Cryptocurrency markets are recognized for their volatility and speed. They can spike or plummet in minutes, making timing and execution as valuable as the correct asset. Trading orders are where this comes into play. Whether an individual is purchasing Bitcoin for the first time or has an active trading portfolio, knowledge about order types is one of the most valuable skills to possess.

A trade order is not an easy buy or sell order. It's a tool that allows the investor to control how much they are willing to pay, when to make a trade, and how to set a limit on profit-taking or close a loss. Without all of this information, beginners will make costly mistakes like paying too much money during a fluctuating market or forgetting to set a stop-loss when the price goes in the wrong direction.

Crypto adoption continues to increase in 2025, as over 420 million people around the world now own digital assets, and spot trading volumes on trading exchanges are happening daily to amounts of over $100 billion. With that kind of liquidity and competition, plain buy and sell clicks are not enough. Knowing how different types of orders work allows traders to gain an edge by allowing them to risk manage, introduce discipline into strategy, and avoid impulse decisions during rollercoaster swings.

This tutorial describes the most popular and advanced crypto trading orders, how they work, and when to use them.

Essentially, a crypto trade order is a set of instructions left on a trading platform to buy or sell a cryptocurrency on some terms. Instead of winging it and guessing with charts when to make a trade, traders utilize different order types in cryptocurrency trading to do so automatically. Not only does it save time, but it also prevents one from knee-jerking into a trade under erratic market conditions.

Think of orders as autopilots that decide:

Without order types, every trade would be a naked market buy or sell, and the trader would be vulnerable to slippage, missed opportunities, and undisciplined losses. With structured orders, traders are able to:

All orders placed remain in the exchange order book, a live list of all sell and buy orders for a cryptocurrency. The order book indicates:

This steady stream of orders decides liquidity and influences how simple trades get filled. Understanding how the order book functions is the secret to recognizing why some orders are filled instantly and others might remain pending.

Cryptocurrency trading without understanding order types is driving with no brakes or signals. You can move forward, but you are not in control. Order types are guardrails that enable traders to decide how the trades pass through instead of leaving everything to chance.

Crypto markets are extremely volatile. The value of a coin can move 5–10% in an hour, and on major events, the moves are even more extreme. By choosing the right order type, traders are able to:

This field is particularly relevant in a market that operates 24/7. In contrast to traditional stock markets that shut down every day, crypto trading does not stop. That implies no trader can realistically watch prices all the time. Automated order types provide traders with control even if they are not at their screens.

For investors based in America, security increasingly matters with regulatory pressure and wild price volatility. Safe crypto trading in the USA is done with the use of proper order types, wherein risk management is at times the difference between long-term success and swift losses.

Order types are not just a technicality. It's a mindset shift—from chasing price action to controlling outcomes.

Beginners usually start with four simple order types. These are the foundations for trading using crypto exchanges without relying only on manual buy and sell buttons.

A market order will be filled instantly at the best accessible price. It's the fastest way to enter or exit a position, but it comes with a trade-off—slippage. In highly volatile markets, the actual price may be higher or lower than expected.

Risk: Paying excess or selling for less on large price moves

A limit order enables users to put in a limit on the highest price at which they want to purchase or the lowest price at which they will sell. The order will be executed only if the market reaches that level. This gives more control but potentially leaves the order unfilled.

Best for:

Risk: Missing out on the trade if the price never reaches your targeted level

The crypto stop-loss order is designed to help cap large losses. Traders set a trigger price, and when the asset falls to that level, the order gets converted to a market sell.

Best for:

Risk: In flash crashes, the sell may fill at a worse price than expected if liquidity is drained away.

A stop-limit order combines limit and stop together. Once the stop price is triggered, a limit order is placed instead of a market order. This adds specificity but also adds the risk that the trade won't fill if the market moves too quickly.

Best for:

Risk: Not being able to execute at all if prices gap across the limit level

These four order types are the foundation of the novice's toolbox. They balance speed, protection, and control, enabling new traders to cultivate discipline and sidestep some of the most common mistakes.

On top of the basics, traders use advanced orders to fine-tune their strategies. Such order types allow taking profit, managing multiple situations at once, or reducing exposure to volatility.

