The internet is excellent in sharing but awful in proving ownership. Anybody can reproduce a photograph, song, or art piece and pretend that it was his or hers. That's where NFTs step in. They provide digital objects with a new property that they have never possessed: the ability to be verified to create some form of ownership that is not subject to being counterfeited, cloned, or manipulated in the background.

NFTs, or non-fungible tokens, are digital assets that exist on a blockchain and signify the ownership of something unique. One way is that something can be anything that people appreciate. Art, game objects, music rights, event tickets and collectibles, property records, identity credentials, and so on. The significant aspect is not the file itself. It's the proof attached to it. An NFT is a kind of certificate of authenticity that is placed in a public place, and any person can check it.

The explanation is simple for why people are paying attention. NFTs enable online property to act like real-life property. When you purchase a painting, you purchase the rights to that particular painting. When you purchase an NFT, you acquire the ownership of a definite digital or tokenized resource supported by documented evidence in the blockchain.

Such evidence cannot be copied in the backroom or faked. It will inherit a history that is permanent and will record who made it, who purchased it, and who is currently the owner of it.

This conversion is larger than the sales of art or the headline price tags. NFTs are ushering in a new form of economy where creators, gamers, brands, collectors, fans, and everyday users can literally own and trade what they purchase online rather than having to rent access to services. The development of NFTs is accelerated in 2026, and it will dictate how the concept of ownership and value will be across the internet.

And in case you have heard much about NFTs but still need to know how they operate and why they are important, then you are on the right page. We will dissect it down to the fundamentals and up to practical examples, and the trends in the future.

NFT can be abbreviated as non-fungible token. The word "non-fungible" just means that it cannot be exchanged on a one-to-one basis with another similar commodity. A single Bitcoin is as good as a single Bitcoin. No NFT is the same as the other NFTs since each depicts something unique.

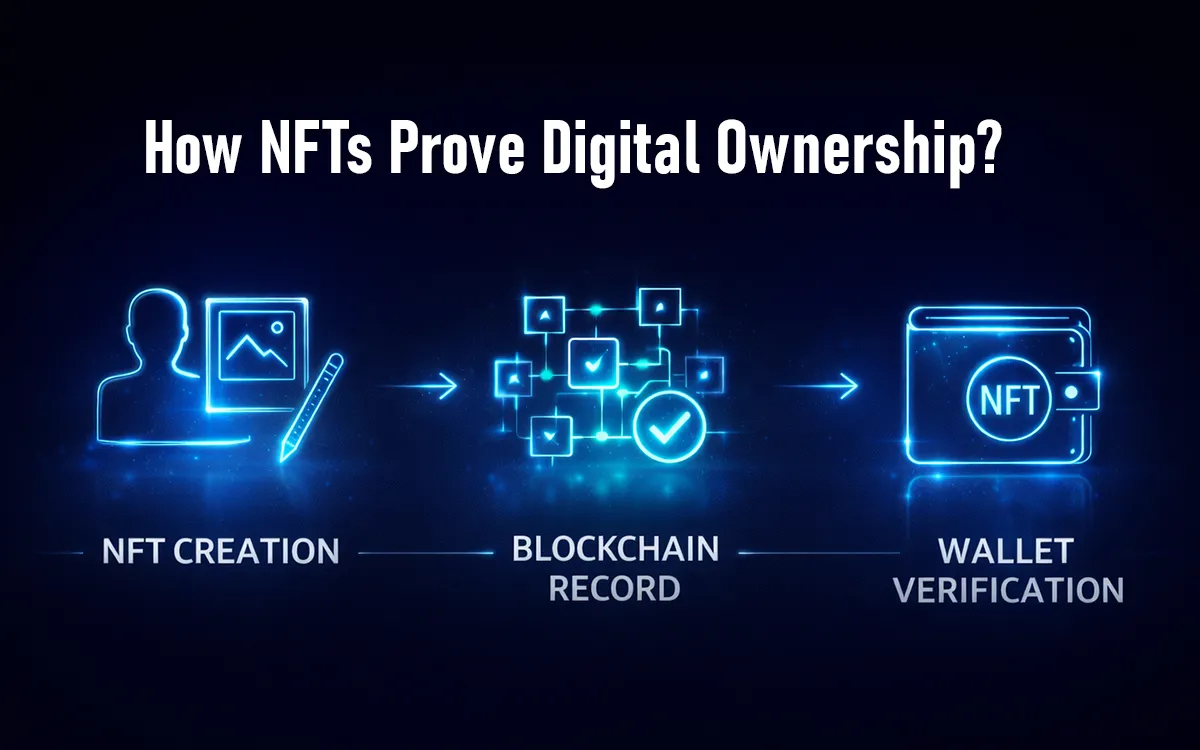

NFT is stored on a blockchain, typically Ethereum, Solana, Polygon, or BNB Chain. When a person creates (or mints) an NFT, the latter transforms into a digital token containing inherent information that shows the creator, the creation time, and the ownership history. All of that is documented on a public registry that can be checked by anybody.

