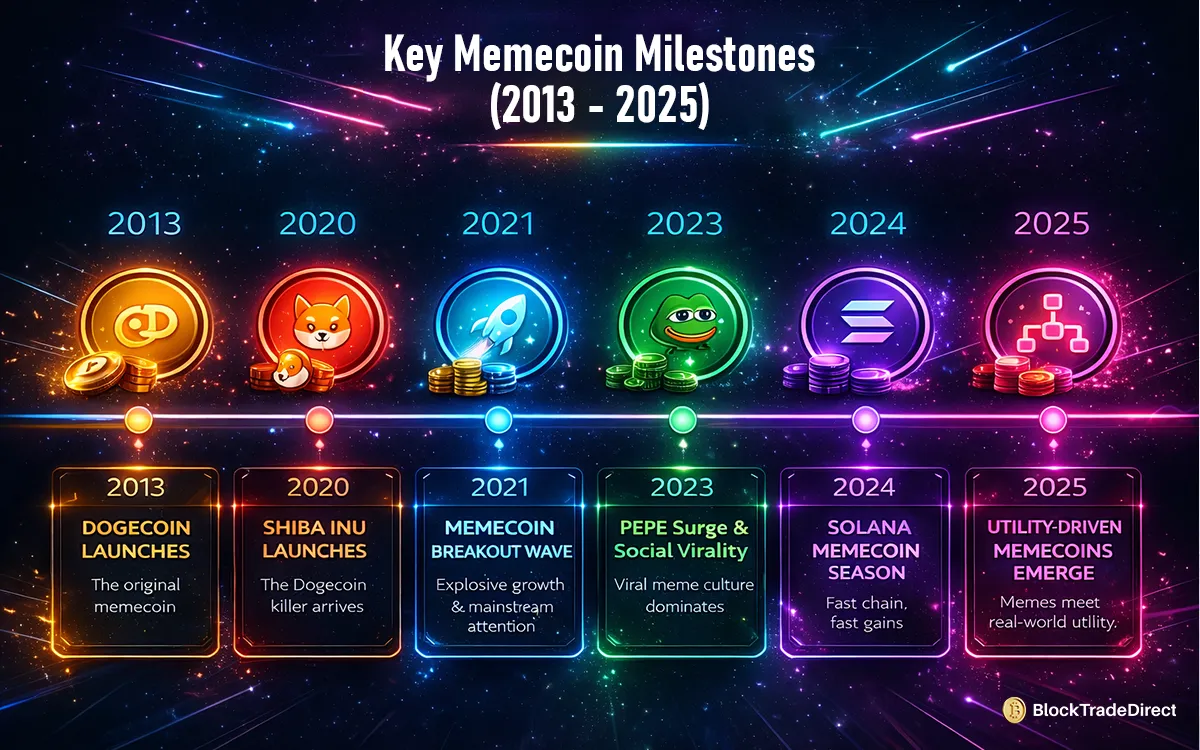

At the time of the debut of Dogecoin in 2013, no one thought that it would become more than a harmless meme about a Shiba Inu dog. It was constructed as a cryptocurrency hype parody, rather than a real investment.

However, jump forward a few years to 2025, and memecoins are among the most unpredictable and discussed areas of the crypto market. The tokens whose origin was a joke now have millions of owners, trade on leading exchanges, and sometimes even surpass already good projects.

The emergence of Shiba Inu, Pepe, Floki, and tens of other viral tokens has shown something significant. The internet culture is a high-speed traffic, which means that wherever there is a concentration of attention, there is money. Memecoins are not like conventional crypto assets. They are fed off the energy of the community, memes, virality on social media, and speculation.

Such a combination is dangerous, unstable, and occasionally insane in terms of profitability. Memecoins are here to stay, and whether one likes or hates them, they have made a mark in the history of crypto, and they are not leaving any day soon.

A memecoin is a cryptocurrency powered more by culture than by fundamentals. Instead of launching with an elaborate whitepaper or a serious mission, most start with humor, internet trends, and community appeal. They don’t win attention through technology first. They win attention through people.

Some common traits show up across most memecoins:

Memecoins sit at the intersection of entertainment and speculation. For some traders, they’re a way to chase high-risk, high-reward opportunities. For others, they’re simply a fun way to participate in crypto culture. Either way, the defining factor isn’t the tech. It’s the attention they generate.

Dogecoin became the first evidence that a cryptocurrency did not require a serious backstory to be popularized. It began as a fun intentionality, yet social media, culture toppling, and endorsement of celebrities catapulted it into international popularity. The tweets of Elon Musk alone resulted in huge trading volumes, placing Dogecoin in the mainstream discussion. It made it to the top 10 rankings of cryptocurrencies by market cap by 2021, no one anticipating that a coin constructed on memes would do so.

