Cryptocurrency trading lures even casual investors and full-time market analysts. The prices are dynamic, opportunities can present themselves at any time of the day or night, and a single decision can determine the future of a whole portfolio. An easy-to-understand cryptocurrency trader is an indication that enables new traders to reduce the noise and learn the true functions of the market.

This cryptocurrency trading guide provides a straightforward approach to trading cryptocurrency, from a beginner to a pro, covering how various markets operate, deciphering charts, and creating a strategy tailored to your risk-taking capacity. Several tools, the most frequent errors, and safety measures are also mentioned. The volumes of crypto trading in the world are increasing, and regulations are getting stricter in key markets.

By the end, it is easier to follow the path from learning the basics through to applying a real strategy. Anyone having questions about how to learn to trade cryptocurrency can use this guide as a structured starting point.

Trading in cryptocurrency is a means of capturing short-term or medium-term price movements by selling and buying digital assets. Cryptocurrency trading falls between long-term investment and active speculation, so many people first learn how different markets work when they look into crypto trading for beginners.

Trading occurs across a few different market types, and each carries its own style and level of risk.

Spot trading is one of the easiest ways to get a feel for crypto trading. Assets are exchanged at current prices, with ownership transferred instantly. Most beginners tend to start here because it avoids leverage and keeps risk more contained.

Futures contracts allow traders to speculate on the market's direction without owning the asset directly. These markets go for both long and short positioning, making them useful in volatility. The potential rewards are higher, and so is the risk.

Margin accounts allow traders to borrow money to increase the size of a position. Since leverage multiplies gains and losses alike, this is the best approach only after solid chart-reading skills and clear risk limits are developed.

Crypto can be traded on exchanges that handle custody and customer support, or via decentralized platforms that run fully on-chain. Each has its differences in liquidity, fees, and user control.

For more detailed information about the differences, see the guide on types of cryptocurrency exchanges.

This foundation gives novice traders a sound understanding of how the market works before moving on to a step-by-step process of starting their first trade.

Getting into crypto trading is far easier once one has had the process broken down into clear steps. Anyone learning how to trade cryptocurrency for the first time can follow this sequence to set up a secure, functional trading setup.

Compare first the centralized versus decentralized platforms. While centralized exchanges have easier onboarding, stronger liquidity, and customer support, decentralized exchanges grant more control over funds, allowing users to trade directly on-chain.

For more details, see the guide on centralized vs. decentralized exchanges.

A wallet helps in storing assets securely, especially when funds are to be moved off an exchange. Hardware, mobile, and web wallets fill different needs.

A more detailed breakdown is available in the crypto wallet guide.

Most of the exchanges require identity verification as part of their regulatory compliance policies. Once verified, enable two-factor authentication, anti-phishing code, whitelist withdrawals, and set strong passwords; this is an extremely important layer of security added.

Funding can be made via bank transfers, cards, or existing crypto holdings. Choose the method that offers reasonable fees and fast settlement. Always double-check addresses and network types before transferring digital assets.

Before placing real trades, use the demo environment to get comfortable with charting tools, order types, and position sizing.

A simple, user-friendly choice is the BlockTradeDirect demo trading account.

Most beginners have a solid foundation and avoid early mistakes if they follow these steps. Once the setup is done, the next step should be learning how to read cryptocurrency price charts.

Price charts form the backbone of crypto technical analysis, showing market trends, momentum, and the behavior of traders. Any person learning to read charts can make more sober decisions rather than guessing where the market is heading.

