The value of monthly crypto derivatives trading was overwhelming at an astonishing $8.94 trillion in 2025, whereas crypto derivatives represented almost three-quarters (approximately 79 percent) of the total crypto trading volume. No, that is no typo.

When everyone is discussing buying and holding Bitcoin or Ethereum, the show is in the derivatives markets, where traders have an opportunity to multiply their gains and insure against the risk, as well as to generate profits in an uptrending market or in a down-sloping market.

Institutional crypto trading has become anchored on crypto derivatives. These financial instruments are now utilized by major banks, hedge funds, and corporations to take advantage of the benefits of cryptocurrencies without actually owning any. Derivatives can no longer be an option to know when you are serious about cryptocurrency trading.

Crypto derivatives are explained in detail by this tipster. You will find out their presence, their functionality, where to trade them, and most importantly, how to use them without being burned by their pure risks.

Crypto derivatives are financial instruments based on a cryptocurrency, such as Bitcoin or Ethereum, although you do not necessarily have to possess the asset. Depending on whether the price is moving sideways, upward, or downward, you can think of them as side bets.

If you think that within a week, Bitcoin will rise. Rather than buying Bitcoin itself, you may enter into a futures contract, which would pay out to you in case the price goes up. When you are correct, you make money. When you lose, you will lose your money, yet you never had any Bitcoin in the first place.

This arrangement is lifted directly out of the traditional financial market, where you have been able to find derivatives for decades. A stock option, a futures contract, or a swap are familiar to traders to help them manage risk or attempt to make money out of price matters. Crypto simply brings digital swiftness and availability.

This is by far an attraction. Using derivatives, you can take part in fluctuations in the price of crypto but never have to hold the coins in a wallet. Involving institutions and risk-averse investors also gets easier.

Derivatives of cryptocurrencies are basically just bets on how the price of cryptocurrencies will move in the future. But, given the right strategies, it turns into an effective means of coping with risk or even seeking larger rewards.

