Cryptocurrency emotional changes are difficult to manage. One day prices go up, and the next day, they will go down, and hence it becomes difficult to make plans or secure capital. Stablecoins intervene to become the stable mediating position. They work to maintain a stable value, and they provide investors with a viable means of transitioning money within the crypto ecosystem without being subjected to the swings and falls of the market.

The conceptual definition of a stablecoin is a digital token that is tied to something that is stable, which could be the US dollar, a commodity, or some other asset. This is the stability that makes them applicable in the form of payments, trading, as well as value storage when markets become rough.

The stakeholders are interested in stablecoins as they provide balance within a fluctuating environment. They may provide a secure place to park when the markets are on the decline, a means of expedited payment, and a component of global payments that is taking on more significance. The knowledge that they exist and the manner in which they operate can enable the investors to make wiser decisions in the rapidly moving sector.

Stablecoins are digital assets that are developed to hold their value at a constant rate. This is due to the fact that the coin is pegged to some other reliable value, like the US dollar or even a basket of currencies or commodities. This is likely the simplest way of reading the definition of a stablecoin: a cryptocurrency that is made to not experience significant price fluctuations.

There is a very obvious reason as to why they do so: to offer the traders and investors some level of value in the market that has assets like Bitcoin and Ethereum that can plummet in price within a span of a few hours. Unlike Bitcoin and Ethereum, which often fluctuate by tens of percent within the bounds of any particular day, stablecoins should theoretically stay close to their peg.

Here are some examples of well-known stablecoins:

To show how their volatility compares, here’s a quick snapshot:

|

Asset |

Typical Daily Price Movement (2024-2025 Avg) |

Stability Level |

|

Bitcoin (BTC) |

3 to 7 percent swings |

Highly volatile |

|

Ethereum (ETH) |

4 to 8 percent swings |

Highly volatile |

|

USDC |

Under 0.1 percent movement |

Highly stable |

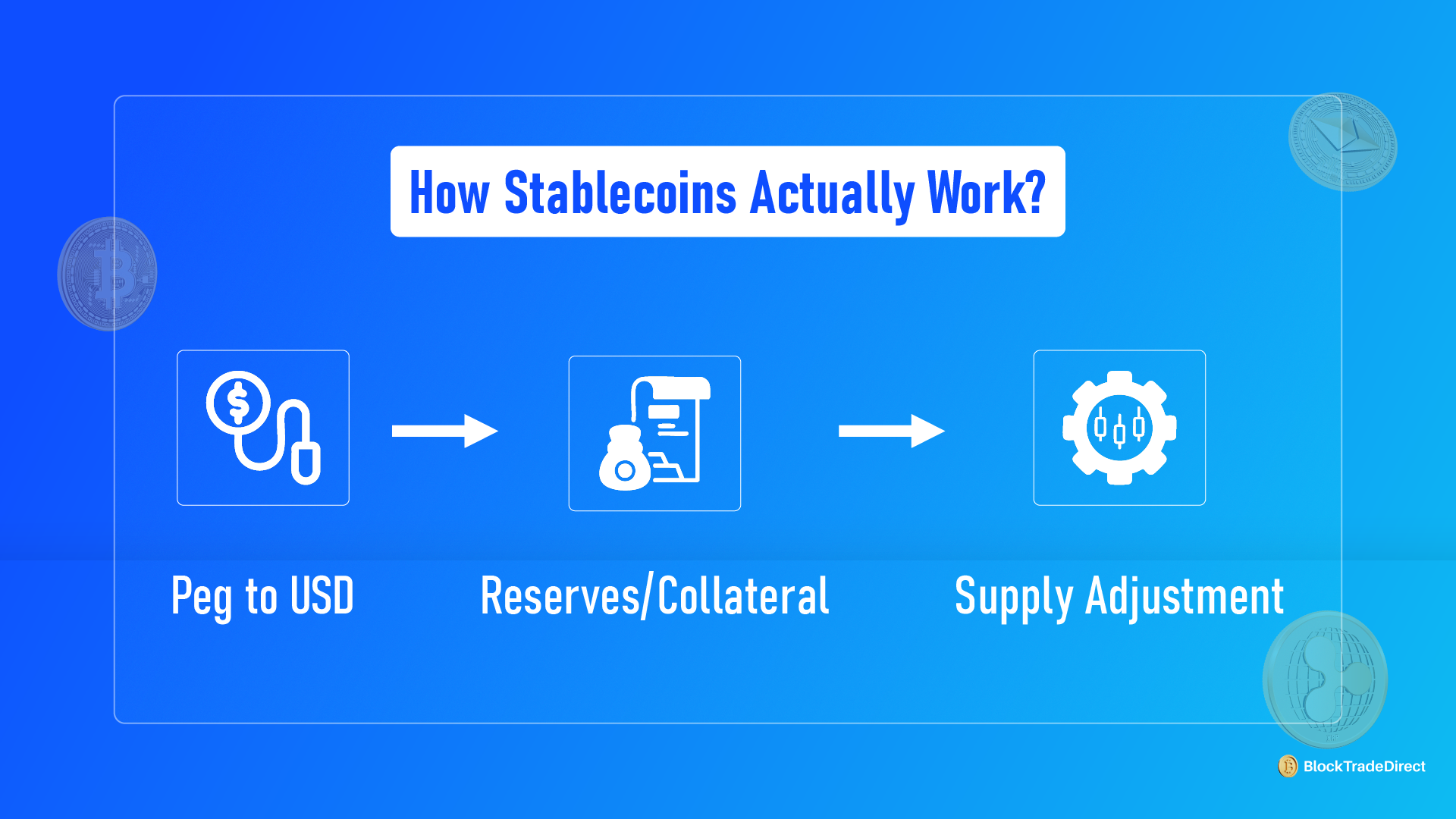

It's called a stablecoin because it tracks the value of some other asset, generally called a peg. Most are pegged to the US dollar, but some track commodities such as gold, while others use algorithms that balance supply and demand. The idea is simple: keep the price near one unit of the asset to which it’s pegged.

Behind this stability, there are a few common mechanisms:

Some stablecoins maintain equal reserves in cash or short-term treasury assets. As demand increases or decreases, the issuer adjusts supply while keeping enough collateral to support redemption.

Essentially, the supply of crypto-backed stablecoins locks up more value than they mint. This buffer helps absorb market swings and avoids sudden losses of confidence.

Algorithmic stablecoins rely on automated rules rather than reserves. If the price moves away from the peg, they shrink or grow the supply. While this model has worked for some, it has failed dramatically in cases where market confidence was broken.

Transfers of stablecoins among exchanges occur just like other crypto assets: they can be instantly traded on centralized platforms or via decentralized swaps. Readers seeking a more nuanced look at the distinction between the two types of platforms can refer to the following guide on the types of cryptocurrency exchanges.