NFTs do not represent the digital file. A blockchain cannot hold a 4K video or a huge piece of art. Rather, NFT is the ownership certificate attached to the asset. Think of it like buying a car. The car remains in your garage, and the registration will illustrate that you own it. Under NFTs, it is a garage that serves as a digital wallet, and it is registered as a blockchain proof.

To simplify it even more:

NFT standards define how these tokens behave. The most common are:

|

Feature |

NFTs |

Cryptos |

|

Fungibility |

Unique asset |

1 unit equals any other unit |

|

Purpose |

Prove ownership of digital or real assets |

Exchange and store value |

|

Supply |

Limited or one-of-one |

Typically large circulating supply |

|

Market value driver |

Scarcity + utility + demand |

Adoption + liquidity + supply |

|

Storage |

Digital wallet |

Digital wallet |

NFTs feel like a natural upgrade to how digital items are owned. They let us treat an online item the way we treat something physical: if you own it, you can transfer it, sell it, lend it, or prove it’s yours anytime.

For years, digital ownership was based on trust rather than proof. Platforms decided what you owned, and if a service shut down or changed its policies, the items you “bought” could disappear. NFTs flipped that model by making ownership independent of any central company.

When an NFT is minted, key information is recorded on a blockchain and becomes part of a permanent, public record. That includes:

Because this information is stored across thousands of distributed nodes instead of on a single server, no one can secretly edit it or delete it. That’s why the blockchain is trusted as the source of truth.

NFTs come with metadata that describes what the token represents. It might point to artwork, a video, a music file, a membership pass, a game asset, or a real-world item like property paperwork. Even if the media is stored off-chain, the ownership certificate always stays on-chain.

Smart contracts play a huge role here. They’re self-executing programs that run automatically on the blockchain. For NFTs, they can handle things like:

All of this makes ownership easy to verify without trusting a middleman.

This is the foundation that allows NFTs to power real utility in gaming, music, sports, ticketing, real estate, membership passes, and more. The next section breaks down where NFTs are being used the most in 2026 and how adoption is shifting beyond digital collectibles.

NFTs are no longer tied to just digital art drops. The market has shifted toward utility, access, and real asset ownership. In 2026, most adoption is coming from industries that benefit from transparent ownership, built-in royalties, and frictionless resale.

Here are the biggest sectors using NFTs today:

Artists and musicians use NFTs to sell original work, limited editions, and unlockable perks for collectors. Built-in royalties mean creators keep earning when their work is resold. Music NFTs now often include streaming rights, backstage access, early releases, or community memberships.

Web3 gaming is the fastest-growing NFT segment. Players actually own their in-game assets, which can include skins, weapons, land, characters, or achievements. Ownership also means players can trade or resell items instead of losing everything when they leave a game.

A 2024 report showed gaming NFTs accounting for over 38 percent of active NFT transactions worldwide.

Teams, leagues, and event organizers are turning tickets into NFTs to stop scalping and counterfeiting. Some NFT tickets also unlock VIP zones, loyalty rewards, or collectible moments from live events. Fan tokens and digital sports memorabilia are also expanding quickly.

Social profiles, badges, and exclusive access passes are becoming tokenized add-ons inside major apps. Influencers and brands use NFTs as proof of membership, early access rights, and subscriber perks.

Ownership of physical items can be digitized as NFTs so that transfer and verification are simple. Common examples include:

Tokenized assets grew sharply in late 2024, with analysts expecting the category to surpass multibillion-dollar volume by the end of 2025 as regulations mature.

NFTs are becoming digital passes for access and identity verification. A single NFT can act as a:

Because ownership is wallet-based rather than email-based, users keep access even if platforms change.

|

Category |

Adoption Share |

Key Drivers |

|

Gaming |

~38% |

Player ownership and marketplaces |

|

Art & Music |

~22% |

Royalties and scarcity |

|

Sports & Events |

~17% |

Anti-counterfeit ticketing and fan engagement |

|

Real-World Assets |

~14% |

Tokenizing property and luxury goods |

|

Identity & Memberships |

~9% |

Community passes and loyalty programs |

NFTs are shifting toward practical ownership instead of speculation. The most successful projects now focus on utility and long-term value, not hype or limited artwork drops.

At first glance, NFTs looked like a trend powered by digital art hype. The real shift became clear later NFTs solve a long-standing problem on the internet: people didn’t truly own what they paid for. Music, skins, e-books, in-game currency, movie content, and digital collectibles everything lived on centralized platforms. If the platform shuts down, your access will disappear. If terms changed, you had no say.

NFTs flipped that dynamic. They move ownership away from platforms and back to users.

Here’s what those changes mean in practice:

If you buy something digitally and it comes as an NFT, it’s yours regardless of where you use it. It isn’t tied to the platform that issued it.

Smart contracts allow artists, developers, musicians, and brands to bake royalties into resales. Every time the NFT changes hands, the creator gets paid instantly.

An NFT game skin can exist outside a single game if the developer supports it. The same goes for tickets, memberships, and passes.

Ownership becomes the entry key. Brands and creators can reward NFT holders with early access, discounts, exclusive content, or real-world perks.

