In 2026, a new generation of American investors is choosing angel investing as their preferred alternative investment strategy, despite the fact that traditional markets are becoming more volatile. The post-pandemic startup boom has fueled unprecedented opportunities, with more than 75,000 new companies popping up monthly in America.

At the same time, increasing interest rates have reduced traditional bonds' appeal, and stock market unpredictability has investors looking to diversify beyond traditional portfolios. This ideal economic cocktail has made Angel Investing in the U.S. one of the most attractive investment strategies available for accredited investors who want to take advantage of early-stage innovation and create wealth with exposure to the private markets.

The angel investor 2026 landscape brings unprecedented opportunities that smart money investors can no longer afford to overlook. Market forces have converged to provide the perfect scenario where early-stage investments present both strategic portfolio advantage and compelling returns that traditional assets cannot match.

And here's why smart money is moving into angel investing:

This strategy of alternative investment has worked especially well as institutional capital enters into later-stage rounds, establishing a supply-demand dynamic to the advantage of early-stage investors who are able to access deals at favorable valuations.

The latest angel investment trends show a market shift that's transforming private investors' USA approach to early-stage financing. Overall angel investment volume has hit $29 billion per year, with single check sizes averaging $75,000 versus $45,000 only three years ago.

The proliferation of angel investing online has created opportunities for smaller investors, and minority and female-founded startups are gaining unprecedented visibility, with venture capital to underrepresented founders rising 45% year-over-year as investors take note of the untapped potential in previously underrepresented communities.

Private equity investors in the USA are top-grade performers endowed with a set of key distinguishing characteristics. Patience is a very significant trait, as the gestation period for an angel investment can be anywhere from 5 to 10 years.

Risk bearing occupies a position of equal importance, with top angels realizing that 60-70% of their investments will be failing ones, while 30-40% of the successful exits will generate huge, outsized returns enough to see performance through at the portfolio level. The majority of successful angels are really very tuned to innovation, spotting market trends and technology changes well before general investment circles have caught on.

Quick Tips for Angel Success:

