The majority of the population believes that crypto is confidential. It isn't. All Bitcoin and Ethereum transactions exist on an open registry forever. Any person can search a wallet, monitor its transfers, check the balance, and create a full spending history. Over the past couple of years, blockchain analytics companies have ensured that making the connection between wallet addresses and actual identities is even more convenient, which implies that on-chain activity is no longer anonymous.

This is where privacy coins are introduced. They are meant to secure financial information to ensure that the customers do not reveal their identity, the origin of the money, or the amount of money transferred. There has been a sharp increase in interest in privacy coins in 2024 and 2026 as exchanges, governments, and compliance tools introduced more thorough tracking and strict requirements. It began exploring the means of having fun with crypto without compromising their privacy.

It is not that you run away from the law. To the majority of users, it is all about security. As soon as random people can view your wallet balance or transaction history, you will become the victim of scamming, stalking, phishing, and even face-to-face theft. The businesses also stand the risk of losing sensitive financial information that may be used with bad intentions by competitors.

The premise is simple. Money is to flow without making your personal life a social fact. Privacy coins are that extra protection, allowing a user to control the extent of their financial imprint reveals, and remain in the benefits of decentralized digital currency.

A privacy coin is a cryptocurrency built to hide transaction details by default. Instead of showing the sender, receiver, and amount on a public ledger as Bitcoin does, privacy coins use cryptographic tools to mask this information while still keeping the network secure and verifiable. They function like regular digital money but without exposing your financial trail to anyone who cares to look.

The easiest way to understand the difference is this:

Bitcoin works like paying someone in a glass room. Everyone can see the payment clearly. A privacy coin works like paying someone in a closed room. The transaction still happens, but the outside world doesn’t get to watch.

These coins exist because financial privacy is not a luxury anymore. It’s a necessity in a digital economy where wallet data can be analyzed, stored, and used against you. Surveillance tools have become strong enough to track wealth, spending patterns, business movement, donations, and even political activity.

On the surface, privacy coins look like regular crypto. You can buy, sell, trade, store, and send them just like any other token. The difference is in what they protect: your financial information. Instead of anyone being able to scan your transactions forever, privacy coins give you the freedom to move money without putting your identity or net worth on display.

Privacy coins don’t hide transactions by luck. They use cryptography to break the link between sender, receiver, and amount so nobody can trace the payment trail. The goal isn’t to destroy transparency, but to make financial activity visible only to the people involved, not the entire world.

Below are the main techniques that power privacy coins, written in plain language.

Every time you receive money, the blockchain generates a one-time address that only you can access. It prevents outsiders from linking payments to your wallet, even if you reuse the same wallet repeatedly.

A transaction is mixed with several other possible senders, making it impossible to identify who actually sent the money. Think of it as blending a real signature inside a crowd of signatures.

These allow you to prove a transaction is valid without revealing any details such as amount or address. The network confirms the payment happened without learning anything about it.

Multiple users pool their transactions together. Coins are redistributed to final destinations in a way that disconnects senders from receivers.

Before a transaction is broadcast to the blockchain, it jumps through random nodes to hide the original IP address.

A system that hides transaction amounts while keeping computation fast and efficient.

To make it easy to scan, here’s a table summarizing the tech under the hood:

|

Technology |

How It Protects Privacy |

Coins That Use It |

|

Stealth Addresses |

Generates unique one-time receiving addresses |

Monero, Haven |

|

Ring Signatures |

Obscures the sender by blending them with decoy wallets |

Monero |

|

zk-SNARKs |

Verifies transactions without revealing data |

Zcash |

|

CoinJoin |

Mixes multiple transactions to break traceability |

Dash, others |

|

Dandelion++ |

Hides the network origin (IP obscurity) |

Monero |

|

Bulletproofs |

Conceals transaction amounts efficiently |

Monero |

The point of all these technologies is the same: your crypto transaction should not reveal your identity, spending behavior, income level, or personal network of recipients. Privacy coins give you digital payments without broadcasting your financial life to everyone.

Not all privacy coins work the same way. Each project takes a different approach to protecting transaction data, and their adoption levels vary. Here’s a clear breakdown of the most influential privacy coins in 2026 and why people use them.

Monero is the most widely adopted privacy coin and is private by default. Every transaction hides the sender, receiver, and amount using ring signatures, stealth addresses, and RingCT. It also uses Dandelion++ to hide the origin of transactions at the network level.

Why people choose Monero:

As of mid-2026, Monero continues to lead the category in hash rate, liquidity, and real-world usage.

Zcash allows users to choose between transparent and private transactions. It relies on zk-SNARKs, giving users complete confidentiality while still enabling selective disclosure for audits, compliance reports, and business recordkeeping.

