Finance is quietly being rebuilt under the hood. Not by banks or payment giants, but by decentralized applications, better known as dApps.

dApps are software applications that run on blockchains instead of centralized servers. In finance, that shift changes who controls money, how transactions settle, and who gets access. No intermediaries holding funds. No closed systems deciding who can participate. Just code, wallets, and open networks.

This matters because trust in traditional financial systems is strained. Cross-border payments are slow and expensive. Access to credit is uneven. Transparency is limited. dApps tackle these problems directly by making financial logic public, automated, and global by default.

In early 2026, financial dApps will no longer be niche experiments. DeFi platforms collectively process trillions of dollars in annual transaction volume, while active dApp wallets number in the tens of millions globally. Stablecoins alone settle more value on-chain each year than many legacy payment networks.

More importantly, dApps are becoming infrastructure, not products. They power decentralized exchanges, lending markets, payments, asset tokenization, and new financial models that were not possible before programmable money.

This article breaks down how dApps are reshaping finance, where they are already winning, and why they are likely to define the next phase of the global financial system.

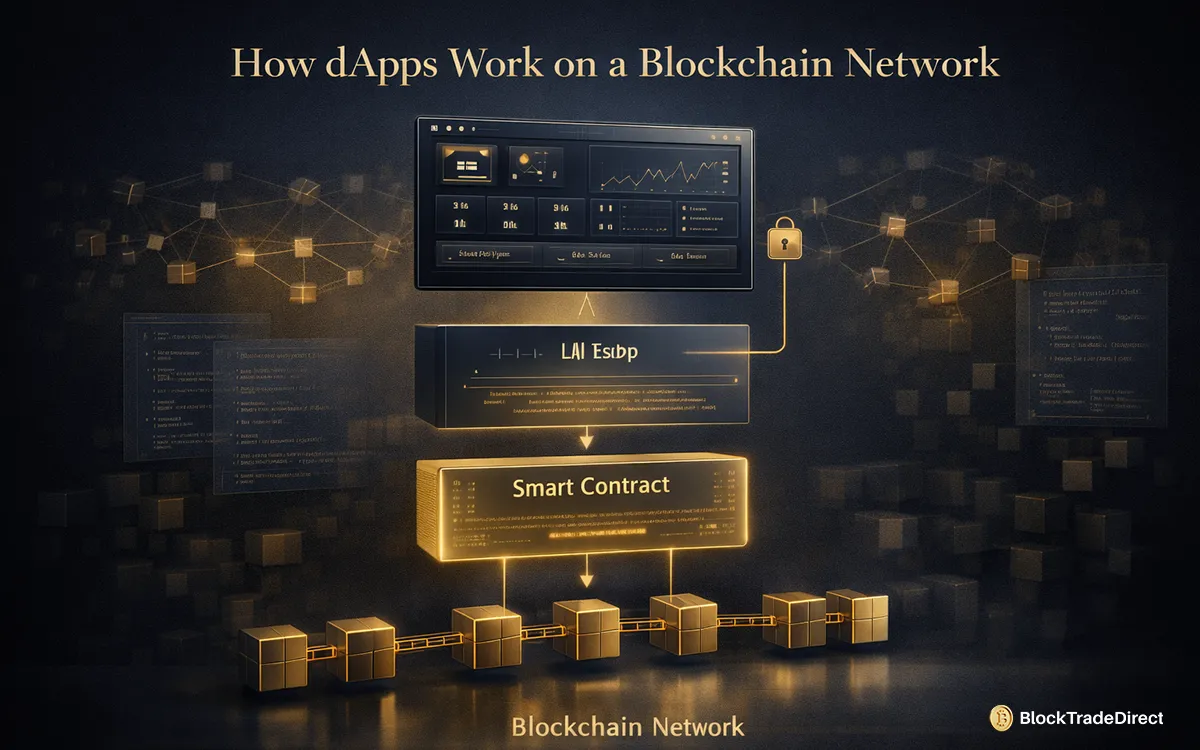

Decentralized applications, or dApps, are applications that run on blockchain networks instead of centralized servers. Unlike traditional finance apps controlled by a single company, dApps rely on smart contracts to execute logic automatically and transparently.

In a financial dApp, rules are written in code and deployed on-chain. Once live, those rules cannot be changed unilaterally. This removes the need to trust an institution and shifts trust to open, verifiable software.

At a basic level, most financial dApps consist of three layers:

Users do not create accounts with email addresses or passwords. They connect a wallet, sign transactions, and retain full control of their assets. If you are new to this concept, understanding how wallets work is essential. A clear breakdown is covered in this guide on crypto wallets.

Most financial dApps today are built on Ethereum and its Layer 2 networks, with growing adoption on newer blockchains optimized for lower fees and higher throughput. As infrastructure improves, dApps are becoming faster, cheaper, and easier to use, closing the gap with traditional financial applications.

