |

Heavily regulated by the SEC |

|

Strategies |

Flexible: shorting, leverage, derivatives |

Long-only, limited use of derivatives |

|

Liquidity |

Lock-up periods common |

Daily liquidity |

|

Fees |

“2 and 20” structure |

Flat percentage of AUM |

Historical Context

Hedge funds are descended from 1949, when Alfred Winslow Jones formed the earliest hedge fund, which was based on short selling to "hedge" against market risk. That simple concept—lessening vulnerability to the large market fluctuations—turned into the target of a whole industry.

During the 1990s and early 2000s, hedge fund expansion took place as international demand and global macro and quantitative fund strategies became more popular. Following the 2008 financial crisis, there was some focus with regard to regulation, which led to alterations in disclosures and risk management.

Over time, hedge funds have transformed by embracing new technologies, increasing transparency, and adopting various strategies. They continue to be a significant component of alternative investments, as investors seek higher returns and the ability to diversify their portfolios.

The hedge fund industry is not accessible to the general public. To become a direct investor, you should pass the threshold of an accredited investor according to the SEC qualification status. By 2025, this translates to fulfilling any of the following:

The reason behind these rules is that the strategies of hedge funds are frequently more complicated and they are riskier, and as such, they are to be used by investors capable of assessing them and developing them.

Hedge funds operate under private offering rules to avoid full SEC registration. The two most typical exemptions are:

These rules close general advertising to investors and limit investor numbers (typically 99 or 499, depending on the type of fund).

Hedge funds typically suit:

Such investors generally have longer horizons and a higher tolerance for risk, illiquidity, complexity of strategy, and losses. For them, hedge funds provide access to non-traditional investment approaches that can diversify portfolios and potentially enhance long-term returns.

Hedge funds are typically set up as either:

In an LP format, the General Partner (GP) is in charge of the fund, with Limited Partners (LPs) investing capital but playing no active role in day-to-day management. The format gives the fund the ability to be flexible and restrict liability for investors.

|

Role |

Function |

|

General Partner |

Manages strategy, executes trades, and makes investment decisions |

|

Limited Partners |

Provide capital; have limited control or liability |

|

Fund Managers |

Often overlaps with the GP; responsible for performance |

|

Prime Broker |

Executes trades, provides leverage and custodial services |

|

Administrator |

Handles fund accounting, investor reporting, and compliance |

|

Auditor |

Verifies financial statements and performance |

Hedge funds typically impose limitations on the timing of withdrawals for investors. These terms help the fund manager maintain strategy stability.

This setup offers more flexibility than private equity or venture capital funds, but less liquidity than mutual funds or ETFs.

Hedge funds have no capital call in general, like in the case of private equity. The investors would rather invest and move funds forward, which would be utilized as the fund plans to do so.

Accredited investors who see hedge funds as an alternative part of their investment plan should know about these structures.

