Money has always been controlled by banks, governments, and financial institutions. If you wanted to borrow, invest, or send money across borders, you had to rely on middlemen who set the rules, charged fees, and decided who got access. Over the last few years, a new system has started changing that pattern, and it’s called decentralized finance, or DeFi.

DeFi enables individuals to access financial services without having banks as intermediaries for blockchain financial services. All that a person has to have is a crypto wallet and an internet connection to be able to lend, borrow, trade, invest, and earn yield at the press of a button. No paperwork. No waiting for approvals. No limited banking hours.

The shift is already visible. By early 2025, the amount of value trapped in DeFi platforms has continued to rise steadily, the number of Gen-Z and young professionals in DeFi has increased exponentially, and large financial institutions are exploring tokenization and on-chain settlement. Finance is finally shifting towards an open, programmable, user-controlled system rather than the closed and institutional version.

This blog breaks down what DeFi really is, how it works, where it’s useful, the risks involved, and why many experts believe it represents the next stage of global finance.

DeFi stands for decentralized finance. It’s a financial system built on public blockchains where transactions are handled by code instead of banks or intermediaries. In DeFi, money moves through smart contracts, which are automated programs that execute agreements without anyone manually approving or rejecting them.

The basic idea is simple. Instead of storing funds in a bank account or applying for a loan through a financial institution, you interact directly with decentralized applications known as dApps. These platforms let you trade crypto, lend it out, borrow against it, earn interest, or participate in markets that normally require large middlemen.

What makes DeFi so appealing is that it hands control back to users. You decide where to put your money, you decide when to withdraw, and you can see exactly how the system works because everything is recorded on the blockchain. No hidden fine print. No selective access based on location or income. Just open financial tools built for anyone who wants to participate.