The difference between financial dApps and traditional finance apps goes far beyond technology. It changes who controls the system, how trust is established, and where risk lives.

Traditional financial applications are built around centralized ownership. A bank, exchange, or payment provider controls user accounts, holds funds, approves transactions, and can reverse or block activity. dApps flip this model by design. Control moves from institutions to users, and rules are enforced by smart contracts instead of internal policies.

|

Feature |

Traditional Finance Apps |

Financial dApps |

|

Control |

Centralized institutions |

User-controlled via wallets |

|

Transparency |

Limited, internal records |

Fully on-chain and verifiable |

|

Access |

Permission-based |

Permissionless |

|

Custody |

Third-party holds funds |

Self-custody |

|

Settlement |

Delayed or batched |

Near-instant on-chain |

|

Downtime risk |

Single point of failure |

Distributed across networks |

These differences matter in practice. Self-custody reduces counterparty risk. On-chain settlement cuts delays and reconciliation costs. Open access enables global participation without credit checks or geographic barriers.

A clear example is trading. Centralized exchanges act as custodians and intermediaries, while decentralized exchanges operate entirely through dApps and smart contracts. If you want a deeper breakdown of how these models compare, this guide on Understanding Types of Cryptocurrency Exchanges: Centralized vs Decentralized explains it clearly.

As dApps mature, the gap in user experience continues to narrow, while their structural advantages in transparency and control become harder to ignore.

Decentralized finance does not exist without dApps. dApps are the interface layer that turns complex blockchain logic into usable financial products.

At the protocol level, DeFi is just smart contracts handling lending rules, trading formulas, or collateral management. dApps sit on top of that logic and make it accessible. They let users deposit assets, earn yields, swap tokens, or borrow funds with a few clicks, all without intermediaries.

This is where dApps quietly changed finance. Instead of siloed products owned by single companies, DeFi runs on open building blocks. One dApp can plug into multiple protocols at once, combining lending, trading, and yield strategies into a single experience. This composability is something traditional finance cannot easily replicate.

In early 2026, DeFi dApps collectively secure tens of billions of dollars in on-chain value, even after multiple market cycles. More importantly, they continue to attract developers, institutions, and fintech platforms experimenting with open financial rails.

For a deeper look at how DeFi itself is evolving and where it is heading next, this guide breaks it down in detail.

As infrastructure improves and regulatory clarity increases, dApps are shifting DeFi from experimental finance into a parallel financial system that runs continuously, globally, and without gatekeepers.

Financial dApps are no longer general experiments. They are dominating specific use cases where speed, transparency, and global access matter more than institutional control.

Trading was one of the first areas where dApps proved their value. Decentralized exchanges allow users to trade directly from their wallets without handing over custody.

Key advantages:

Automated market makers and on-chain order books now handle billions in daily volume, with Layer 2 networks making trades faster and cheaper than early DeFi models.

Lending dApps replace banks with smart contracts. Users deposit assets into pools and earn interest, while borrowers access liquidity by posting collateral.

What makes this model work:

In 2026, newer dApps are experimenting with undercollateralized loans using on-chain reputation, real-world data, and tokenized income streams, pushing DeFi closer to traditional credit markets.

Payments are one of the most practical applications of financial dApps. Stablecoin-based payment dApps enable near-instant transfers across borders at a fraction of traditional banking costs.

Why dApps are gaining ground:

These systems are increasingly used by freelancers, global businesses, and emerging market users who face limited access to traditional rails.

Asset management dApps simplify complex strategies into automated workflows. Users allocate funds, set risk parameters, and let smart contracts handle execution.

Common features include:

As these dApps mature, they are attracting more conservative users who value visibility and control over opaque fund structures.

Together, these use cases show why dApps are not just alternatives to traditional finance. In many areas, they are already more efficient, accessible, and resilient.

dApps are not standalone products. They are the connective tissue for the entire Web3 financial stack.

In traditional finance, infrastructure is vertically integrated. Banks own accounts, payment rails, settlement systems, and user data. In Web3, these layers are separated. dApps sit in the middle and coordinate how everything works together, without owning the system itself.

A single financial dApp can interact with wallets, identity tools, price oracles, multiple blockchains, and several DeFi protocols at once. This modular setup allows developers to build faster and users to move freely across services without being locked into one platform.

This structure gives users something traditional finance cannot. Financial self-sovereignty. Assets are portable. Data is transparent. Switching between platforms does not require permission or paperwork.

dApps also make it easier to work with different digital assets across chains. From stablecoins to governance tokens to tokenized real-world assets, everything can be accessed through the same wallet and interface. If you want a breakdown of how these assets differ, this guide explains the main categories clearly.

As Web3 infrastructure matures, dApps are becoming the default way users interact with decentralized finance. Not because they are flashy, but because they quietly make an open financial system usable.

