Crypto continues to develop rapidly, and the market share of digital assets has burst. Every year, thousands of projects are launched, the vast majority of which are not developed on their own network but on top of the existing ones. Due to that, many novices get into the same trap: what is the difference between a cryptocurrency and a crypto token?

They are both traded, and both are on blockchains, but they are not the same. Such coins as Bitcoin or Ether are native currencies of their respective blockchain. Instead, tokens are created using the foundation of another blockchain and may take the shape of virtually anything, such as access to an application, voting rights, ownership of a particular asset, or even digital collectibles.

Such a difference is important when one is starting to invest, trade, make a project, or even trying to comprehend the way Web3 functions. This guide will tackle everything in stages: what crypto tokens are, how they differ from cryptocurrencies, how they are used, some real-life examples, market trends in 2025, and what to look for before getting involved.

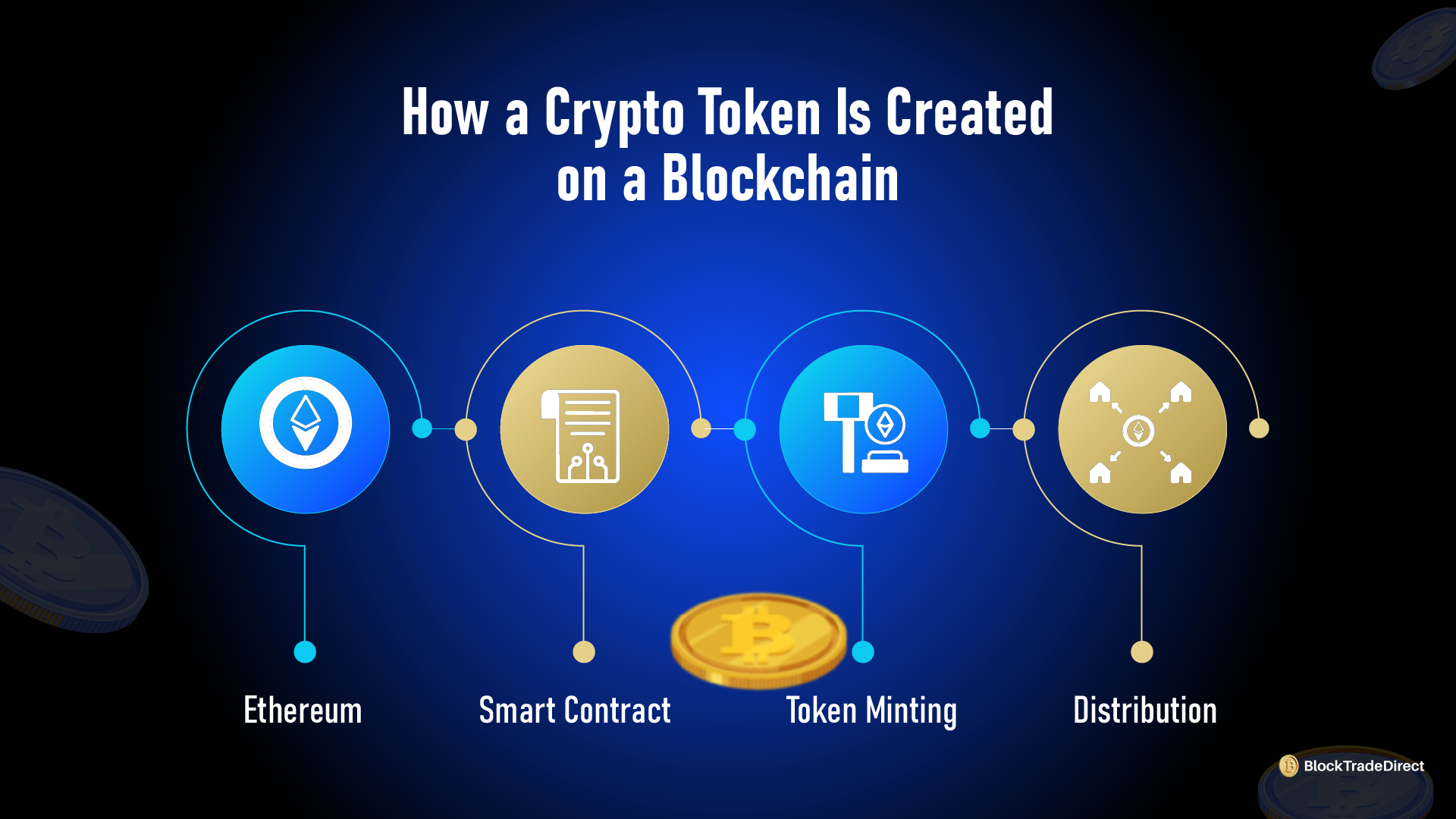

A crypto token is a digital currency that is built over an already existing blockchain instead of operating a network. Rather than creating an entirely new chain, a project can get tokens created on a host blockchain such as Ethereum, Solana, Binance Smart Chain, or Polygon via a smart contract. This enables quick and channelable development at a lower cost.

The use of tokens is flexible since they can be used to signal almost anything. Others are access to a service or platform, others are ownership in a project or physical object, and others enable the user to vote on protocol changes. NFTs are classified under the umbrella of crypto tokens since they are developed using smart contracts on existing blockchains.

In simple terms, a crypto token isn’t just a digital currency. It’s a programmable asset that can carry value, authority, or access depending on how its issuing smart contract is designed.