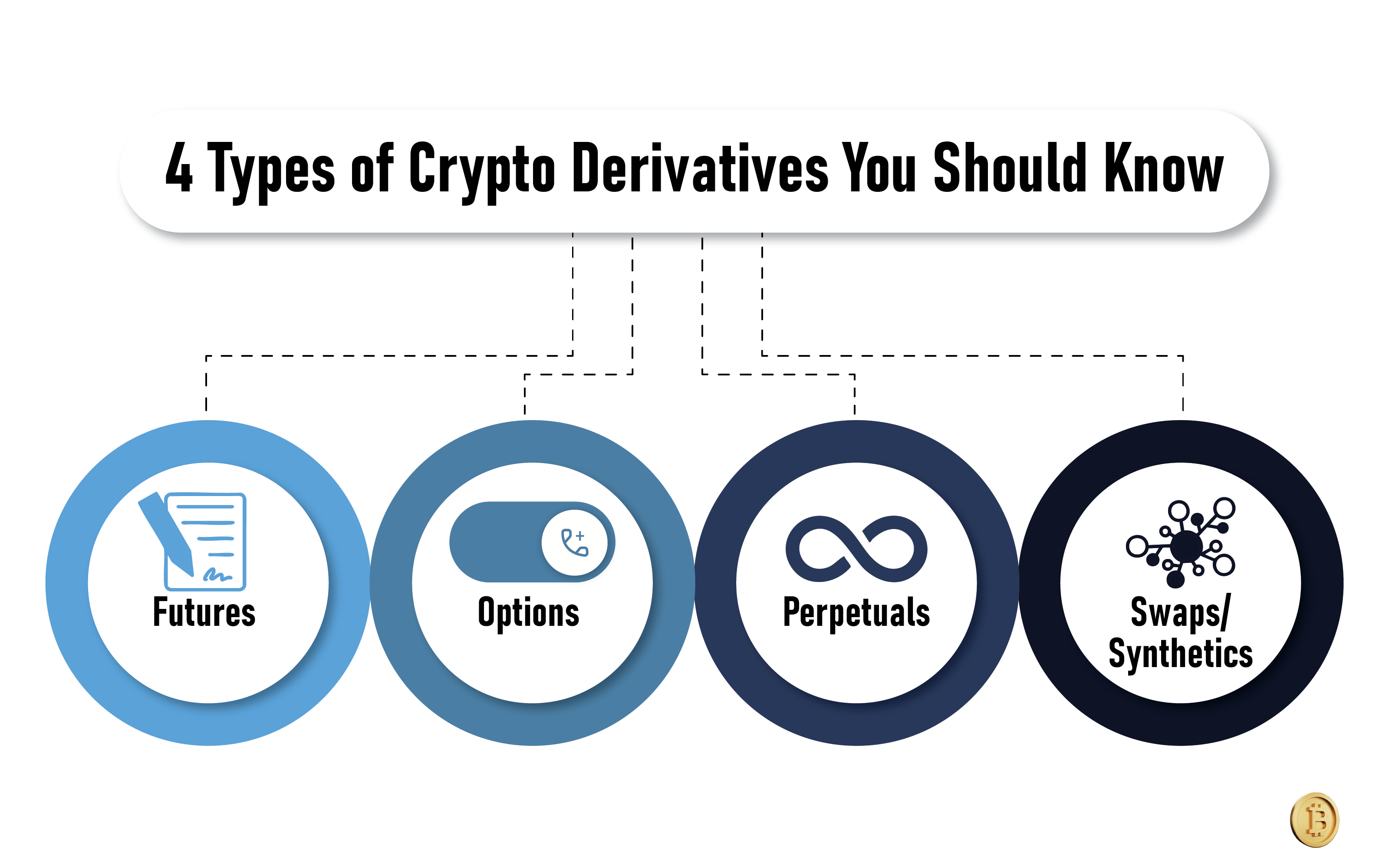

There are various forms of crypto derivatives, but they are roughly divided into a few types, each being subject to distinctive rules and risks, as well as strategies. And this is a breakdown of the most common types you will find on trading platforms:

There are various forms of crypto derivatives, but they are roughly divided into a few types, each being subject to distinctive rules and risks, as well as strategies. And this is a breakdown of the most common types you will find on trading platforms:

Each of these derivatives is used for a unique trading style—ranging from speculative short-term wagers to strategic hedging. Knowing how they operate is step one prior to entering any live market.

Crypto derivatives enable traders to speculate, hedge, or take care of risk using much greater flexibility than buying and selling. Let's see how that works in real-world terms.