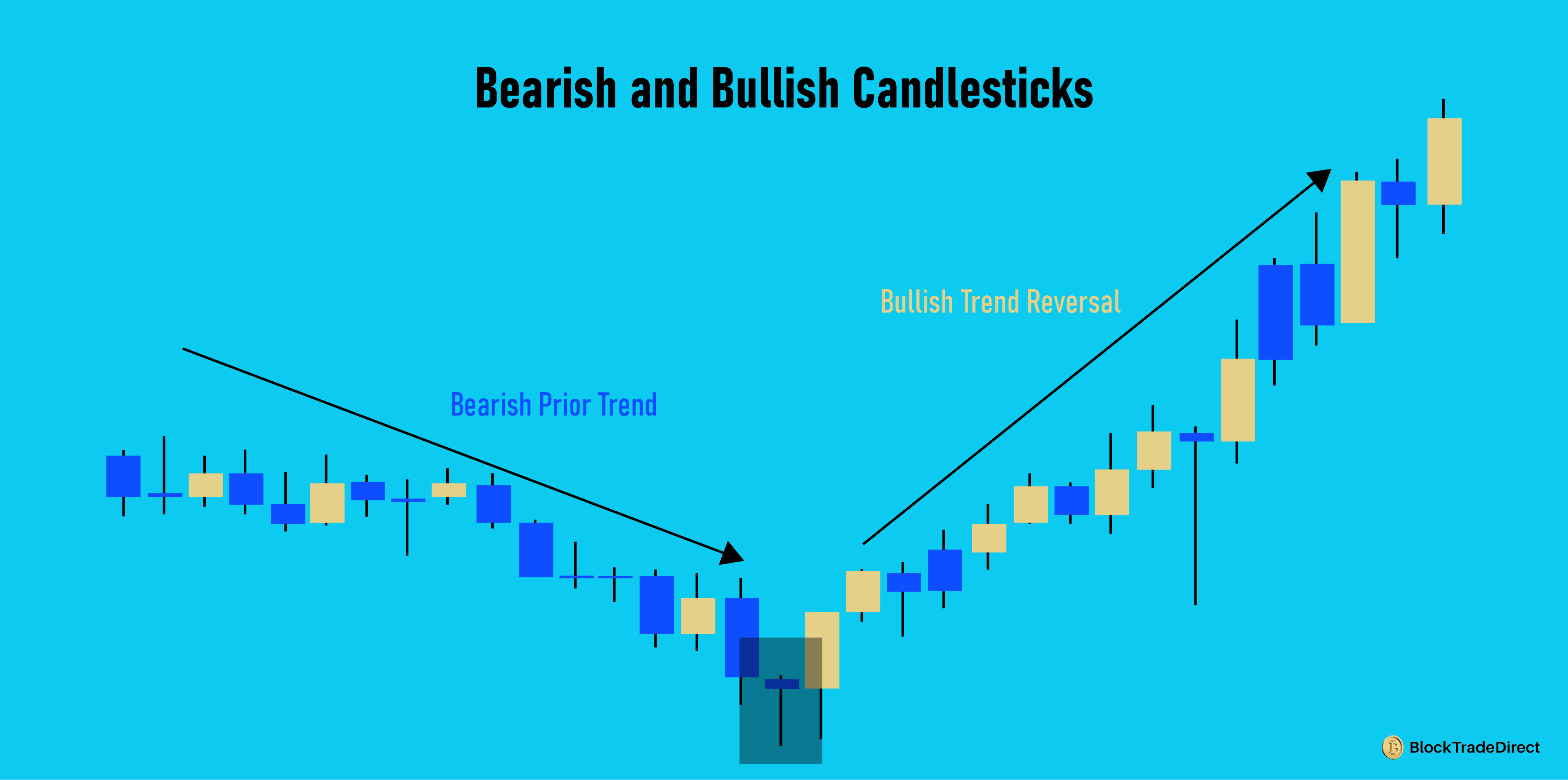

Candlestick charts represent the movement of price over any given time frame. Each candle shows the opening, closing, high price, and low price. Green candles signal upward movements in price, while red candles signal downward price movements. Understanding how these candles form into patterns helps identify shifts in the market's sentiment.

Support acts like a floor where buyers tend to step in and push prices higher. Resistance acts like a ceiling where sellers apply pressure. These levels do help traders plan entries, exits, and stop-loss placements, among other things. In addition, they have a leading role in the strategizing of bitcoin trading and the general crypto trend analysis.

Volume defines the strength of a price movement. High volume typically refers to a stronger conviction among traders. Trend indicators, such as moving averages or MACD, are good for determining whether or not a market is trending upwards, trending downwards, or remaining range-bound. These tools guide both short-term and long-term strategies.

For further reading on chart reading, refer to the dedicated guide on how to read cryptocurrency price charts.

Mastering the basics empowers traders with the confidence needed to analyze price movements and refine their own crypto trading indicators.

A good strategy keeps traders from randomly placing trades and gives them a clearer understanding of market conditions. Several top crypto trading strategies depend on a trader's time, risk tolerance, and style. The approaches discussed here will cover the most widely used methods by beginners and experienced traders alike.

Day trading involves small, intraday price movements. Trades are opened and closed the same day, and decisions are often based on technical analysis, volume spikes, and momentum indicators. This style works best during periods of strong volatility. Beginners often start small until they build enough skill to handle fast-moving markets.