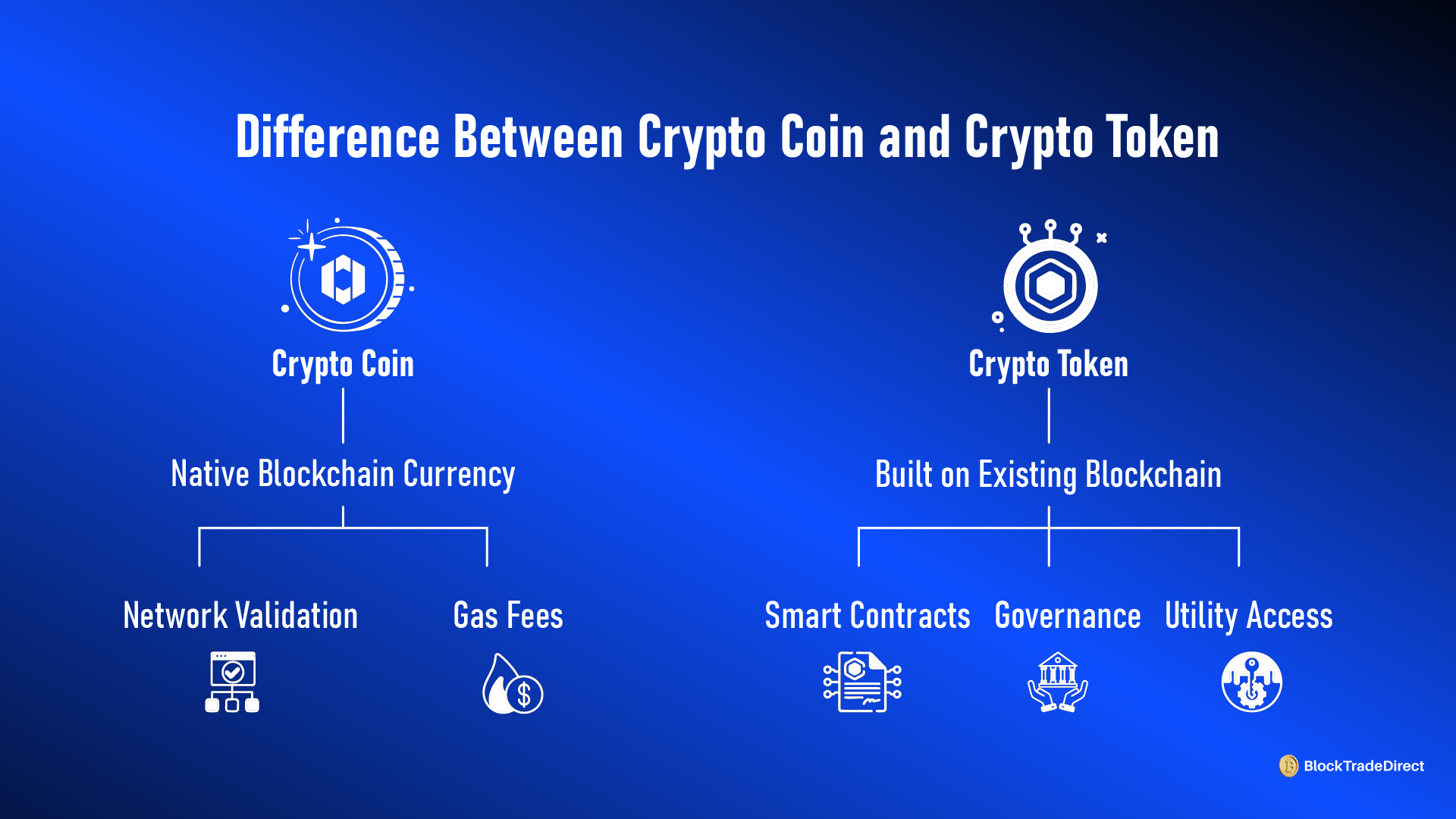

A crypto coin is a cryptocurrency which is the native currency of its blockchain. It drives the network on the foundation level. Bitcoin is based on the Bitcoin blockchain, Ether is based on the Ethereum network, etc. These are not coins that are minted as an outcome of smart contracts on another chain. Their existence is due to the existence of the network.

The cryptocurrencies are made to work mainly as electronic currency. The payments, walleting money, transferring finances across the world, or even rewarding the validators and miners who ensure the safety of the network are all achieved using them. All the transaction fees that are paid on a blockchain are paid in its native coin, and therefore, coins are necessary in the operation and maintenance of the infrastructure.

In short, cryptocurrencies act as the economic backbone of blockchain networks. Without a native coin, the underlying blockchain cannot operate securely or process transactions. That’s the core distinction between coins and tokens — coins fuel a network, while tokens are built on top of one.

Both tokens and cryptocurrencies are digital assets, but they play different roles in the blockchain ecosystem. Coins power their own blockchains, while tokens rely on another blockchain to function. The easiest way to understand the difference is to compare how each works at the network level.

|

Aspect |

Crypto Coin (Cryptocurrency) |

Crypto Token |

|

Origin |

Native to its own blockchain |

Built on an existing blockchain |

|

Network Control |

Full control over its blockchain rules, security, and consensus |

Relies on the host blockchain’s infrastructure for validation and security |

|

Creation |

Comes into existence through blockchain consensus, mining, or staking |

Issued through smart contracts |