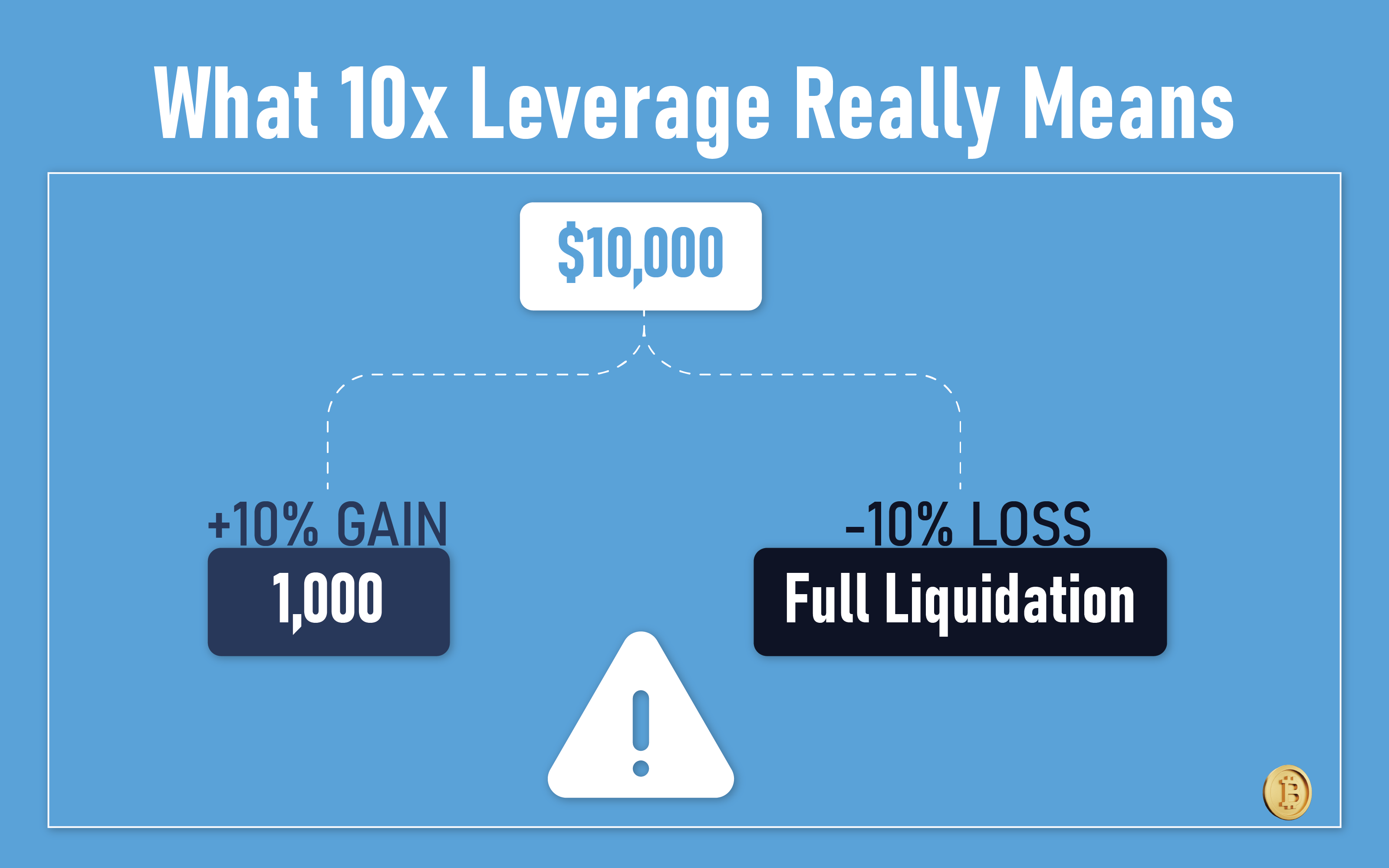

Let's say Bitcoin is currently $55,000. You think it will reach $60,000 within a week. Rather than directly buying 1 BTC (which is $55,000), you enter into a futures contract with 10x leverage using only $5,500 worth of margin.

For this reason, leverage is both powerful and risky.

For instance, if there is a significant market pullback, a trader can short Ethereum to hedge against losses in their spot ETH positions.

Platforms tend to auto-liquidate your position when the margin gets too low. It's called a margin call or forced liquidation.

|

Platform Type |

Examples |

Key Features |

|

Centralized (CEX) |

Binance, Bybit, Kraken, CME |

Higher liquidity, better UI, KYC required |

|

Decentralized (DEX) |

More privacy, no KYC, relies on smart contracts |

Both types support crypto derivatives, but centralized exchanges currently dominate in volume and features.

In practice, crypto derivatives are fast-moving, data-driven, and capital-efficient—but they demand discipline. Knowing when to use leverage, how to manage your margin, and which platform suits your needs is what separates smart traders from reckless ones.

Crypto derivatives are not merely about going big on a bet—they provide actual tools for traders to hedge risk, leverage returns, and open up more sophisticated strategies. Here's why most seasoned traders prefer derivatives to spot trading:

Derivatives trading unleashes instruments that spot markets simply can't provide. Used judiciously, they provide traders with greater control, greater accuracy, and greater means to make profits.

Crypto derivatives present enormous upside, but they also pose significant risks—particularly to novices. It is just as crucial to understand these pitfalls as to learn the strategies.

Example: If you buy Bitcoin at $60,000 with 10x leverage and it goes down to $54,000, your position is lost.

|

Risk Type |

Details |

|

Smart Contract Bugs |

On decentralized platforms (DEXs), vulnerabilities in code can be exploited. |

|

Exchange Hacks |

CEXs have been hacked in the past, risking user funds. |

|

Downtime/Freezes |

Platforms sometimes freeze trading during high volatility—leaving traders stuck. |

Crypto derivatives aren't suitable for everyone. With no firm understanding of risk, it's simple to lose more than you intend to. Intelligent traders approach risk management as part of strategy—rather than an afterthought.