Then the story was made more by Shiba Inu. SHIB became more of an ecosystem, including staking, NFTs, and a decentralized exchange, instead of being just a meme token. What started as a fun cultural project gradually turned out to be a utility-based network. Early dismissers of the memecoins were compelled to admit that community-based assets could become a reality.

These two coins defined the whole wave of the memecoins. Dogecoin established the fact that attraction was sufficient to promote adoption. Shiba Inu demonstrated that a meme token could evolve to become a complete crypto ecosystem. All the large memecoins which followed afterwards were based on the two following ideas: capture culture first, add utility later, and should momentum remains high.

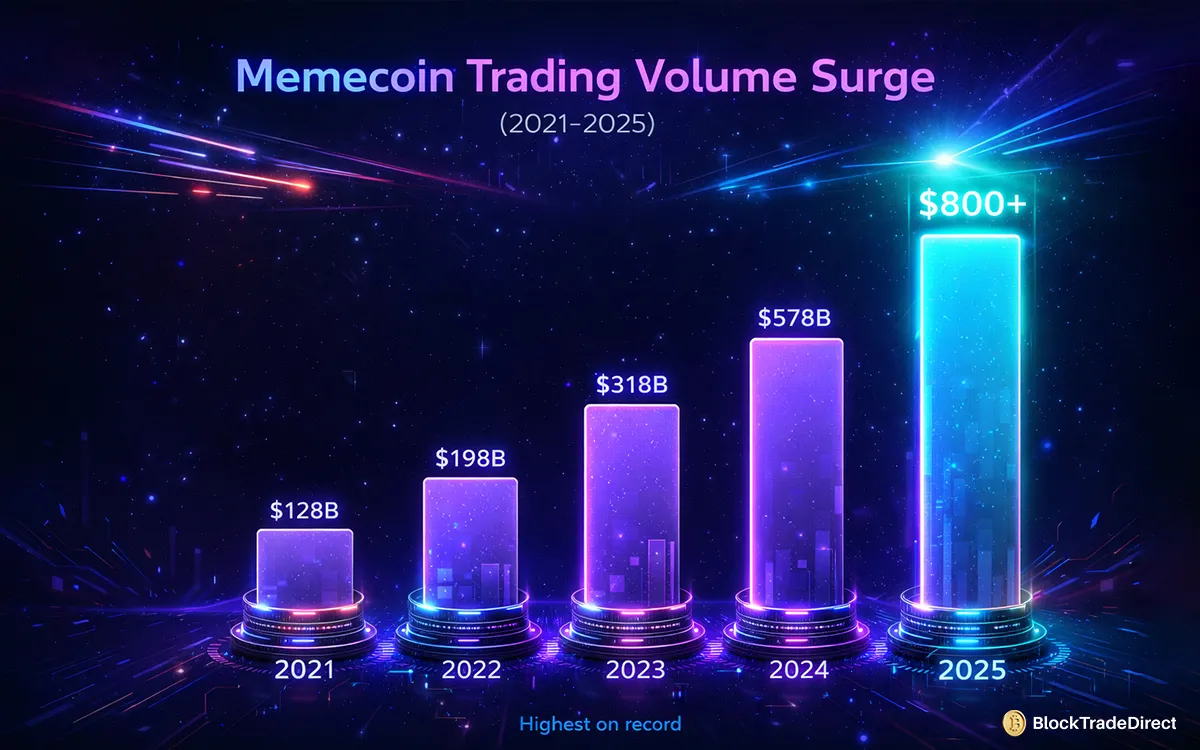

Memecoins aren’t new, but 2025 turned into their biggest breakout year. Trading volume surged, more exchanges started listing them earlier, and thousands of new retail investors entered the market looking for quick wins. The boom wasn’t accidental. Several trends hit at the same time and amplified one another.

A few forces played the biggest role:

Crypto has always rewarded visibility, and memecoins are built for maximum shareability. Viral memes spread faster than serious technical narratives, and that gives these tokens a massive advantage on social platforms.

TikTok, X, Reddit, and Telegram became the engines of discovery. A single meme, livestream, or endorsement could take a token from obscurity to trending within hours.

New traders liked the idea of buying millions of units for a few dollars. It felt more exciting than owning a tiny fraction of Bitcoin or Ethereum.

Stories of ordinary users turning a small investment into life-changing money fueled nonstop speculation. Everyone wanted to find “the next Shiba” before it took off.