|

Purpose |

Digital currency for payments, value transfer, staking, and paying gas fees |

Utility, governance, asset representation, access rights, stablecoin use, NFTs |

|

Dependency |

Independent |

Dependent on the parent blockchain |

|

Examples |

BTC, ETH, BNB, SOL, ADA |

UNI, MATIC (before Polygon mainnet), APE, USDT, LINK, NFTs |

|

Fees |

Used to pay transaction or gas fees |

Must be paid using the network’s native coin |

A token can never replace the native currency of the network it lives on. No matter how valuable a token becomes, users still need the native coin (like ETH on Ethereum) to pay gas fees and interact with the blockchain. That reliance is the biggest structural difference.

It is not mere technical trivia to know the distinction between coins and tokens. It influences the way you utilize them, the way you appraise the project, and the manner in which you take care of the risk in case it is an investment.

Money Coins are more like digital. They are perfect in payment, transfer, and storing of long-term value.

Tokens are more specialized. They may require them to access an application, invest in a platform, or participate in governance.

Not all digital assets are equal. The utility of coins is normally more evident as coins are directly linked to the existence of the blockchain. The value of tokens may be so great, and their worth is determined by the success of the project behind them. In case the project fails or falters, there is nothing the token is supported by.

Launching a completely new blockchain is complicated and costly. The process of issuing a token on an existing chain is significantly quicker and enables the development teams to work on products and not on a base network. That is why the majority of Web3 applications do not create their own blockchain but issue tokens.