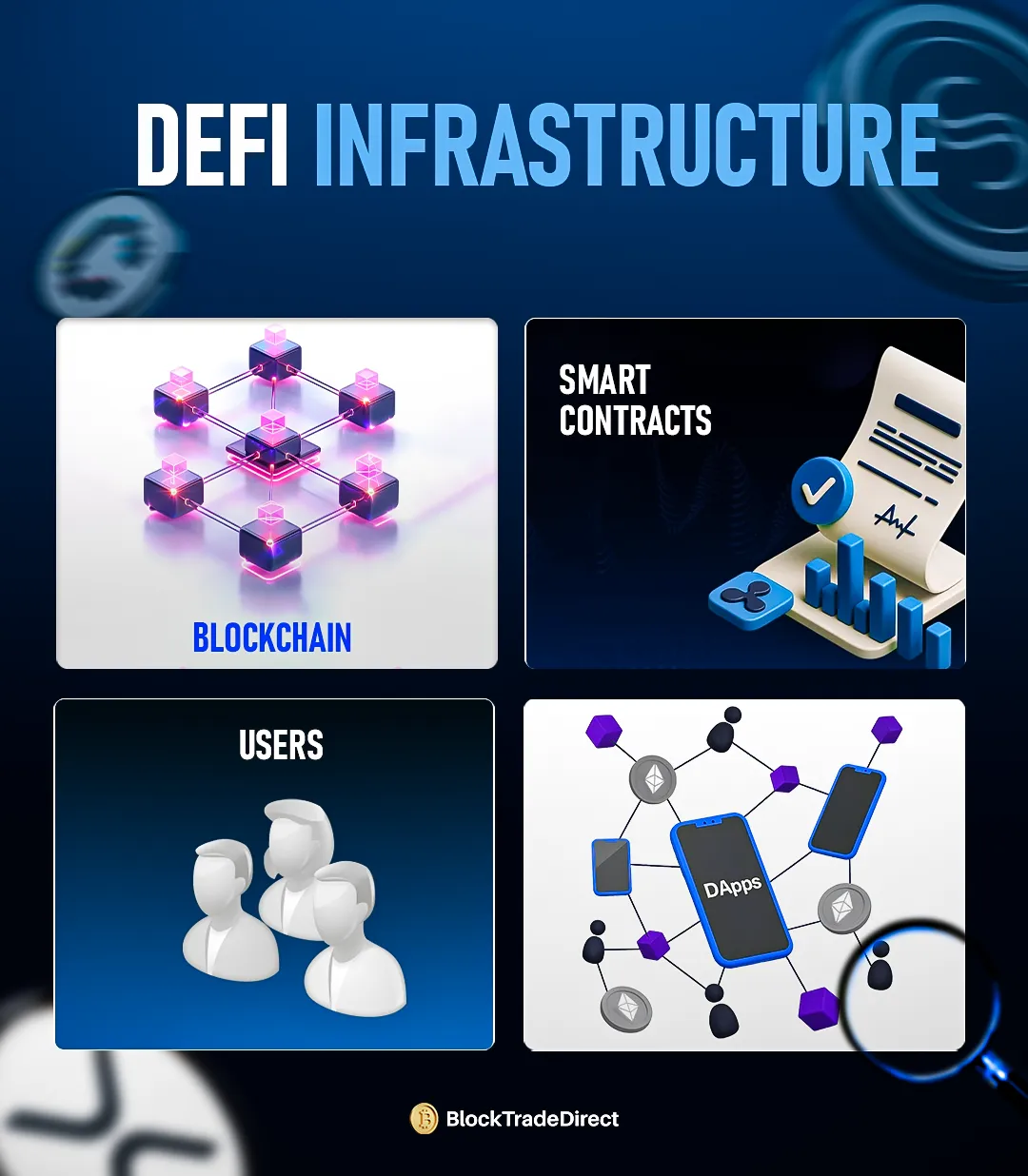

It may appear that DeFi is a complex concept on the surface, but once it is decomposed, the central framework is relatively simple to comprehend. The system is based on blockchain technology and automation to offer intermediary-free financial services.

The following are the key elements that comprise the DeFi ecosystem:

Ethereum, Solana, and BNB Chain are examples of public blockchains where the transaction is documented and validated. There is absolute transparency and traceability.

They are computer codes, and they serve as financial agreements. The contract automatically becomes effective when some conditions are fulfilled. No permits or documentation needed.

DApps are user interfaces that are based on smart contracts and enable you to lend, borrow, trade, or invest directly out of your crypto wallet.