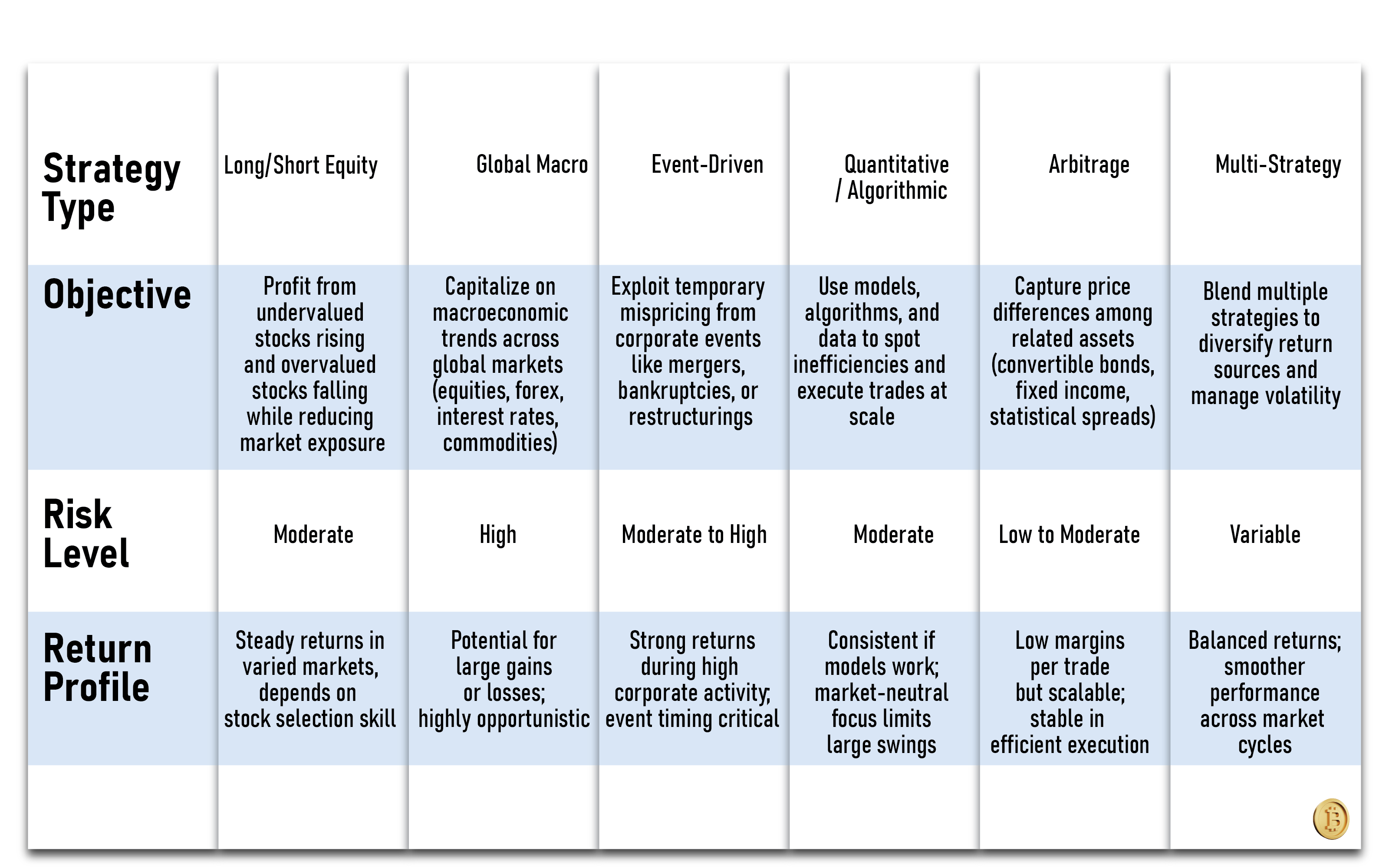

Perhaps among the largest reasons why hedge funds remain outstanding in the alternative investment world is the fact that they are able to employ differing, active investment techniques that are intended to allow the generation of returns without regard to the market situation. And below are the most typical hedge fund strategies you can encounter:

This is the most commonly employed strategy in hedge funds.

Keyword note: Long/short equity is often the entry point for new accredited investors exploring hedge fund strategies.

Macro views are big-picture based with a focus on macroeconomic trends.

Example: Betting on interest rate changes across countries during a tightening cycle.

Concentrated on corporate events that lead to temporary mispricing of securities.

When business activity cycles are high, event-driven strategies do well.

Also referred to as quant strategies, these funds are based on models, data, and automation.

Bent on price differences among related assets.

These strategies are low-margin but executed at scale with high discipline.

Within a single framework, these funds integrate several strategies.

Multi-strategy hedge funds have become popular for inherent diversification.

The risk, complexity, and return characteristics of these hedge fund strategies vary significantly. The proper one will depend on your investment objectives, tolerance for risk, and degree of access as a qualified investor.