Why do people choose Zcash:

It’s often preferred by users who want privacy without breaking compatibility with regulatory requirements.

Dash is best known for fast payments and low fees, and it offers optional privacy through PrivateSend. While it doesn’t match the full anonymity of Monero or Zcash, it gives users improved privacy while keeping speed and accessibility as priorities.

Why people choose Dash:

To compare them side by side, here’s a quick snapshot:

|

Coin |

Default Privacy |

Transaction Speed |

Selective Transparency |

Key Use Case |

|

Monero (XMR) |

Always private |

Moderate |

No |

Personal financial privacy |

|

Zcash (ZEC) |

Optional |

Fast |

Yes |

Individuals and enterprises |

|

Dash (DASH) |

Optional |

Very fast |

Yes |

Everyday payments |

Each privacy coin solves a different need. Monero focuses on full anonymity. Zcash bridges privacy with compliance. Dash prioritizes speed and usability while offering optional privacy.

Depending on the location, privacy coins may be legal or not. No single global rule exists. They are free in some countries, highly monitored in others, and some countries have prohibited them. The controversy is straightforward: citizens desire financial autonomy, whereas the government wishes to be able to trace crime. Privacy coins are in between that tension.

Privacy coins can be legally owned and bought, and sold. Nonetheless, transactions have to be monitored and meet the AML regulations. A number of centralized exchanges have removed XMR and ZEC in the past, although it is still widely used via DEXs and non-custodial wallets.

Greater monitoring is being advanced by the MiCA framework. Privacy coins are not prohibited, and exchanges are more strictly regulated, with their reporting requirements being more selective in their listings.

The major exchanges delist the privacy coins. They can still be held technically by the user, but access and liquidity within the region are restricted.

Legal, but both jurisdictions hold crypto service providers to the utmost transparency.

In a nutshell, then, privacy coins are legal today, even though regulators are more vigilant than ever. Liquidity, exchange accessibility, and on-ramp/off-ramp convenience are influenced by legality, rather than the presence or absence of the networks.

This also explains why most crypto investors are keen on seeking the means of insuring their assets outside the exchange's surveillance. Privacy coins do not fade. The legislation surrounding them is simply changing, and the users must be aware of the regulations within their jurisdiction prior to trade.

Privacy coins tend to spark debate. Supporters see them as a basic financial right. Critics worry they can be misused. The truth sits somewhere in the middle. Privacy coins protect people who don’t want their financial life exposed on a public blockchain, but like cash, they can also be used in the wrong way. Understanding both sides brings clarity.

Most privacy coin activity comes from people who simply value privacy, not secrecy.

Like cash or any neutral technology, privacy coins can be misused.

These cases attract regulatory attention even though they don’t represent the majority of activity.

To show the full picture:

|

Category |

Valid Use |

Abuse Risk |

|

Personal privacy |

Protecting everyday transactions |

Low |

|

Corporate finance |

Concealing profit strategies |

Medium |

|

Activism & political safety |

Anonymous donations |

Low |

|

Cybercrime |

Ransomware, darknet payments |

High |

Privacy coins aren’t the problem by default. Most users want privacy, not crime. The real challenge is finding a balance between protecting individual freedom and minimizing illegal use.

For investors who hold privacy coins and want to reduce exposure to phishing attacks, SIM swaps, and wallet tracing, guides like Protect Crypto Investments can help. Similarly, Security Measures for Crypto Investors offers practical steps for securing assets across both public and private cryptocurrencies.

Privacy coins should be handled responsibly, just like any powerful financial tool. The next section will focus on how to use and store them safely without putting yourself at regulatory or security risk.

Buying and using privacy coins isn’t complicated, but doing it safely requires a bit of awareness. The goal is to protect privacy without breaking local laws or exposing yourself to security risks.

You have a few options:

Follow KYC rules and stay compliant in your region.

Liquidity is usually strong for XMR and ZEC. Make sure you’re compliant with your local regulations before using them.

Works well in regions where exchanges have limited access.

Privacy coins provide anonymity, but careless habits can still leave traces. A few smart rules keep you safe:

|

Do |

Don't |

|

Use trusted wallets and backup keys securely |

Store coins on custodial exchanges long-term |

|

Keep software updated |

Reuse receiving addresses |

|

Follow regulations in your region |

Brag about wallet holdings or transactions |

|

Verify transaction fees and waiting times |

Ignore phishing or fake support contacts |

You don’t need to be a cybersecurity expert to use privacy coins safely; you just need awareness and discipline. If you’re also investing in non-privacy crypto, combining privacy coins with standard security techniques makes your portfolio harder to track or target.