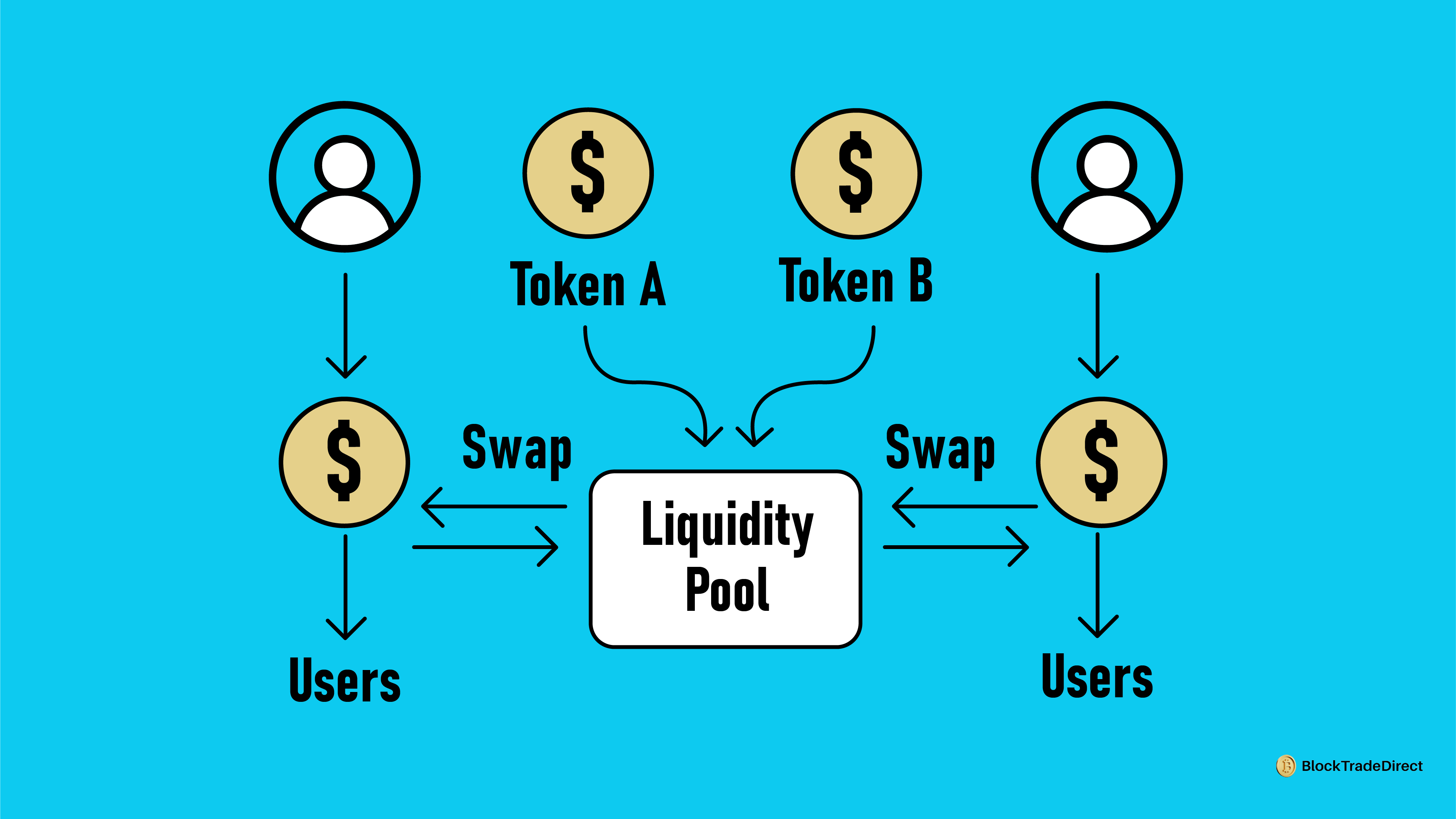

Rather than using brokers or market makers, the users place tokens in liquidity pools. Such pools facilitate trading and allow their members to receive rewards or charges.

Various platforms issue tokens that provide the holder with voting rights on upgrades, fee structures, and decisions on new products. The development of the platform is determined by the users.

MetaMask or Trust Wallet are wallets that serve as identity layers in DeFi. They keep your digital data and link you to dApps without any personal information.

|

Component |

Purpose |

Example |

|

Blockchain |

Records and verifies all transactions |

Ethereum |

|

Smart Contract |

Automates financial agreements |

AAVE lending contract |

|

Liquidity Pool |

Enables trading without intermediaries |

USDC–ETH pool |

|

Governance Token |

Gives users voting rights |

UNI / COMP |

|

Wallet |

Stores crypto and interacts with DeFi platforms |

MetaMask |

Together, these pieces eliminate the dependence on banks and financial institutions. Instead of trusting people or organizations, you rely on open code and transparent systems.