A trailing stop order tracks the market. Instead of setting a stationary stop-loss, the stop price lags behind as the asset trends in your favor.

A take-profit order will close a position automatically if a target price is reached.

A bracket order enters three orders at the same time: an entry, a stop-loss, and a take-profit.

An OCO order links two orders. If one is triggered, the other one gets canceled.

These will only trigger if certain conditions are met, e.g., price hitting a level or volume hitting a level.

TIF indicates how long the order will be in force. Examples are:

A flash order reveals your trade intention for a moment to the market before execution.

An iceberg order hides the full size of the trade by breaking it into small visible chunks.

A TWAP order splits a large order into smaller trades over time to achieve an average entry or exit price.

Entering multiple limit orders at different price levels to create a ladder.

These order types of higher orders are less favored by new traders, but are excellent tools when one gains expertise. They provide higher accuracy, allow complex trading strategy automation, and are widely employed by professionals to cope with volatile markets.

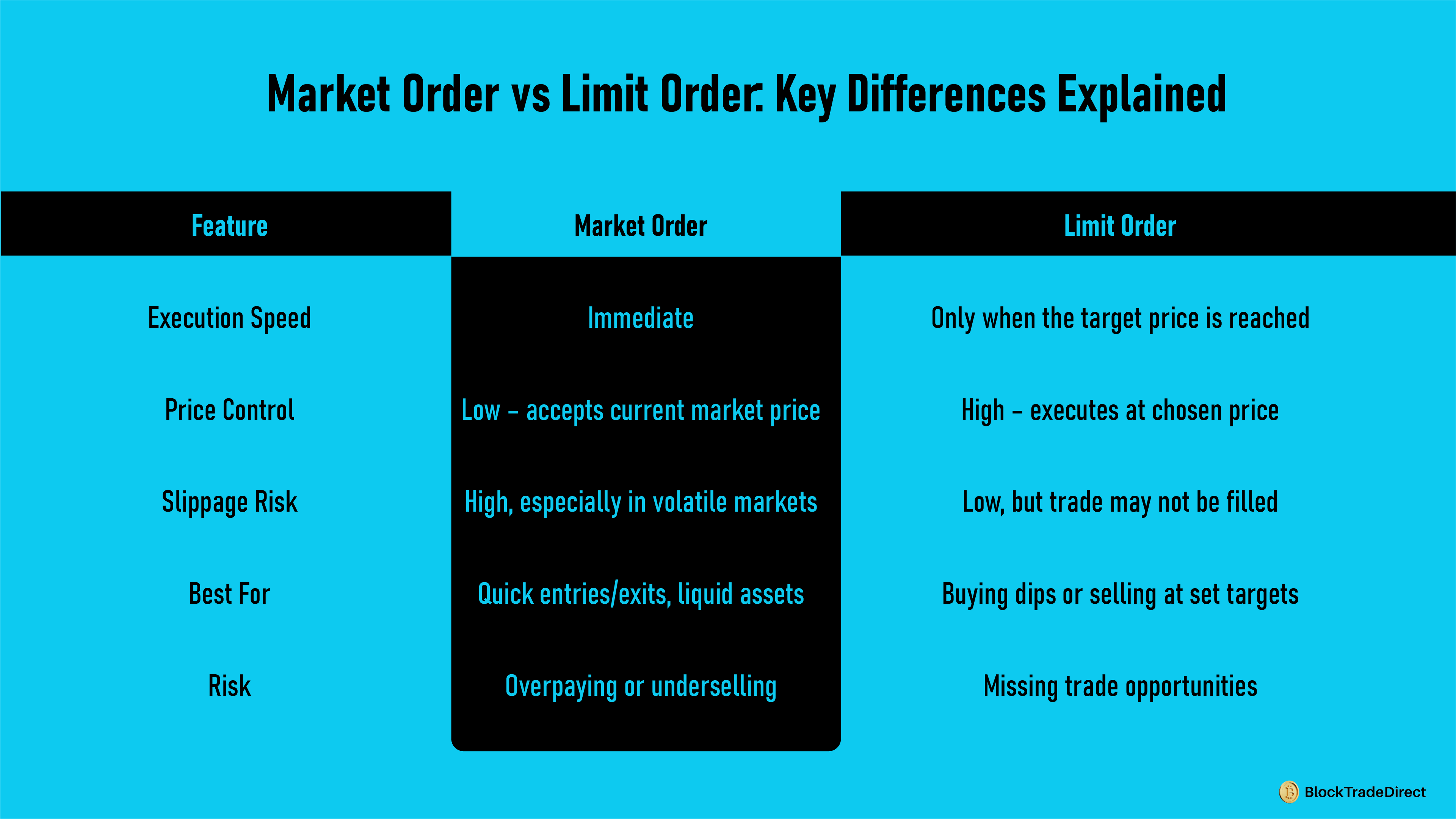

The most confusion among new traders is generally between limit orders and market orders. Both are popularly employed, yet they differ significantly in their role.

A market order prioritizes speed first, trading instantly at the best current price. A limit order prioritizes price control first, trading only if the market reaches the desired level of the trader. Understanding which one to use when is most crucial to avoid unnecessary cost.

Traders will use both. They can, for example, have a limit order to buy an asset at any price, and then have a stop-loss market order to avoid losses.

The best order type to use for crypto trading is one that suits your objectives. A long-term investor seeking sole exposure to Bitcoin might not need sophisticated setups, but an active trader is assisted by employing several orders to deal with volatility.

Beyond mechanics, traders should think about more broader strategy. Knowing order types is one step, but combining them with analysis, portfolio management, and proper risk sizing brings together consistency. To provide additional context, see the trading and investment strategy that bridges order execution and long-term planning.

Having the right order type is not complicated, but it is aligned with your goals and risk tolerance.

Although traders have a sound understanding of order types, they all end up misusing them or applying only one method. A few strategic adjustments can turn orders much more powerful.

For American traders, the right orders combined with disciplined habits are the way to long-term success. Read Protecting Your Crypto Investments for more techniques that complement order types to insulate your assets from market fluctuations.