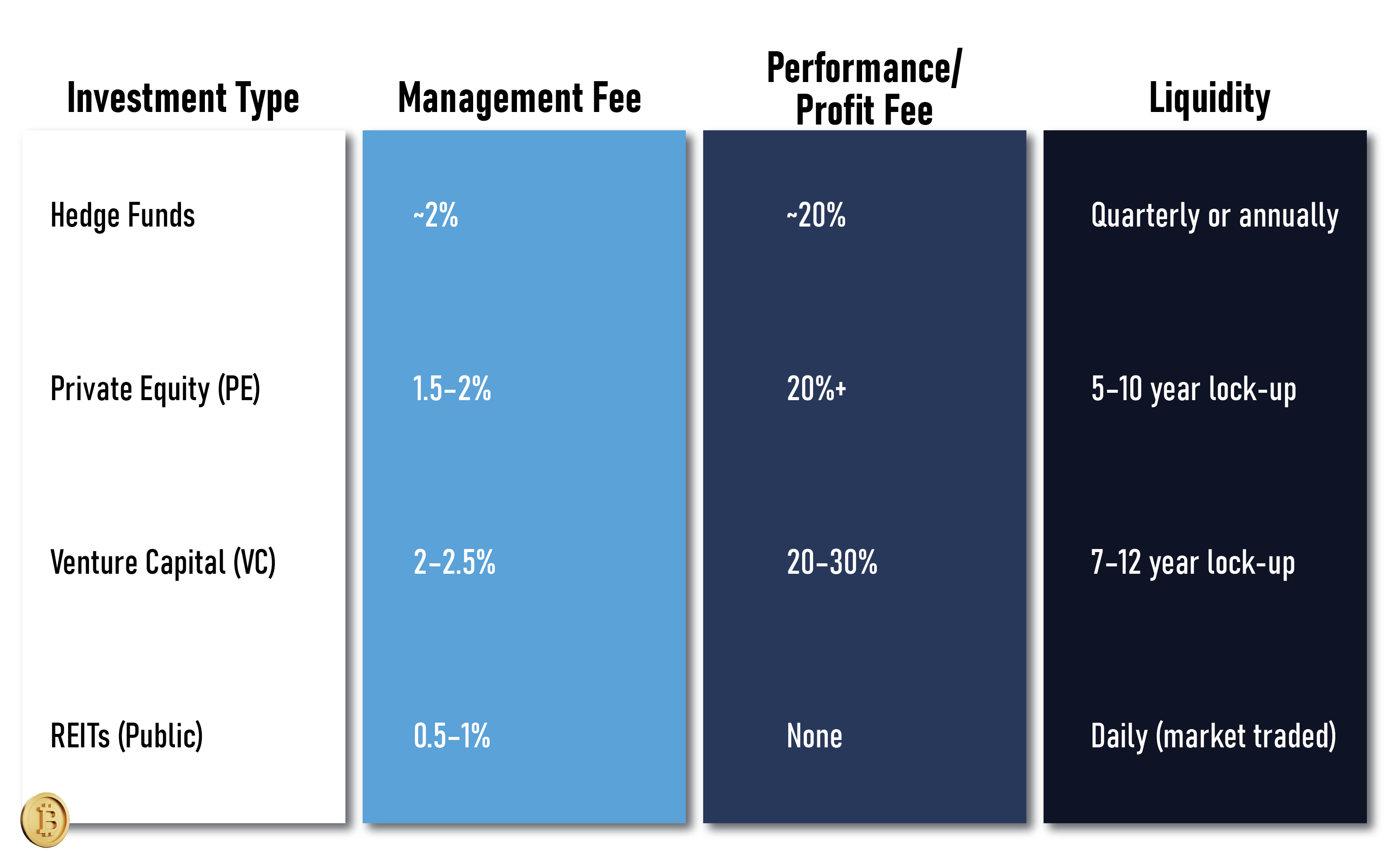

Hedge fund fee structures are frequently the subject of intense debate. Most use the classic “2 and 20” model:

Aligning fund managers' and investors' interests is the goal of this performance-based model. But it also means investors pay high fees—especially in strong market years.

To keep things fair, many funds use:

These characteristics ensure that investors are shielded from covering costs associated with poor performance or modest gains.

In 2025, pressures from the industry are compelling hedge funds to reduce fees—particularly for big institutional investors. Some newer funds are trying out performance-only structures or tiered fees by capital committed or lock-up period.

For accredited investors, it is important to know fee structures. Fees can nibble into returns, so always consider fees against the fund's past performance and strategy risk.

Hedge funds offer light-footed solutions and the potential of sound gains, but they have exclusive risks as well. It is necessary to know these risks before an investor invests their capital, especially accredited investors, when it comes to alternative investments.

Contrary to mutual funds or ETFs, hedge funds are not designed for rapid unwinding.

If you require immediate access to capital, hedge funds might not be a good fit.

To increase returns, some hedge fund strategies rely on borrowed money.

Always review a fund's leverage ratios and exposure concentration before investing.

Hedge funds are more opaque than conventional investment vehicles.

This makes operational due diligence paramount—know who's manning the fund and how they communicate with investors.

Reforms after 2008, such as Dodd-Frank, stepped up hedge fund regulation.

By 2025, regulators will have been discussing stricter regulations on complex strategies and an increase in the transparency expectations.

The point cast in brief terms to investors is that due diligence when investing in any hedge fund is not an option but a necessity. Read the strategy, structure, team, risk controls, and service providers of the fund carefully.

On the one hand, it is likely to be the most controversial element of hedge funds, particularly when compared to the performance of other alternative investments such as private equity or real estate, or indeed of the benchmark such as the S&P 500.