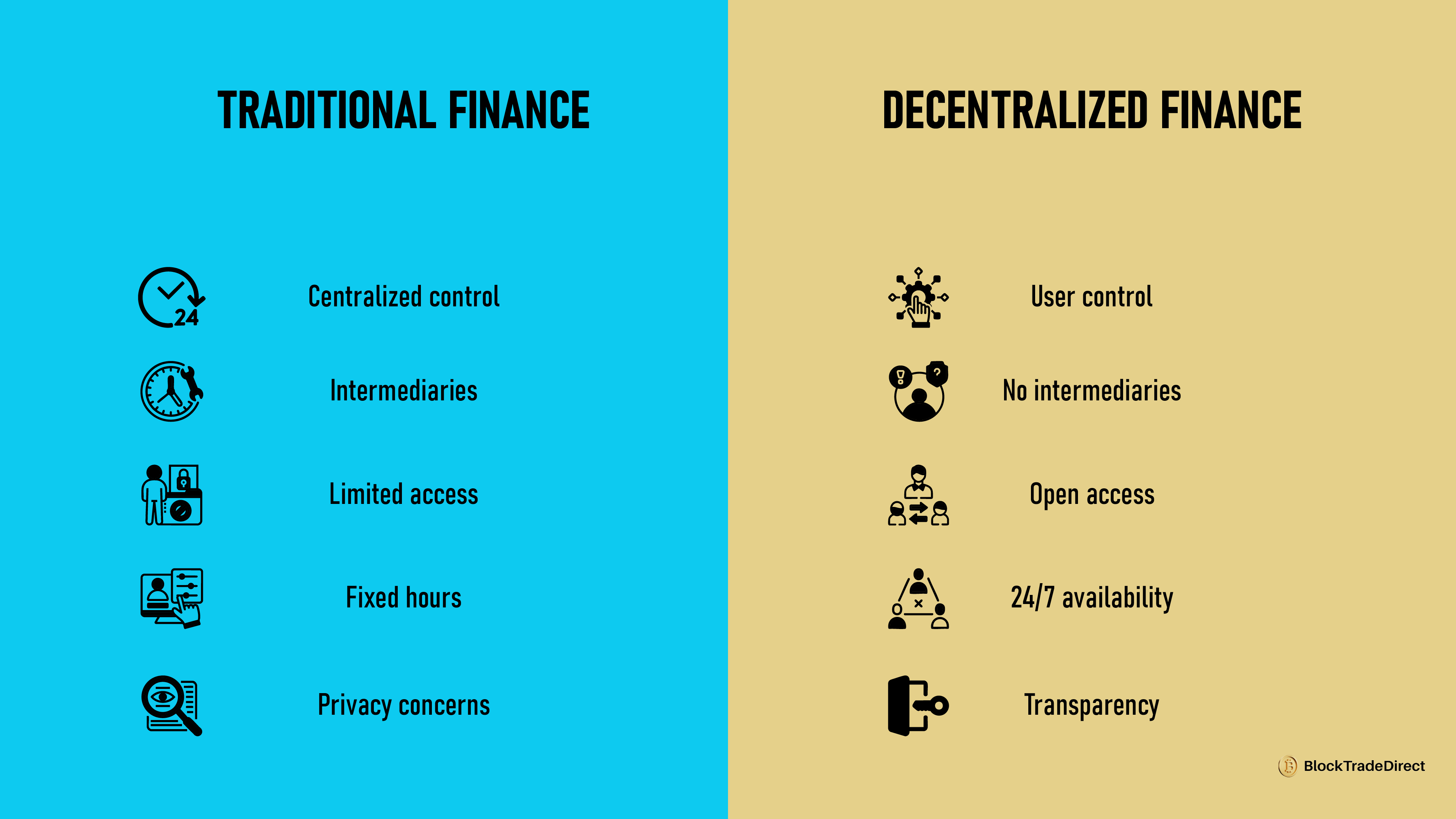

Traditional finance and decentralized finance serve the same purpose, but the way they operate couldn’t be more different. The old system is built around institutions that guard access, approve transactions, and take a cut every step of the way. DeFi removes that dependency.

Here’s a clear breakdown to help compare both models:

|

Traditional Finance |

Decentralized Finance |

|

Controlled by banks, governments, and institutions |

Controlled by users through blockchain and smart contracts |

|

Requires paperwork, credit scores, and KYC |

Wallet-based access with no approval barriers |

|

Transactions are limited by banking hours |

Available 24/7 globally |

|

Slow settlements due to intermediaries |

Near-instant settlement |

|

Higher service and processing fees |

Generally, lower transaction costs |

|

User funds are held by banks |

Users maintain full control of their assets |

|

Opaque systems |

Transparent on-chain records |

On the traditional side, you’re required to trust institutions with your money and follow their rules. In DeFi, trust is shifted to transparent code that anyone can verify. That’s a major reason why DeFi resonates with people who want direct control over their finances, not just access to services on someone else’s terms.

The difference isn’t only technical. It’s philosophical. One system is built on gatekeeping and centralized authority, and the other is built around openness and financial freedom.

DeFi isn’t just a concept anymore. It’s a growing ecosystem filled with real applications that millions of people use every day. Here are the most prominent use cases shaping the space in 2025:

Users can lend crypto to earn interest or borrow assets using their crypto as collateral. No bank involvement, no credit check, and the entire process happens through smart contracts.

Platforms like Uniswap and Curve allow users to trade tokens directly from their wallets, with prices determined by liquidity pools instead of centralized order books.

Participants lock tokens into protocols to earn rewards. Yield rates can be significantly higher than what banks offer, though they carry risks tied to market movements and protocol stability.

Digital assets pegged to fiat currencies (like USDT or USDC) help users transact on-chain without worrying about crypto price volatility. They’re widely used in trading, payments, and savings.