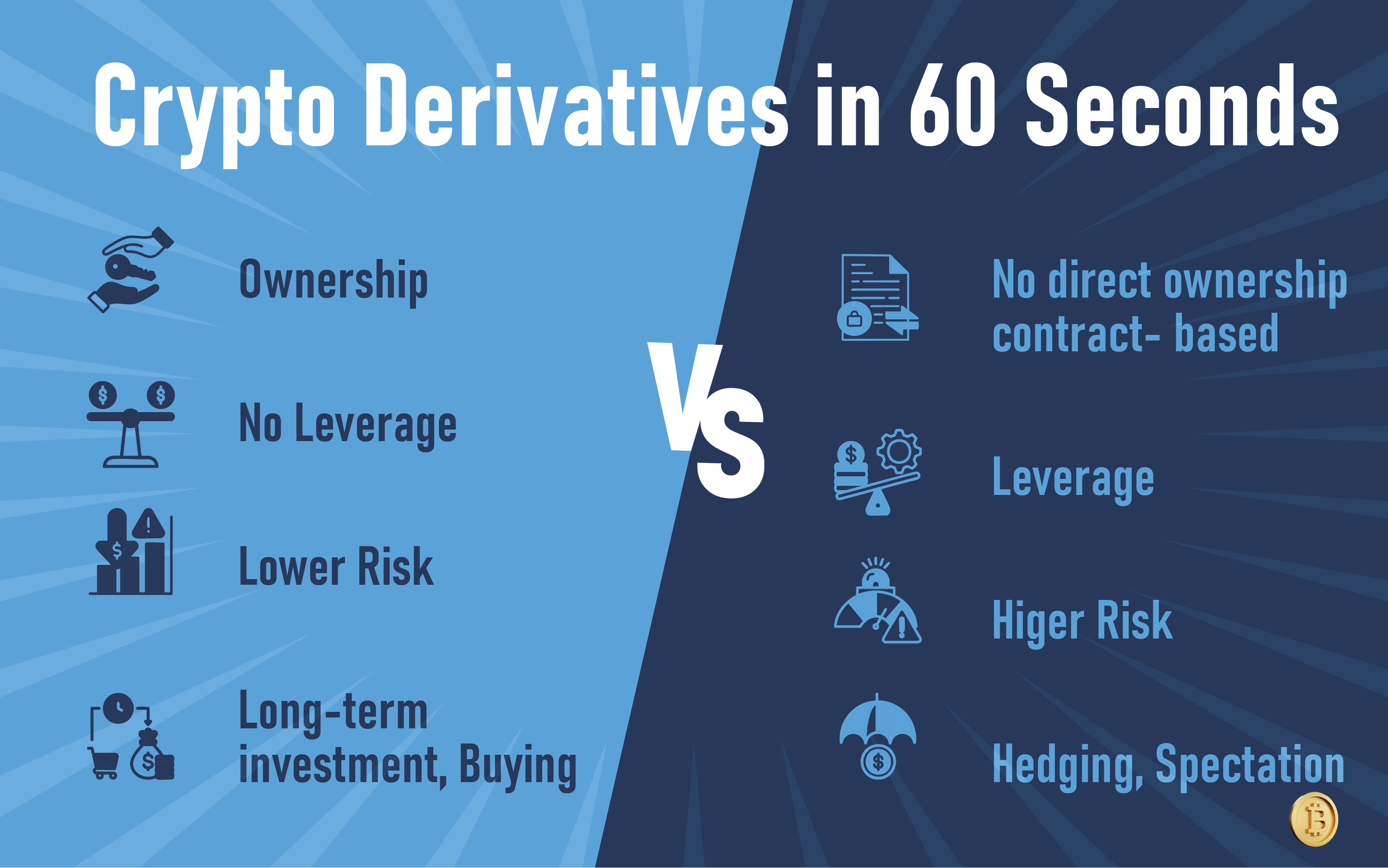

If you're used to buying and holding coins on the spot market, crypto derivatives might seem like a whole different game. And in many ways, they are. Here's a breakdown of how the two approaches compare—and why some traders prefer one over the other.

|

Factor |

Spot Trading |

Crypto Derivatives |

|

Ownership |

You directly own the asset (e.g., BTC in your wallet) |

No ownership—just exposure to price |

|

Leverage |

No leverage (unless a margin account is used) |

Leverage up to 100x on some platforms |

|

Risk |

Limited to what you invest |

Can lose more than the initial margin |

|

Use Cases |

Long-term holding, simple investing |

Hedging, speculation, shorting, arbitrage |

|

Volatility Protection |

None—exposed to market swings |

Hedging tools available (shorts, options) |

|

Trading Hours |

24/7 (but lower activity on weekends) |

24/7 with global liquidity and funding cycles |

|

Capital Required |

Full asset value |

Fraction of position size via margin |

Both spot and derivatives have their place. Spot is great for building a portfolio. Derivatives are ideal for traders who want flexibility, speed, and more strategic control—if they can handle the risks.

Both the decentralized exchange (DEX) and centralized exchange (CEX) have crypto derivatives, which differ in terms of access, security, and functionality.