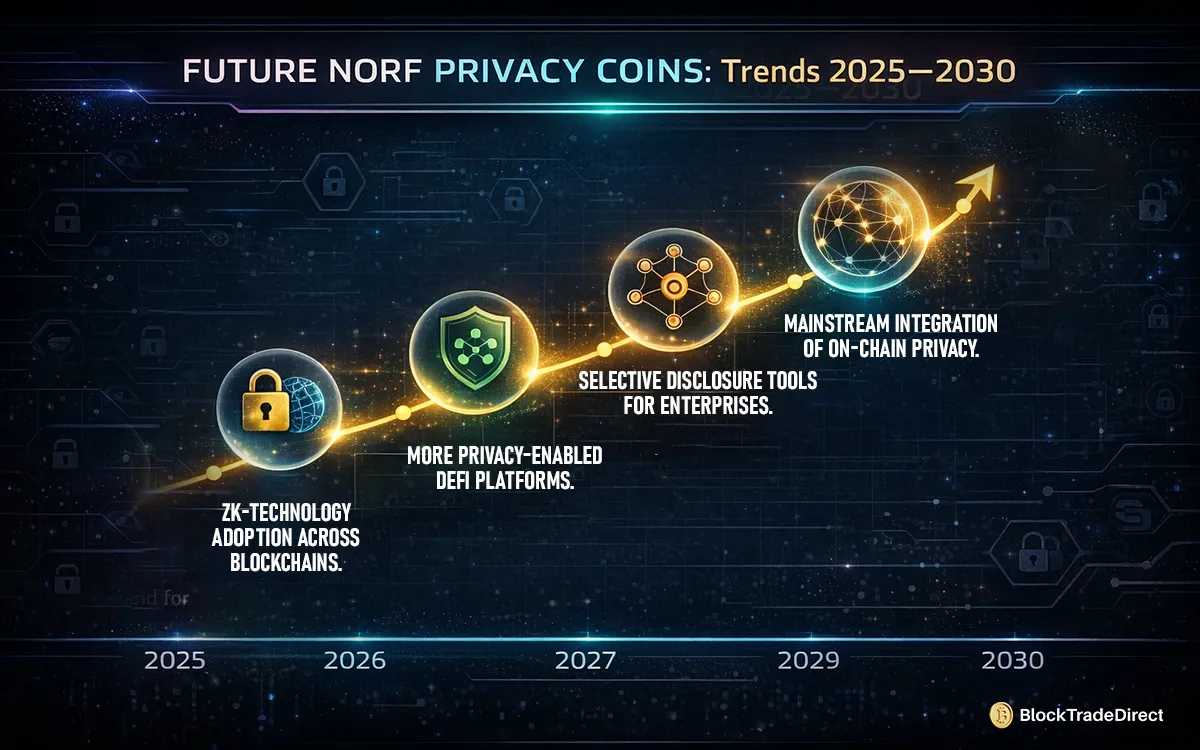

Privacy coins aren’t fading away. If anything, they’re becoming more relevant as blockchain adoption grows. Governments push for more transparency and compliance, while everyday users push for more financial privacy. That tug-of-war is shaping how privacy tech evolves.

Here are the key trends shaping the future:

So the real question isn’t whether privacy coins will survive. It’s how they’ll evolve. Fully private networks like Monero will likely remain popular for personal privacy. Hybrid models like Zcash may lead enterprise adoption. And privacy technology itself will spread far beyond the crypto niche and into everyday digital payments.

Privacy coins filled a gap that the crypto industry had ignored for years. That gap isn’t going away.

Crypto has always promised freedom, but real freedom includes privacy. Public blockchains expose far more information than most people realize, and anyone with basic tools can trace wallet balances, spending patterns, and financial relationships. Privacy coins step in to fix that gap by letting users move money without turning their entire financial life into public data.

They aren’t a shortcut to avoid regulations or laws. They’re a safeguard for personal safety, financial independence, and fair competition. Whether someone uses them for personal protection, business confidentiality, or donations in risky environments, the core purpose stays the same: you should decide who sees your financial footprint, not the internet by default.

Used responsibly and with awareness of regional rules, privacy coins give crypto users something the traditional financial world rarely offers, control.

No. In most countries, owning and using privacy coins is legal. Restrictions usually apply to centralized exchange listings and reporting requirements rather than personal possession.

Tracing privacy coins is extremely difficult when users follow good operational habits. Some analytics firms claim partial tracking ability, but full transaction visibility isn’t possible with correctly used privacy tools.

They reduce visibility into financial transactions, which makes it harder for law enforcement to track money laundering and cybercrime. Regulators focus on risk, not everyday users.

Most beginners choose Monero because it provides full privacy automatically without technical setup. Zcash is a strong choice for people who want privacy with optional transparency for audits or compliance.

Yes. You can swap privacy coins using centralized exchanges that list them, decentralized exchanges, or peer-to-peer platforms. Liquidity varies by region, so check local availability before trading.