These tokens mirror the value of real-world assets like stocks, gold, or commodities. They give users exposure to broader markets without needing brokerage access.

People can send money worldwide within minutes instead of waiting days for bank transfers or paying large international service fees.

Insurance platforms use smart contracts to automate claim payouts and reduce overhead. They’re still emerging but gaining traction fast.

This sector is among the fastest-growing in 2025. Property, treasury bills, invoices, and even fine art are being tokenized for fractional investing and faster settlement.

These use cases highlight why so many users and institutions see DeFi not as an experiment, but as the next chapter of financial infrastructure.

The appeal of DeFi isn’t only about technology. It’s about what people and companies can actually do with it that wasn’t possible before. The biggest benefits become obvious as soon as you start using on-chain financial tools.

Anyone with a wallet and internet connection can use DeFi without asking a bank for permission.

Lending, staking, and liquidity provisioning can offer better yields than traditional savings products.

You hold your funds directly in your wallet instead of a bank holding them on your behalf.

Sending money globally takes minutes, not days, and you’re not limited by banking hours or holidays.

On the blockchain, every rule and transaction is visible. Nothing is hidden behind bureaucracy.

On-chain transactions reduce processing and intermediary fees.

Payments don’t get stuck in clearing cycles, so cash flow improves.

Invoices, credit, and recurring payments can be automated using smart contracts.

Businesses can accept payments from worldwide customers without needing separate banking setups for each region.

A company issuing on-chain invoices can get paid in minutes instead of waiting weeks for bank-clearing cycles. Each invoice is represented as a token and settled automatically through a smart contract. Faster settlement means smoother operations and better liquidity without taking loans just to keep cash flow steady.

DeFi’s biggest value doesn’t lie in abstract tech terms. It lies in giving both individuals and businesses more control, more speed, and more opportunities while removing bottlenecks created by the traditional financial system.

DeFi unlocks huge financial possibilities, but it also comes with real risks that every user should understand before putting their money on the line. Most of the problems don’t come from the idea itself, but from weaknesses in code, unpredictable markets, and a lack of user awareness.

DeFi platforms rely on smart contracts to execute everything automatically. If there’s a bug in the contract, attackers can exploit it and drain liquidity before anyone notices. When funds are stolen on-chain, recovering them is rarely possible.

Some projects are launched with the intention of disappearing once they collect enough deposits. They gain attention through hype and unrealistic rewards, then vanish with user funds. Good research is non-negotiable before trusting any protocol.

Liquidity providers earn fees and rewards by supplying two assets into a pool, but if the prices of those assets move too far apart, the final value of the position can end up lower than just holding the tokens.

Crypto markets move fast. If collateral used for borrowing drops sharply in price, positions can be liquidated instantly by the smart contract. Users often underestimate how quickly this can happen.

Governments are still trying to figure out how to handle DeFi. Future changes to policy may affect how certain protocols operate or who can access them in specific regions.

Not all tokens have deep liquidity. When trading volumes are low, users might not be able to exit large positions without heavy slippage.

Staying safe in DeFi is possible, but it takes awareness and discipline. Learning how to secure digital assets plays a huge role in reducing risk. For example, understanding the difference between hot and cold storage can prevent most wallet-related losses.

Another smart move is learning how to evaluate platforms before depositing funds. The guide to protecting your crypto investments explains how to spot red flags like unaudited contracts, anonymous teams, and unrealistic returns. These checks alone can save users from most of the common traps in DeFi.

The takeaway is simple. DeFi is full of opportunities, but only for users who approach it with caution, not excitement alone. Researching platforms, verifying smart contracts, and securing wallets can make the experience safer and far more rewarding.

DeFi has already gone through its early experimental phase. The next phase is growth, maturity, and real-world adoption driven by both everyday users and institutions. The trends unfolding in 2025 make it clear that DeFi is becoming a key layer of the global financial landscape rather than a niche crypto segment.

Traditional assets like government bonds, real estate, invoices, and commodities are moving on-chain. Tokenized U.S. Treasuries have already attracted billions in liquidity across major blockchains, and more institutions are exploring similar models to improve transparency and settlement speeds.

Until recently, most DeFi activity came from desktop users. In 2025, mobile wallets are onboarding the fastest-growing segment of users, especially in regions with limited access to traditional banking.