Coins maintain the digital infrastructure.

Tokens expand what is possible on that infrastructure — from decentralized finance and gaming to NFTs, supply chain tracking, and tokenized real-world assets.

In short, the distinction matters because coins form the foundation of a blockchain economy, while tokens are everything built upon it.

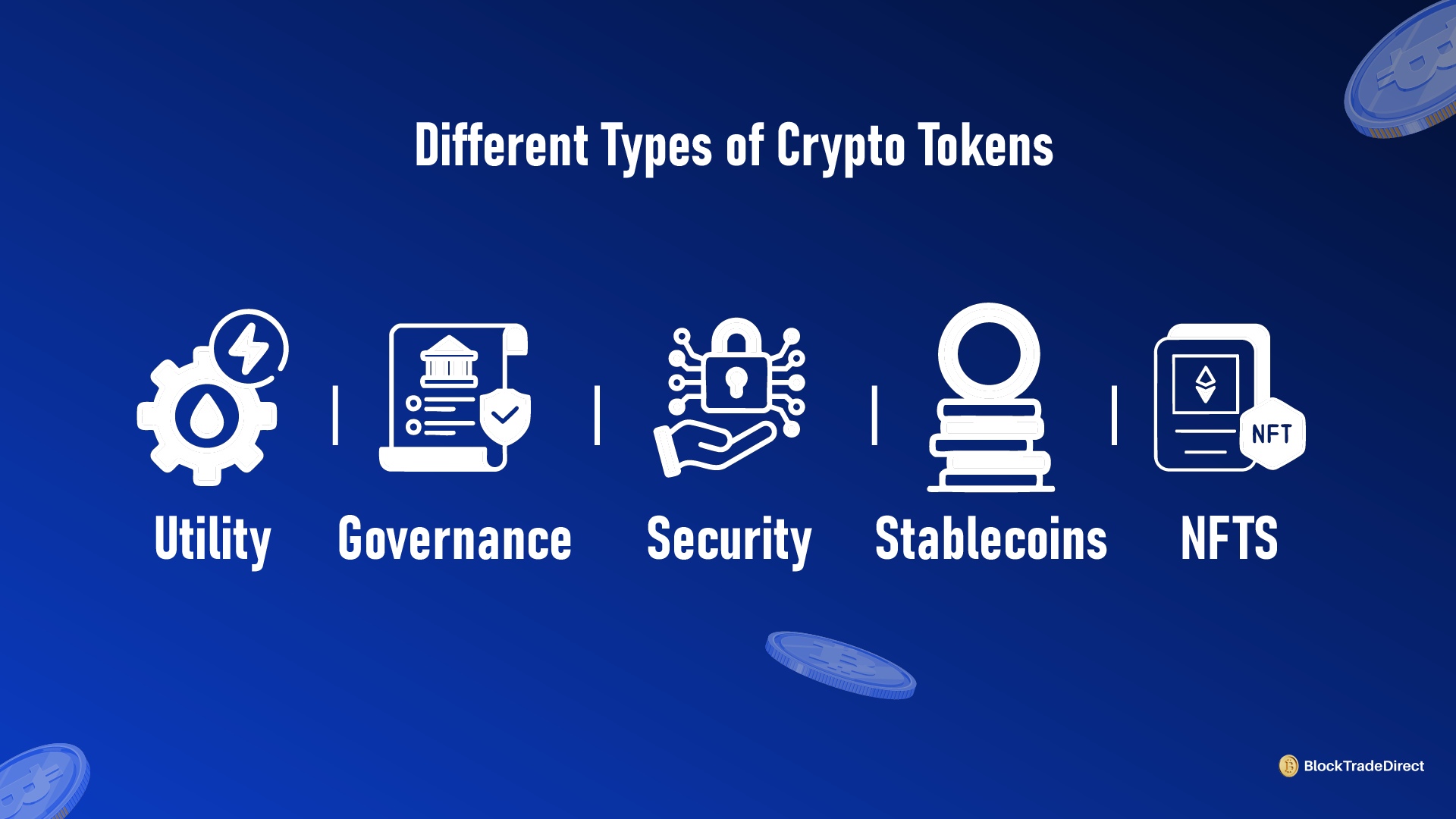

Tokens come in different forms because they’re not limited to being digital money. They can carry utility, authority, ownership, or rights depending on the project that issues them. Understanding the categories helps you identify what value a token actually provides.