The position is held for several days or weeks by a swing trader. They look to catch medium-term trends, not every minor move. This strategy fits traders who can't view charts throughout the day and want to remain active. Support and resistance zones, along with moving averages and breakouts, play the main role here.

Scalping targets tiny price changes using rapid trades. Trades may last seconds or minutes, and frequency is high. It demands sharp execution, discipline, and a platform with low fees. Scalpers usually depend on order book depth, liquidity levels, and precise entries.

Long-term traders target broader market cycles and fundamental trends. Short-term traders rely more on technical analysis and small fluctuations. Both approaches work, but each requires different expectations. Long-term trading reduces stress and noise. Short-term trading offers more opportunities but comes with more decisions and a higher emotional load.

These strategies will help traders figure out how to approach the market with more structure, rather than mere guesswork. Once one has a strategy in place, the next step involves understanding how different crypto trading orders work.

Knowing how order types work gives traders better control over entries and exits and helps with risk. Most beginners start with simple orders, then move into advanced setups as they gain confidence. A clear understanding of these tools helps shape stronger crypto trading strategies.

A market order executes instantly at whatever the currently available price is. It's useful when speed matters more than precision. The downside is possible slippage during high volatility, especially in fast-moving markets.

With a limit order, a certain buying/selling price is set. The trade will be executed only in the case of the market reaching this price, therefore giving better control of entries and exits. Limit orders avoid emotional decisions, and they are widely used, from crypto trading for beginners to experienced setups.

Stop-loss orders automatically close a position when the price starts to move against the trader. Take-profit orders help lock in gains when the desired price target has been reached. Both together give the very basics of risk management and discipline when conditions may turn volatile.

Advanced order types add more flexibility.

These tools assist traders in protecting capital and automating decisions during unpredictable market swings. To understand these in more detail, refer to the full guide on cryptocurrency trading order types.

Having covered orders and execution, the next step will be building the right mindset and properly managing risk.

Good traders survive longer not because they find perfect entries but because they manage their losses and control their emotions. Risk management and psychology shape long-term success more than any single strategy or indicator.

Position sizing is the size of your capital that goes into each trade. Small, consistent sizing protects the account in case of losing streaks. Many traders use a fixed percentage rule whereby they risk only one to two percent per position. This will keep losses contained while leaving room for multiple opportunities.

The risk-reward ratio compares the potential loss with the expected profit. A simple example is risking 1 dollar to aim for a profit of either 2 or 3 dollars. Sticking to favorable ratios helps to offset losing trades by keeping the overall system profitable. This approach fits well with most crypto trading strategies.

Fear, greed, and impatient moves tend to create more mistakes than bad analysis. Emotional trading may result in chasing pumps, revenge trading after a loss, or moving out of a plan in the middle of a trade. Clear rules, pre-set stop-loss levels, and calmness help remove emotion from decisions.

Crypto markets are fast-moving, but consistent results come from steady habits, not necessarily unrealistic expectations. So start with the simple stuff: improve your chart reading, refine your entries, or limit your losses. Small, measurable goals help build confidence without putting unnecessary pressure.

Strong psychology and sound risk rules give traders stability in a market known for sharp swings. The next vital area, once these are in place, is staying safe.

One of the most important parts of learning crypto trading is how to stay safe. The market attracts innovation, but it also attracts scams, security vulnerabilities, and unregulated platforms. A few simple rules help protect both funds and personal information.

Most scams come in the form of phony investment schemes, phishing links, impersonated support accounts, or offers of guaranteed returns. Always double-check the URL, never share your private keys, and only use reputable exchanges. If it seems too good to be true or urgent, it's probably a scam.

Know Your Customer and Anti-Money Laundering laws are followed by traders in the United States. Identity verification, suspicious activity monitoring, and required transaction reporting are some of the methods employed by exchanges. This regulation enhances transparency and diminishes fraud risk. Understanding them helps traders avoid compliance issues and choose platforms that follow proper standards.

Safety in trading can be ensured by secure storage. Hardware wallets are used for keeping holdings offline. The account of exchanges is protected by strong passwords, two-factor authentication, and withdrawal whitelists. Keeping software updated and avoiding public Wi-Fi for transactions also reduces exposure to attacks.

For a more comprehensive overview of safe trading standards in the United States, access the guide to safe crypto trading in the USA.