Although the actual returns measured by headlines vary, eventually the hedge fund will always focus its increases on risk-adjusted return rather than absolute return. This implies less volatility and holding capital in failing markets rather than simply aiming at earning large profits.

|

Asset Class |

Annualized Return |

Volatility |

Liquidity |

|

Hedge Funds (Avg.) |

~6–8% |

Moderate |

Low to Moderate |

|

Private Equity |

~11–14% |

High |

Very Low (Locked-in) |

|

Real Estate (Private) |

~7–9% |

Low-Moderate |

Low |

|

S&P 500 |

~10–12% |

High |

High (Daily) |

Note: Hedge fund returns vary widely by strategy. Some may outperform equity markets; others underperform but offer better downside protection.

Hedge funds may become helpful tools of portfolio diversification:

Hedge funds might not necessarily beat the S&P 500 as a qualified investor; however, they will reduce the volatility of returns and reduce downside over the long run.

Hedge funds are not entirely unregulated, although they enjoy more flexibility than what is applied to mutual funds. U.S. regulators have stepped up their oversight since the 2008 financial crisis in an effort to keep an eye on systemic risk and enhance transparency, particularly among larger funds.

SEC (Securities and Exchange Commission)

Controls the managers within the hedge funds that tend to be registered as investment advisors. Everything is mandated to be disclosed on Form ADV (disclosure of strategy, fees, conflicts, etc.).

CFTC (Commodity Futures Trading Commission)

Manages hedge funds that trade in futures and options as well as other derivatives. Such money is also eligible for registration with the National Futures Association (NFA).

One of the most important changes (after 2008) was that of Form PF (Private Fund):

While hedge funds remain better off in terms of privacy than mutual funds, the disparity is dwindling. For accredited investors, knowing the regulatory environment ensures adequate due diligence—and steers clear of funds operating on legal gray areas.

As an accredited investor in the United States, there are a few main avenues of entry into hedge funds—each with compromises regarding access, fees, and disclosure.

Direct Investment

In most cases, it involves a high minimum (usually $1–5 million) and access to the best fund managers. You will negotiate terms directly and have full disclosure, but you must have good personal networks or advisory relationships.

Feeder Funds

Pooled investment vehicles that let multiple investors access a master hedge fund. These lower the entry point and streamline operations but may add a layer of fees.

Fund of Funds (FoF)

These provide immediate diversification through investments in a hedge fund portfolio. FoFs reduce manager-specific risk but tend to double up on fees (you pay both FoF and hedge fund fees).

Online Alternative Investment Platforms

Accredited investors can now gain exposure to vetted hedge fund opportunities through digital portals, with minimums as low as $25,000. These come with dashboards, performance reporting, and curated offerings.

Due Diligence Checklist

Before investing, inquire:

Being selective and asking tough questions early on is critical to avoiding later surprises.

Hedge funds in the U.S. aren't merely holding on—they're changing quickly. As markets shift, new technologies, asset classes, and investor demands are compelling fund managers to rethink conventional models. Here's where the industry is going:

Funds are merging AI-powered models, machine learning, and natural language processing to analyze massive datasets and identify market inefficiencies quicker.

Anticipate increasing funds moving towards quant-oriented strategies that eliminate emotional bias and grow more quickly.

Hedge funds are growing to invest in Bitcoin, Ethereum, and altcoins—either directly or via derivatives—despite regulatory resistance.

Certain funds are opening crypto-native funds to take advantage of DeFi, tokenization, and volatility in the markets.

ESG is now more than a public markets fad. When it comes to screening and strategy development, hedge funds are incorporating governance, social, and environmental considerations.

More long/short ESG strategies and climate transition goal-oriented funds are on the way.

Fintech platforms and feeder fund structures are democratizing hedge fund access to accredited investors with reduced minimums and simplified onboarding. This movement is changing the traditional exclusivity of the hedge fund industry.

After focusing on liquidity mismatches and private fund disclosure in 2022 and 2023, the SEC is now tightening its regulations. Upcoming hedge funds must accept improved reporting, liquidity management, and communication with investors to stay competitive.

The hedge fund model is changing—quickly. The surviving funds of the next ten years will not only pursue alpha. They'll be tech-savvy, diversified, transparent, and designed for a new type of investor.

Hedge funds present an appealing—albeit complicated—entrance into alternative investment. They're designed for qualified investors who appreciate the risk-return-access trade-off. Across numerous strategies, changing technology such as AI and crypto, and increasing regulation, contemporary hedge funds are more dynamic than ever.

If you're looking for diversification beyond stocks and bonds, hedge funds may be a valuable part of your portfolio. But do your homework. Know the structure, the strategy, and your risk tolerance before you invest.

Want to dig deeper? Take a look at our Beginner's Guide to Private Equity or contrast Angel Investing vs. Venture Capital to determine which alternatives best suit your strategy.