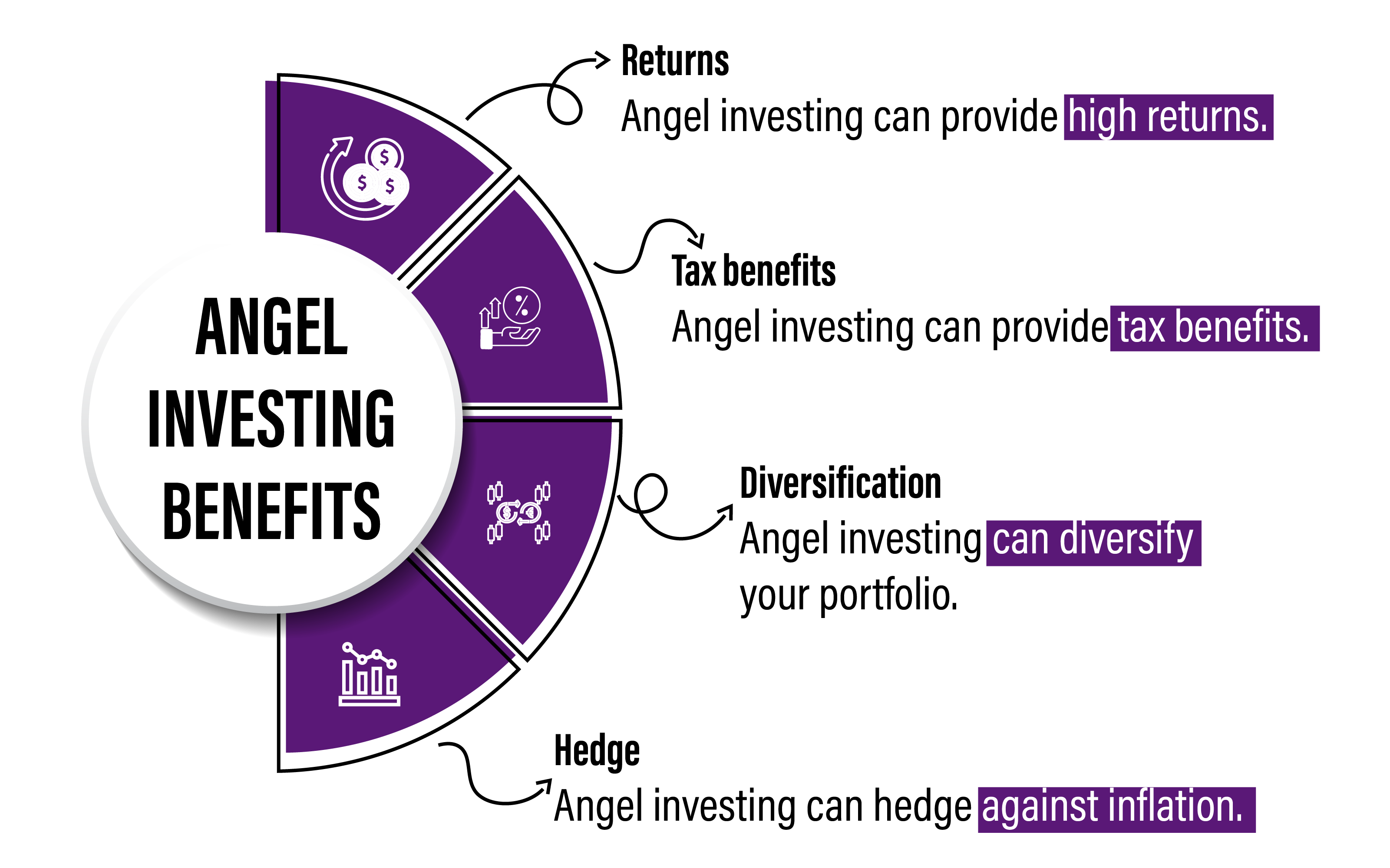

Angel investments are a strong complement to other alternative assets within a diversified portfolio approach. Financial planners advise investing 20-30% of total investment in alternative assets, 5-10% of which should be invested in angel investing in order to maximize risk-adjusted returns. This alternative investment approach operates synergistically with commodities, real estate, and private equity to minimize portfolio volatility in total while achieving growth from diverse asset classes.

Intelligent 2026 capital deployment means structuring angel investments as a market volatility hedge in addition to commodities investing, with the opening up of further investment opportunities that complement exposure to private markets. For investors new to this space, understanding the fundamentals through Angel Investing 101 provides an essential foundation of knowledge for building a successful angel portfolio strategy.

Angel investing carries inherent risks that require careful management and realistic expectations. Startup failure rates remain high, with 90% of new companies failing within their first decade, making due diligence crucial for protecting capital and identifying viable opportunities.

Risk Management Strategies:

Accessing angel investor 2026 opportunities involves satisfying certain requirements and adopting tactical measures to establish deal flow and investment know-how.

Steps to Get Started:

The secret is creating knowledge via education and networking prior to putting up substantial capital. Early-stage funding success is more reliant on the selection of deals and due diligence than investment amount, so rigorous preparation is crucial for long-term success.

The current angel investing trends are centered around finding a tech way into how investors locate, assess, and manage their early-stage investments. AI-based deal sourcing platforms would, for instance, automatically reject low-quality initial deal flows, while machine learning algorithms detect the best opportunities by scouring founder backgrounds, market conditions, and the competitive landscape.

Equity models based on blockchains and tokenization could create new liquidity avenues for traditionally illiquid investments, thereby possibly shortening investment cycles and allowing secondary market tradability. Regulatory innovation and new SEC rules might see a widening of the definition of an accredited investor, making the field of angel investing accessible to a wider base of investors.

On the other hand, social winds flowing towards impact investing and applying ESG principles will change the startup fundraising agenda, with sustainable and socially conscious companies fetching a premium valuation.

Angel Investing in the U.S. is one of the most exciting investments in alternative investments, providing exclusive access to high-growth potential firms before institutional capital bids drive valuations up. The 2026 opportunity window is especially attractive, with a favorable market, increasing deal flow, and enhanced access platforms contributing to the perfect setup for new angel investors. This way of investing offers portfolio diversification, tax benefits, and profit potential distinct from that of traditional assets.

Start building your base of knowledge by looking into angel networks, attending investing in startup events, and getting to know experienced investors. The art of smart angel investing begins with learning, is enhanced by networking, and is made successful by thorough due diligence and smart portfolio building that will generate long-term wealth.