Acquiring these habits of safety early helps traders refrain from making many expensive mistakes as they grow more active in the market.

Strong trading skills are a product of consistent practice, reliable tools, and steady learning. With the right resources at their disposal, traders can test ideas, track performances, and make more sense of the market.

Demo platforms allow traders to practice without risking actual funds. They will also mirror live market conditions so that the novice can learn the types of orders, reading charts, and risk management more safely. This can be an important step in building confidence before trading with live capital.

Bots automate preset strategies and can run day and night, but they require careful setup and monitoring. Portfolio trackers manage holdings across several exchanges and provide a clear view of your gains, losses, and asset allocation. They make decisions a lot easier and give organization to everything.

Structured lessons will enable traders to learn both fundamentals and advanced concepts. Sites like Coursera, Udemy, and Skillshare have introductory classes for beginners that extend to deep dives into technical analysis, trading psychology, and strategy design. Quality courses save time by eliminating guesswork.

For US-based traders looking to get into structured learning, refer to crypto trading strategies for US investors.

Employed consistently, these can develop one's overall skills in discipline and decision-making and make it easier to trade with a plan rather than to react to every fluctuation in price.

Even motivated beginners fall into predictable traps. Recognizing these mistakes early helps protect the capital and keeps trading decisions more consistent.

Many beginners jump in and out of the market too often. This usually leads to higher fees, emotional decisions, and unnecessary losses. A clear plan and fewer, well-timed trades often produce better results.

FOMO catapults traders into impulsive entries whenever there is a sudden spike. More often than not, such sharp moves are reversed equally fast, trapping late buyers. Waiting for confirmation and sticking to a strategy helps avoid this trap.

Skipping stop-losses, risking too much on one trade, or trading without defined exit points leads to larger losses. Good risk management underpins every trading style, from day trading crypto right through to longer-term swing strategies.

Few tips from unknown sources or social media hype have ever been the basis for long-term gains. A structured strategy-even a simple one-provides direction for traders and can help to rein in emotions.

For more detailed examples, see the guide on common mistakes crypto traders make and how to avoid them.

By avoiding such mistakes, traders grow with swiftness and maintain focus on gradual improvement.

Small habits make a big difference over time. These tips help traders stay sharp, avoid unnecessary risk, and build a more disciplined approach to the market.

Looking back at past trades reveals patterns, strengths, and weak points. A simple journal with entries, exits, emotions, and outcomes helps traders refine strategies and avoid repeating mistakes.

Crypto markets move quickly, and news often drives volatility. Following reliable sources, tracking updates from major exchanges, and watching regulatory changes helps traders plan with more clarity.

A short checklist prevents rushed decisions. This can include confirming support or resistance levels, checking volume, aligning trend direction, and reviewing risk-reward. Consistent use improves discipline.

Good decisions require focus. Stepping back during stressful or busy moments reduces the chance of emotional trades.

For more practical guidance, see the list of things every trader should know before investing in cryptocurrency.

With these habits in place, traders are better prepared to handle different market conditions and protect their capital.

A strong foundation makes the trading journey far less overwhelming. This guide covered the core ideas that help beginners grow into confident traders, from chart reading to risk management and strategy building. The next step is applying these concepts with consistency and patience.

Start by practicing in a demo environment, explore the internal guides linked throughout this article, and keep refining your approach as you learn. Focus on clear setups, manageable risk, and steady improvement rather than quick wins. Crypto rewards discipline more than speed.

As skills grow, move toward advanced strategies, deeper technical analysis, and long-term planning. With the right mindset and tools, anyone can continue improving and trade with more intention and confidence.

FAQ’s About Crypto Trading

Choose a regulated exchange, complete KYC verification, and secure your account with strong authentication. Set up a wallet for long-term storage and begin with small trades while practicing risk management.

Beginners often start with day trading or simple swing trading because both rely on clear chart patterns and manageable timeframes. A basic plan, strict stop-losses, and steady practice usually work better than complex strategies at the start.

Focus on candlestick patterns, support and resistance levels, and key indicators such as moving averages or volume trends. With practice, these elements reveal momentum shifts and help predict potential price moves.

Use stop-losses, limit your position size, and aim for favorable risk-reward ratios on every trade. Consistent rules help protect capital during volatile market swings.

Yes, demo accounts are valuable because they let beginners practice strategies in real market conditions without losing money. They help build confidence before moving to live trading.