Compared to previous cycles, it became much easier to buy tokens from centralized and decentralized platforms using mobile apps and instant swaps.

Put all of that together, and memecoins became a perfect product for a digital world where attention moves fast, money follows momentum, and communities can change markets overnight.

The early perception of memecoins was simple. They were jokes. No roadmap, no utility, no long-term plan. That idea isn’t completely wrong, but it’s no longer the full story. By mid-2025, a noticeable shift had happened. Projects that started with humor began adding real functions to survive beyond the hype cycle.

Utility trends emerging in the memecoin space:

Not every memecoin evolves into something useful, and plenty remain hype-driven with no long-term plan. Still, the path from pure meme to functioning crypto project is becoming more common. The coins that combine strong communities with real utility are the ones showing the clearest staying power.

Memecoins can be exciting, but they’re not the kind of asset anyone should jump into blindly. The upside can be huge, and the downside can be brutal. The smartest way to look at them is through a balanced lens instead of hype or fear.

|

Pros |

Cons |

|

Low entry price makes it easy to start |

Extremely volatile and unpredictable |

|

Potential for explosive returns in short periods |

Value heavily depends on social sentiment |

|

Strong online communities create momentum |

High risk of scams, rug pulls, and abandoned projects |

|

Fast liquidity on most DEXs and major exchanges |

Emotional trading and FOMO can lead to big losses |

Some people treat memecoins as a small high-risk slice of a larger portfolio, not the main investment. They know it’s speculative and approach it with caution. Others go all-in chasing quick money, and that usually ends badly when hype fades.

Memecoins aren’t inherently good or bad. They just move differently from traditional crypto assets. If someone chooses to participate, the smartest mindset is patience, research, and risk control rather than impulse.

Not every memecoin is a scam, but plenty rely on hype rather than real development. If someone’s planning to invest, the smartest move is to slow down, research the project, and protect their funds instead of chasing the loudest trend.

A reliable approach looks something like this:

It also helps to understand safe trading habits before diving in. New traders in the USA often consult guides on secure crypto trading practices to avoid leaving their security to chance. Another smart habit is learning from common crypto trading mistakes early on, rather than paying for them later.

People who treat memecoin investing like research, not gambling, tend to last longer in the market. Impulsive buying rarely ages well. Steady decisions do.

A lot of memecoins look exciting at first glance. Slick websites, loud communities, and promises of huge gains can feel convincing. But if you look closely, the warning signs usually show up early. Spotting them can save someone from falling into obvious traps.

Here are the most common red flags:

If any of these show up, it’s often better to walk away. The memecoin market moves fast, so another opportunity will always come along. The goal is to avoid losses that could have been prevented with a little caution.

Memecoins aren’t fading anytime soon. As long as social media keeps shaping cultural trends, there will always be tokens built around humor, characters, and virality. But the market is evolving. Short-term hype alone isn’t enough to stay relevant anymore. The projects that survive are the ones that combine community energy with real utility.

A few directions look increasingly likely:

Memecoins will probably remain high-risk and unpredictable, but that unpredictability is also what keeps traders coming back. They sit in the space between entertainment and speculation, and that combination isn’t going away.

Memecoins began as internet humor, yet they managed to carve out a lasting place in the crypto ecosystem. Dogecoin proved that a joke can turn into a global asset, and Shiba Inu showed how a meme-driven token can evolve into a full-featured network with staking, NFTs, and DeFi utilities. By 2025, the market will be louder and faster than ever, but also more mature in unexpected ways.

There’s a real opportunity here, along with real risk. Some traders walk away with life-changing returns. Others lose money by chasing hype without research. The people who tend to do well are the ones who stay cautious, verify projects before investing, and protect their funds instead of rushing in.

Memecoins aren’t going away because attention is a currency of its own. As long as culture drives markets, new tokens will keep appearing. The key is knowing how to enjoy the excitement without letting it control decision-making. A steady mindset always outperforms impulse.

Yes, some do, but there’s no guarantee. Gains usually come when a project builds real momentum and liquidity, not just hype. The timing of entry and exit matters more in memecoins than in most other crypto sectors.

Most are not built for the long haul, but a few evolve into real ecosystems with staking, NFTs, or gaming utility. The ones that add functionality and maintain active communities tend to last longer than meme-only tokens.

Start with research, not FOMO. Stick to trusted exchanges or well-reviewed DEXs, verify contract addresses, and use secure wallets. Learning safe trading basics early can prevent mistakes that many new investors make.

Consistency. Active development, transparent founders, a clear roadmap, and a sustainable community are stronger signs than trending memes or celebrity endorsements.