These are the most popular venues for crypto derivatives. They offer deep liquidity, a smooth user interface, and high leverage options.

|

Exchange |

Key Features |

|

Binance |

Futures, perpetuals, up to 125x leverage, massive volume |

|

Bybit |

Derivatives-focused, low fees, fast execution |

|

Kraken |

U.S.-friendly, strong compliance, lower leverage |

|

CME Group |

Institutional-grade Bitcoin and Ether futures |

|

OKX |

Wide product range, global user base |

Pros:

Cons:

DEXs let you trade directly from your crypto wallet using smart contracts.

|

DEX |

Key Features |

|

dYdX |

Perpetuals, no KYC, low fees, growing volume |

|

GMX |

Leverage, simple UX, community-driven fees |

|

Synthetix |

Synthetic asset exposure, deep DeFi integration |

Pros:

Cons:

Choosing the right platform depends on your strategy, risk tolerance, and location. Some traders even use both CEXs and DEXs to diversify access and reduce counterparty risk.

Crypto derivatives will offer a chance to explore the prospect of deploying complex trading strategies that are not viable in the spot market. The following are some of the most common ways that are adopted by sly traders:

Example: Long ETH perpetuals when ETH breaks above a major resistance level with confirmation on volume.

Example: Place stop orders to capture a breakout in BTC following hours of ranging price action.

Example: Purchase a BTC put option to hedge gains after a 20% rise.

How it works: Take advantage of price differences between:

Why it works: There are inefficiencies in illiquid, volatile markets.

Example: Long spot BTC, short BTC futures that are traded at a premium to capture the funding difference.

These strategies depend on discipline, timing, and a solid risk understanding. Crypto derivatives amplify both your edge and your exposure, so each move planning is even more critical.

Crypto derivatives trading is half study of data, half decision-making. These metrics and tools allow you to measure the tone of the market, manage your risk, and identify smart entry or exit opportunities.

Smart trading begins with smart tracking. These numbers provide you with a better sense of the market—and shield you from emotional, reckless choices.

Crypto derivatives aren't slowing down. In 2025, their daily volumes often beat out spot markets—particularly on exchanges like Binance and CME. But what comes next? Here's where things are going:

The U.S., UK, and Singapore are establishing more defined frameworks for crypto derivatives.

Regulated futures and options platforms make safer onboarding for institutional players possible.

Hyperspect will anticipate tighter leverage, KYC, and platform audit rules.

The bottom line: crypto derivatives are evolving fast. Whether you’re trading on a DEX or a regulated exchange, expect more sophisticated products, smarter risk tools, and broader adoption across finance.

Crypto derivatives afford opportunities to traders to do more than HODL. They give room to hedging against risk, earning money on both sides of the market, and to capital management. And with that ability also comes the increased risk, especially when the leverage and volatility combine.

You need to understand how it all works, regardless of whether you are shorting Bitcoin futures, experimenting with perpetuals, or hedging risk by covering with options. Strategy and speculation are a thin line in crypto, and the other issue here is which one you are, the intelligent trader or the gambler—when to get in and when to keep out.

And in case you are indeed sincere in your intentions of having a step-up to your trading and are willing to make an essential step, then such derivatives as crypto may become a potent weapon in your arsenal. However, do not get an all-in precedence. Start with the basics, educate yourselves on the platforms and the risk tools at your disposal.

Ready to begin? Take a look at our hand-curated list of resources and platform reviews to trade smarter—not harder

Yes, but it varies by where you're located. In the United States, there are regulated exchanges such as CME that allow you to trade crypto futures, but most offshore exchanges are not allowed. Offshore exchanges in the EU permit crypto derivatives, but only under specific compliance guidelines. You must always verify your local laws and whether the platform is approved to do business in your area.

No. One of the prime advantages is that. Crypto derivatives allow you to bet on price changes without really holding the underlying asset. You simply have to post collateral—in crypto or stablecoins—to take a position. That facilitates traders to get into and out of markets more quickly.

A perpetual swap is a type of futures contract that doesn’t expire. It tracks the price of a crypto asset and uses a funding rate mechanism to stay aligned with the spot price. Traders can hold positions indefinitely, as long as they have enough margin to cover potential losses and funding fees.

Most beginners should stick to low leverage—1x to 3x—until they fully understand how it works. Higher leverage (10x, 20x, or more) can lead to fast liquidation, even with small price moves. Start small, manage your risk, and never trade more than you’re willing to lose.

When your margin balance goes below the maintenance level, your position will automatically be closed by the platform to avoid further losses. You forfeit the margin you had posted for the trade, and in worst-case scenarios, you could owe more should there be slippage or lots of volatility. Placing stop-loss orders is one way to minimize this risk.