Applying orders intelligently doesn't simply enhance trade execution. It keeps traders disciplined, allows them to handle risk, and prevents emotional trading decisions in a market that's always active.

Order types are the foundation of trading discipline. They transform simple buy-and-sell activities into disciplined trading strategies that can curtail losses and secure gains. For beginners, starting with market, limit, and stop-loss orders provides assurance. As experience increases, advanced instruments like brackets, OCO, or trailing stop orders allow greater flexibility.

With over $100 billion traded daily on crypto markets in 2025, things get intense. Those traders who understand how to use order types effectively are able to weather volatility instead of being caught out by it.

The key to mastering is practice. Most trading platforms now have demo accounts where one can practice with various order types without investing real money. This experiential learning helps familiarize and minimize errors when switching to live markets.

Ultimately, mastering crypto orders is more about putting definitions into practice to suit your individual trading objectives and risk appetite.

For beginners, using limit orders paired with stop-loss orders is generally the safest approach. Limit orders allow traders to control the price at which they buy or sell, preventing overpayment or underselling. Adding a stop-loss order helps protect against sudden market drops, reducing the risk of large losses in volatile conditions.

A limit order only executes if the market reaches the price you specify. If the price never reaches that level, the order stays open indefinitely, which means you might miss the opportunity to trade at a different level. Traders can choose to cancel or adjust the price to increase the chance of execution.

Not all exchanges offer advanced order types like OCO, bracket, or iceberg orders. Larger, well-established platforms typically provide a full range of advanced tools, while smaller exchanges may only allow basic market and limit orders. It’s important to check the order types supported before committing to a platform, especially for complex trading strategies.

Most exchanges allow traders to cancel or modify orders before they are executed. Market orders, however, are executed immediately and cannot be changed once placed. Limit, stop, and advanced orders can usually be adjusted, giving traders flexibility to respond to market changes.

A stop-loss order triggers a market sale once the stop price is reached, which ensures execution but may result in selling at a less favorable price during sudden market moves. A stop-limit order converts into a limit order at the stop price, giving more control over the execution price. The trade-off is that it may not execute at all if the market moves past the limit too quickly.