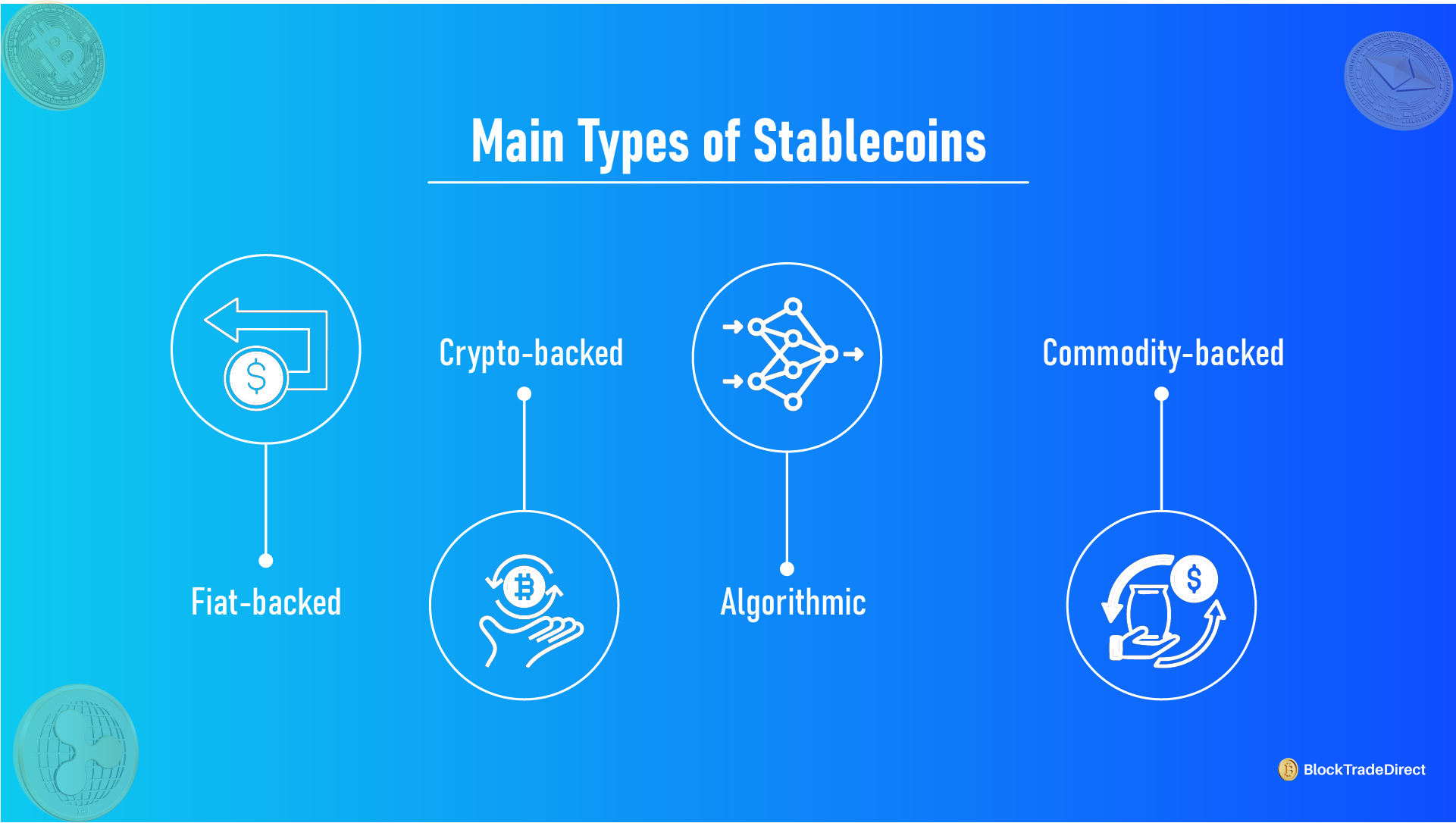

There are a few clear categories into which stablecoins fall. Each has its own structure, strengths, and risks, making it important for investors to understand the differences among them before choosing.

These are the most common and widely used. Each coin is backed by reserves such as cash or short-term treasury bills. Their goal is to keep the value close to one dollar at all times. USDT and USDC lead this category, with both holding the largest share of global trading volume. This group is often considered the most stable cryptocurrency option because of its straightforward model and strong market liquidity.

These rely on digital assets as collateral instead of traditional reserves. In order to remain stable, they are over-collateralized, holding more crypto value than the value issued. For example, DAI often requires overcollateralization in order to protect the peg during sharp market declines. This class satisfies those users who believe in decentralized systems and transparent on-chain models.

These try to maintain stability through automated supply adjustments rather than reserves. Supply increases or decreases depending on the market price. Although this may work in theory, in practice, it has also demonstrated major vulnerabilities. The particular case of the TerraUSD collapse in 2022 showed that reliance exclusively on algorithms and not being backed by hard collateral can be extremely dangerous.