Tokenized items can be bought, sold, fractionalized, or used as collateral more easily than traditional paperwork.

The shift isn’t just technological. It’s cultural. People are used to logging into apps and accepting whatever the platform decides. NFTs introduce a different mindset: you aren’t just a user, you’re an owner.

That change is driving more businesses toward blockchain-verified ownership models in gaming, entertainment, ticketing, luxury goods, and even property. It isn’t hype at this point—it’s a new foundation for how digital value works.

Anyone can get into NFTs in a few minutes, but doing it safely matters. The process usually includes five steps: pick a marketplace, set up a wallet, add crypto, make a purchase, and store the NFT securely. The experience feels similar to online shopping, except you control the asset directly rather than leaving it on a platform.

Different marketplaces specialize in different types of NFTs.

The best approach is to stick to well-known platforms with verified creator badges and transparent histories.

You’ll need a self-custody wallet to hold your NFTs. Popular choices include:

A wallet is the only proof of ownership, so private keys and recovery phrases must be stored safely offline.

If you're not familiar with wallet setup or storage principles, the Crypto Wallets Guide is a good starting point.

NFTs are bought with cryptocurrency. On Ethereum, it’s usually ETH, on Polygon, it’s MATIC, and so on. Gas fees cover network processing, so prices can vary depending on how busy the blockchain is.

Once you complete a transaction, the NFT moves directly into your wallet. You can check it on blockchain explorers to confirm it’s recorded permanently.

The biggest risk today isn’t hacking the blockchain. It’s tricking people into revealing their private keys or signing malicious contracts.

Security tips:

If you hold NFTs as part of your investment strategy, it’s worth reading this guide on protecting your digital assets.

Handled correctly, the security model of NFTs is far stronger than the old system of trusting apps to store everything for you. You own the asset, and you control the access.

NFTs aren’t a guaranteed path to profit, and they’re not meant to be treated like lottery tickets. Some NFTs have appreciated massively in value; others have dropped to zero. The smarter way to look at NFTs is through utility and long-term demand, not hype or short-term speculation.

When an NFT offers benefits that people actually want access, identity, status, yield, or utility demand tends to be more stable than hype-driven collections.

A lot of early NFT losses came from buying based on hype instead of value. The market in 2026 behaves differently. People focus more on utility and community than on speculative rarity.

The healthiest mindset is simple: buy NFTs because you value what they offer, not because you’re expecting a flip. Strong projects can turn into great investments, but that shouldn’t be the only reason to enter.

The next wave of NFTs won’t be driven by headline sales or celebrity drops. Growth is happening quietly through everyday utility, where people use NFTs without needing to understand the technology powering them.

Here are the biggest shifts underway:

Apps, streaming services, and games are starting to create NFTs for users behind the scenes. People might mint a ticket, badge, or reward without ever touching a crypto wallet. Web2 to Web3 onboarding becomes invisible.

Luxury goods, property records, collectibles, vehicles, and even legal contracts are moving to blockchain-backed ownership. The market for tokenized real-world assets is projected to be one of the largest drivers of adoption through 2026 and beyond.

Instead of passwords and email logins, NFTs can function as digital identity keys. Brands already use NFTs for:

NFTs won’t be limited to one blockchain. Transfers and listings across Ethereum, Solana, Polygon, Avalanche, and Base are getting easier. Liquidity pools for NFTs are growing, making buying and selling smoother.

AI-generated works are becoming tokenized immediately at creation, so provenance and creator rights are recorded forever. This helps solve the ownership dilemma around AI content.

The future of NFTs isn’t about novelty. It’s about normalizing digital ownership the same way the internet normalized digital communication. The user experience will get simpler, while the underlying tech shapes how people manage assets online and offline.

NFTs gave the internet something it never truly had before a reliable way to prove ownership. People can finally buy digital items and own them rather than depend on a platform to grant access. That shift has already changed how creators earn, how gamers trade value, how fans interact with brands, and how real-world assets are handled online.

The momentum in 2026 isn’t coming from big-price art drops. It’s coming from useful NFTs that provide access, perks, identity, transparency, or ownership of something that matters. As long as a project offers real value and not just hype, the long-term upside becomes far more meaningful.

If you’re getting into NFTs, the smartest approach is simple: choose utility over speculation and protect your wallet like it’s your bank. Ownership gives you power, but it also comes with responsibility.

No. Art helped popularize the concept, but NFTs now represent game assets, memberships, event tickets, licenses, digital identities, and tokenized real-world assets like property or luxury goods.

They can copy the image, but not the ownership. The blockchain records the original creator and owner. Copies don’t show up in the verified ownership history, so they have no value.

Not if it’s stored in a self-custody wallet. The NFT exists on the blockchain, not on a company database, so access remains intact even if a platform disappears.

Blockchain networks charge “gas fees” for processing transactions. Costs depend on network congestion and the blockchain you’re using.

In most countries, yes. Buying, selling, or earning from NFTs can trigger taxes similar to crypto transactions. Always check local regulations.