AI isn’t replacing developers, but it’s becoming a major force in auditing smart contracts, predicting vulnerabilities, and monitoring suspicious activities. More projects are expected to integrate automated threat detection to prevent hacks before they happen.

Users no longer want to bridge assets manually or stay locked into one network. Cross-chain protocols and Layer-2 rollups are making DeFi platforms easier, cheaper, and safer to access, no matter which blockchain someone starts with.

Networks like Arbitrum, Optimism, and Base are scaling Ethereum with lower fees and higher throughput. This shift makes everyday DeFi activity far more practical for average users instead of just long-time crypto veterans.

Regulators in multiple regions are working on frameworks that allow innovation while managing risks like fraud and illicit activity. Instead of fighting regulation, many projects are preparing for integrations such as KYC-optional layers or compliant liquidity pools.

As the ecosystem matures, insurance platforms and automated compliance tools are gaining momentum. Covering smart contract exploits, wallet risks, and cross-chain transactions can make DeFi safer and speed up institutional participation.

Anyone can enter DeFi, but doing it the right way matters. A structured approach helps you explore opportunities without exposing yourself to unnecessary risk. Here’s a simple roadmap anyone can follow.

Pick a non-custodial wallet you control, not one where a company holds your keys. MetaMask, Ledger, and Trust Wallet are popular choices. Your wallet is your identity in DeFi, so set it up carefully and store your seed phrase offline.

Buy crypto on a trusted exchange and transfer it to your DeFi wallet. ETH, USDT, USDC, MATIC, and SOL are among the most commonly used for DeFi platforms. Always double-check the network you are sending on.

Begin with well-known names rather than new projects promising high returns. Lending, staking, or swapping small amounts on established protocols helps you understand how DeFi works without overexposing your funds.

Take time to learn before committing large amounts. The biggest losses in DeFi usually come from rushing into platforms without proper research.

High yields are tempting, but they often match high risk. Look for audited contracts, transparent documentation, community reputation, and realistic reward structures.

Good security decisions make the biggest difference in long-term success with DeFi. A few must-follow habits:

If someone wants to dig deeper into wallet safety, the crypto wallets guide is a helpful resource for choosing secure storage and avoiding beginner mistakes.

DeFi is designed to give you control, not overwhelm you. Start slow, focus on learning, protect your wallet, and you’ll gradually find the opportunities that match your risk appetite and financial goals.

DeFi isn’t just another crypto trend. It signifies a change in the way individuals engage with finances. Instead of asking banks for permission, waiting for approvals, or paying layers of fees, users can access financial services directly on the blockchain with full control over their assets.

The strongest advantages of DeFi come down to three things:

At the same time, DeFi comes with real risks. Smart contract bugs, scams, volatility, and regulatory uncertainty mean users need to take safety seriously. Research, platform evaluation, and secure wallet practices are essential, not optional.

If adoption continues at the pace we’re seeing in 2025, DeFi won’t stay a niche corner of crypto. It will gradually blend into everyday finance. Businesses will use blockchain for payments and settlements. Investors will hold tokenized real-world assets. People will borrow and lend without banks. Some users may not even realize they’re using DeFi, it will simply become part of how money moves.

The bottom line is simple. DeFi gives people and businesses new ways to interact with value that are faster, open, and globally accessible. Learning how it works today puts you in a stronger position tomorrow as this new financial system continues to grow and evolve.

It can be safe if you take security seriously. Using trusted platforms, storing funds in a secure wallet, and avoiding hype-driven projects make a big difference. Most losses happen when users rush in without research.

Yes. Lending, staking, liquidity pools, and savings-style products offer passive income opportunities. Returns vary, and higher yields usually come with higher risk, so checking platform safety is crucial.

You deposit crypto into a lending protocol, and borrowers take loans using their assets as collateral. Smart contracts handle the entire process automatically, and lenders earn interest from the borrowing activity.

DeFi is decentralized and automated through smart contracts, letting users control their assets directly. CeFi (centralized finance) works like traditional crypto exchanges, where a company manages funds and operations on behalf of users.

No. Most platforms only require a crypto wallet to get started. No paperwork or credit checks. Some protocols are beginning to add optional KYC layers for compliance, but they’re not the norm.