Some stablecoins track the value of assets such as gold or oil. They tend to appeal more to investors who want a digital representation of hard assets. These coins are less common but are gaining attention as tokenized commodities grow.

Investors usually weigh liquidity, transparency, and collateral reliability. Fiat-backed stablecoins offer the most stability for everyday use. Crypto-backed options provide more decentralization. Algorithmic models need careful scrutiny because they rely heavily on market confidence. Commodity-backed coins suit those who prefer tokenized real-world assets.

Stablecoins play a vital role in contemporary cryptocurrency portfolios, offering various practical benefits. For one, their stable value provides a secure store of funds for investors when the markets become too unpredictable. Rather than hop back onto traditional banking rails, users can shift into stablecoins and protect their capital without leaving the crypto ecosystem.

They also work well as a hedge during sharp downturns. Traders often switch to stablecoins to lock in gains, reduce exposure, or pause risk without fully exiting the market.

Another attraction is earning potential. Most DeFi platforms offer yields either through staking, lending, or providing liquidity. While returns may vary widely, the presence of stablecoins allows for passive income without dealing with price swings.

Stablecoins are also used for fast global payments. They move across borders without delays or heavy fees, making them so useful for remittances and international businesses in general.

Those who are considering stablecoins for investment purposes or who want to learn how to invest in a stablecoin will find that the primary benefits revolve around stability, flexibility, and accessibility in trading and real-world use.

With stablecoins, investors get a combination of convenience and risk. Understanding both sides will help investors decide how and when to use them.

Their values never stray too far from the peg, making them a stable option in times of turbulence.

Traders can easily get in and out of the positions without waiting for bank transfers or facing other delays.

Shifting into stablecoins helps investors lock in gains or step off during periods of great volatility.

Many payment providers are integrating stablecoins into their systems, along with fintech firms and global businesses, which increases credibility and adoption.

Some stablecoins are heavily reliant on a single issuer, raising concerns about control, custody, and transparency.

Even well-known stablecoins may temporarily slip below or above their peg due to market stress or liquidity shocks.

Policies vary greatly depending on the region; changes in rules affect the way these assets are issued, backed, or traded.

These points cover the main advantages and disadvantages of stablecoins and help in responding to concerns about the risks of stablecoins and whether they are safe for investors.

In fact, stablecoins are the result of a constantly changing, regulated environment. The emphasis in the US is on the management of reserves, operation of issuers, and possible consumer and financial system risks. Regulators seek industry stability, prevention of misuse, and transparency.

Several agencies play a role. The SEC, for one, considers whether the structure of a particular stablecoin comes under securities regulations. The CFTC monitors incidents where the stablecoin works within derivatives or commodities markets. The Treasury, through FinCEN, enforces anti-money laundering requirements and tracks compliance obligations for issuers and exchanges.

Lawmakers have been growing more vocal since 2023, speaking of clearer frameworks for reserve backing, auditing, and consumer protection. The discussion goes into 2025, and with it comes the rise of stablecoin regulation to center stage in digital asset policy.

Readers who want more detail on compliance can refer to this guide on crypto trading compliance in the US.

Stablecoin buying is quite easy using verified platforms and basic security checks. Thus, the first thing to do is to decide upon a reliable exchange, create an account, and complete identity verification. At this point, one will be able to deposit money, look for the desired stablecoin type, and buy it.

Holdings of stablecoins can be made via exchange wallets or private wallets. Convenience aspects come in on centralized exchanges, while in non-custodial wallets, the user has complete control over their assets. It will all depend on how often one trades and how much independence is wanted over one's funds.

Investing in stablecoins usually entails staking, lending, or earning yields on DeFi platforms. Each option comes with its own level of risk, so it pays to check reserve audits, platform reputation, and withdrawal rules before committing funds.