These grant access to a product or service inside a blockchain ecosystem.

They’re used for things like paying platform fees, staking for rewards, accessing premium features, or participating in dApps.

Examples:

These represent financial ownership. They behave similarly to traditional securities like stocks or bonds, but in tokenized digital form.

They may provide dividends, profit sharing, or equity rights.

Examples:

These provide voting power in decentralized organizations or protocols.

Holders can vote on upgrades, fees, incentives, and future direction.

Examples:

These are created to maintain price stability by being pegged to a fiat currency, commodity, or basket of assets.

Examples:

Technically, NFTs are also tokens because they’re built using smart contracts on blockchain networks.

Their key difference is that they are non-fungible, meaning each token is unique and cannot be exchanged on a one-to-one basis.

Examples:

In short, the word “token” covers a huge spectrum. A token might be a digital membership pass, a voting chip in a DAO, a digital dollar, or even proof that you own a virtual sword in a game.

The crypto market in 2025 looks very different from the early years when digital assets were mostly seen as experimental money. Tokens have taken center stage because they unlock so many use cases beyond payments. While coins still dominate in terms of long-term store-of-value and network security, the real growth right now is coming from tokenized applications and real-world utility.

Even if exact figures vary by source, three trends remain consistent across industry reports:

Tokens can offer incredible opportunities, but they also carry higher uncertainty because they depend on the success of the projects behind them. A clear approach helps you stay safe and make smarter decisions.

Before buying or using any token, check:

If the entire value of a token depends on hype instead of usage, it’s a warning sign.

Not every token is legally treated the same way.

Security-type tokens may be subject to investment regulations depending on the country. That affects investor rights, taxation, and even whether the token can be traded on certain platforms.

Some tokens release new supply too rapidly, rewarding insiders and hurting long-term holders.

Make sure incentives are sustainable and not built around short-term hype.

Owning only hype-driven tokens can be risky.

A mix of strong assets from different sectors reduces the impact if one project collapses.

Always trade and store tokens through reputable exchanges and wallets.

Scam tokens and phishing links are common, especially when new projects trend on social platforms.

If you're learning how to navigate the crypto market safely, you might find this guide helpful too: crypto trading mistakes to avoid. It breaks down the common errors beginners make while trading and how to avoid costly slip-ups.

The goal isn’t to scare people away from tokens. The idea is to make sure anyone interacting with them knows how to recognize value, protect themselves, and navigate the market responsibly.

Coins and tokens both play important roles in the blockchain world, but they serve different purposes. Coins act as the lifeblood of a blockchain, keeping the network running and secure. Tokens are built on top of those networks and unlock real utility — access to apps, voting rights, stable digital dollars, ownership of assets, or digital collectibles.

If you’re considering getting involved, a simple checklist helps:

Digital assets are no longer limited to just currency. Tokens are becoming the way people participate in apps, finance, digital ownership, and online communities. Coins provide the foundation. Tokens build the experience on top of it.

Anyone learning crypto today doesn’t need to master everything at once, but understanding this core difference makes the rest of Web3 far easier to navigate.

No. A cryptocurrency (or coin) is the native currency of its own blockchain, like BTC or ETH. A crypto token is built on an existing blockchain and is used for specific purposes inside a project or application.

Tokens can have real value if they offer true utility or represent ownership. The risk comes from tokens that rely only on hype rather than real usage. Always check what problem the token solves and how people are expected to use it.

No. Tokens depend on the host blockchain for transactions. You always need the native coin (like ETH on Ethereum) to pay gas fees and interact with tokens.

Not necessarily. Some tokens are meant only for access, rewards, or participation inside a platform. Only security-type tokens are designed to represent ownership or provide investment rights.

Buy from trusted exchanges and store them in a secure crypto wallet. Always double-check contract addresses, and avoid clicking token links shared on social media or private messages.