Financial dApps in 2026 look very different from the first DeFi wave. The focus has shifted from experimentation to scale, usability, and real-world integration.

Here are the trends pushing that shift.

|

Trend |

Why It Matters for Finance |

|

Layer 2 expansion |

Lower fees and faster settlement make dApps viable for everyday use |

|

Account abstraction |

Smart wallets remove seed phrase friction and improve security |

|

Real-world asset tokenization |

Brings bonds, funds, and commodities on-chain |

|

Compliance-aware DeFi |

Makes institutional participation possible |

|

AI-assisted financial dApps |

Improves risk management and automation |

Layer 2 networks are now the default for most high-volume dApps. Users get near-instant transactions with fees low enough for payments, trading, and micro-investments.

Account abstraction is quietly fixing UX. Users can recover wallets, batch transactions, and pay gas fees in stablecoins. This removes one of the biggest onboarding barriers for non-crypto users.

Real-world assets are no longer theoretical. Tokenized treasuries, credit instruments, and yield-bearing funds are being integrated directly into DeFi dApps, giving users exposure to traditional markets without leaving the blockchain.

Compliance tooling is emerging as a middle ground. Instead of blocking regulation, newer dApps offer selective disclosure, on-chain identity proofs, and permissioned pools that meet regulatory requirements while keeping settlement decentralized.

AI-driven automation is improving how dApps manage risk. From dynamic collateral management to smarter liquidation logic, AI is being used behind the scenes to make protocols more resilient.

Together, these trends signal a shift. Financial dApps are no longer trying to replace everything at once. They are becoming a reliable infrastructure that both individuals and institutions can actually use.

Despite rapid progress, financial dApps still face real obstacles. These challenges are less about technology working at all and more about making it work safely, at scale, for everyday users.

Key friction points include:

The good news is that most of these issues are being actively addressed. Better audits, simpler interfaces, account abstraction, and clearer regulatory frameworks are reducing friction with each cycle.

The direction is clear. The remaining barriers are no longer structural. They are refinement problems, and dApps tend to improve fast once the foundations are in place.

Financial dApps are often framed as a replacement for banks and financial institutions. In reality, the more accurate picture is coexistence.

Traditional finance still excels at compliance, consumer protection, and large-scale capital allocation. dApps excel at transparency, speed, programmability, and global access. Those strengths do not cancel each other out. They fit together.

In 2026, many banks and fintech firms are experimenting with on-chain settlement, tokenized deposits, and blockchain-based payments, while keeping customer relationships and regulatory oversight off-chain. At the same time, DeFi dApps are integrating compliance tools that allow regulated entities to participate without sacrificing decentralization at the protocol level.

What is emerging is a hybrid model:

This shift makes the old “DeFi versus TradFi” narrative outdated. The real competition is between closed systems and open ones. In many cases, dApps are not replacing finance. They are quietly upgrading it.

The next phase of finance will not be defined by a single breakthrough. It will be shaped by the steady adoption of dApps as everyday financial infrastructure.

In the coming years, dApps are likely to move deeper into areas that were once off-limits to open systems. Tokenized equities and bonds will trade alongside crypto assets. Payments will become programmable by default. Financial products will be assembled from modular components rather than built as closed platforms.

Several shifts are already taking shape:

As trust grows and interfaces improve, users will interact with dApps without thinking about blockchains at all. They will simply experience faster settlement, lower costs, and more control over their assets.

The long-term impact is subtle but significant. dApps do not just change how finance works. They change who it works for.

Decentralized applications are no longer experimental tools for niche users. They are quietly becoming the foundation of a more open financial system.

By removing intermediaries, increasing transparency, and giving users direct control over assets, dApps solve real problems that traditional finance has struggled with for decades. They make global access possible. They make financial rules visible. And they make innovation faster by building on shared infrastructure instead of closed platforms.

The future of finance will not belong entirely to banks or entirely to DeFi. It will belong to systems that are open, programmable, and interoperable. dApps sit at the center of that shift, not as a trend, but as infrastructure that keeps compounding in value with every new use case built on top of it.

A dApp runs on blockchain infrastructure and uses smart contracts instead of centralized servers. Users connect with wallets, keep custody of their assets, and rely on code rather than institutions to enforce rules.

In most regions, using dApps is legal. Regulation usually applies to how platforms offer services, not to the underlying software. In 2026, many dApps will be adding compliance layers to work alongside existing laws.

Not entirely. dApps are better seen as infrastructure that complements traditional finance. Banks still handle regulation, large-scale lending, and consumer protection, while dApps handle settlement, automation, and transparency.

They can be, but risk still exists. Security depends on smart contract quality, audits, and user behavior. Self-custody gives more control, but also more responsibility.

Less than before. Wallet UX, account abstraction, and simpler interfaces have lowered the barrier significantly, though a basic understanding of self-custody is still important.