A few tips stand out:

Anyone looking to understand safe trading practices can go through this informative guide on safe crypto trading in the USA.

Stablecoins have moved beyond trading and now support a wide range of practical uses: their speed, low fees, and predictable value make them useful in both everyday financial activity and advanced crypto applications.

Stablecoins also help decrease the cost and time it takes to send money across borders. Most remittance corridors today use either USDT or USDC to settle payments in a matter of minutes, bypassing expensive transfer fees and long times of processing times.

Many decentralized finance platforms rely on stablecoins for lending, borrowing, and liquidity pools. They act as the base currency for most DeFi activity because users can earn yields without dealing with constant price swings.

A growing number of merchants accept stablecoins for online transactions. PayPal’s PYUSD, introduced as a regulated dollar-backed stablecoin, made it easier for mainstream users to pay for goods, transfer money, or move funds between digital and traditional accounts.

Investors use stablecoins as a buffer during volatile markets. Holding part of a portfolio in stablecoins makes it easier to rebalance positions, secure profits, or shift into new opportunities without delays.

These examples show how crypto stablecoins are becoming everyday financial tools while still supporting stablecoins as investment options across trading and DeFi.

Technology, regulation, and digital payments continue to develop and, as a result, stablecoins will take a larger part in global finance. They offer speed, transparency, and predictable value, which makes them an appealing tool to both retail users and institutions.

The emergence of CBDCs is one of the key trends. Central banks worldwide are experimenting with digital currencies, which are as stable as fiat-backed stablecoins. They would be competing with stablecoins in certain fields but would also be coexisting, particularly in cross-border settlement and on-chain commerce.

The adoption at the institutional level is increasing. Fintechs, global banks, and payment networks are investigating tokenized deposits, quicker settlement rails, and payment flows based on stablecoins. This change indicates that it will be more incorporated into mainstream finance in the coming years.

There is also an improvement in technology. Risk reduction and trust generation are intended to be achieved through real-time reserve verification, automated auditing systems, and increased transparency tools. Such upgrades may make the stablecoins work in a safer way and appeal to a greater number of users.

With more and more adoption, the use of stablecoins will probably be central to on-chain payments, trading activity, and a global liquidity pool. Long-term investors can count on consistent growth when controls become more mature, and the digital asset markets will stabilize.

Modern digital finance is anchored on stablecoins. They provide the stability of traditional money and the speed and flexibility of the blockchain network. Their consistent value ensures that they can be used in payments, investments, and in trading on a daily basis in cases where market fluctuations are unpredictable.

To investors, this is a very easy lesson. Stablecoins serve to secure capital, transfer payments effectively, and explore new opportunities between exchanges and the DeFi ecosystem. Their contribution to bridging the gap between conventional finance and crypto will only increase as regulations get stronger and become more transparent.

A stablecoin is a digital currency designed to hold a steady value, usually by tracking the US dollar or another reliable asset. It offers the convenience of crypto without the large price swings seen in coins like Bitcoin or Ethereum. This makes it useful for payments, trading, and storing value.

Stablecoins can be safe when they are fully backed, transparent, and issued by reputable companies. The risks come from poor reserve management, weak auditing, or sudden depegging events. Reviewing reserve reports and choosing well-known issuers helps reduce these risks.

Fiat-backed stablecoins such as USDC and USDT are considered the most reliable because they hold matching reserves in cash or treasury assets. Their prices stay close to one dollar even during market volatility. They also have the highest liquidity across exchanges.

They follow a peg system that ties each coin to a reference asset like the dollar or a commodity. Stability is maintained through reserves, collateral, or algorithmic supply adjustments. The strength of this mechanism decides how well the stablecoin holds its price.

Stablecoins fall under the oversight of agencies such as the SEC, CFTC, and Treasury. Regulations focus on reserve transparency, consumer protection, and compliance with financial rules. The framework continues to evolve as policymakers refine standards for digital assets.