Crypto trading has changed quietly but completely. What started as people watching charts and placing manual orders has turned into a market where software reacts in milliseconds. By early 2026, a large share of crypto trades will no longer be placed by humans at all. They are executed by algorithms, trading bots, and AI-driven systems running around the clock.

This shift did not happen because traders wanted shortcuts. It happened because the market itself changed. Crypto trades 24/7, reacts instantly to global news, and moves faster than human decision-making allows. AI and automated trading bots stepped in to fill that gap.

Today, these systems scan massive datasets, detect patterns invisible to the human eye, and execute trades without emotion or hesitation. Retail traders use bots to manage risk and consistency. Institutions rely on AI to handle scale and speed. The result is a market where machine-led trading is no longer an edge. It is becoming the baseline.

Understanding how AI and automated trading bots work is now essential for anyone trading crypto in 2026, whether actively or long-term.

AI and automated trading bots are software programs that place trades on a trader’s behalf. They connect directly to crypto exchanges through APIs and execute buy or sell orders based on predefined logic or learned behavior. While they are often grouped together, not all bots are built the same way.

Traditional trading bots follow strict instructions set by the user. They do exactly what they are told, nothing more.

These bots work well in stable or predictable conditions, but struggle when the market shifts suddenly.

Common characteristics:

Popular use cases:

Once configured, these bots execute consistently but blindly. If market conditions change, the strategy can break.

AI trading bots go a step further. Instead of following static rules, they analyze data, identify patterns, and adjust their behavior based on market conditions.

They rely on machine learning models trained on historical and real-time data, allowing them to adapt as the market evolves.

Key capabilities:

|

Feature |

Traditional Bots |

AI Trading Bots |

|

Decision logic |

Predefined rules |

Data-driven models |

|

Adaptability |

None |

High |

|

Market response |

Reactive |

Predictive |

|

Risk handling |

Static |

Dynamic |

|

Long-term performance |

Strategy-dependent |

Model-dependent |

Understanding this distinction matters. Many traders fail not because bots don’t work, but because they expect rule-based tools to behave like intelligent systems.

AI trading bots are not growing in popularity because they sound advanced. They are growing because the crypto market has become too fast, too complex, and too competitive to trade manually at scale.

By 2026, algorithmic systems are estimated to account for a significant share of spot and derivatives trading volume across major crypto exchanges. Retail traders are adopting bots to stay consistent. Institutions are using AI to manage speed, size, and risk. The reasons on both sides overlap more than most people expect.

Key drivers behind adoption:

AI bots also fit how modern traders behave. Many manage multiple assets, trade across exchanges, or run strategies while working full-time. Automation turns trading from constant screen time into a system-driven process.

Another shift in 2026 is trust. Bots are no longer seen as experimental tools. They are becoming standard infrastructure, similar to stop-loss orders or portfolio trackers. Not using automation is starting to feel like trading with one hand tied behind your back.

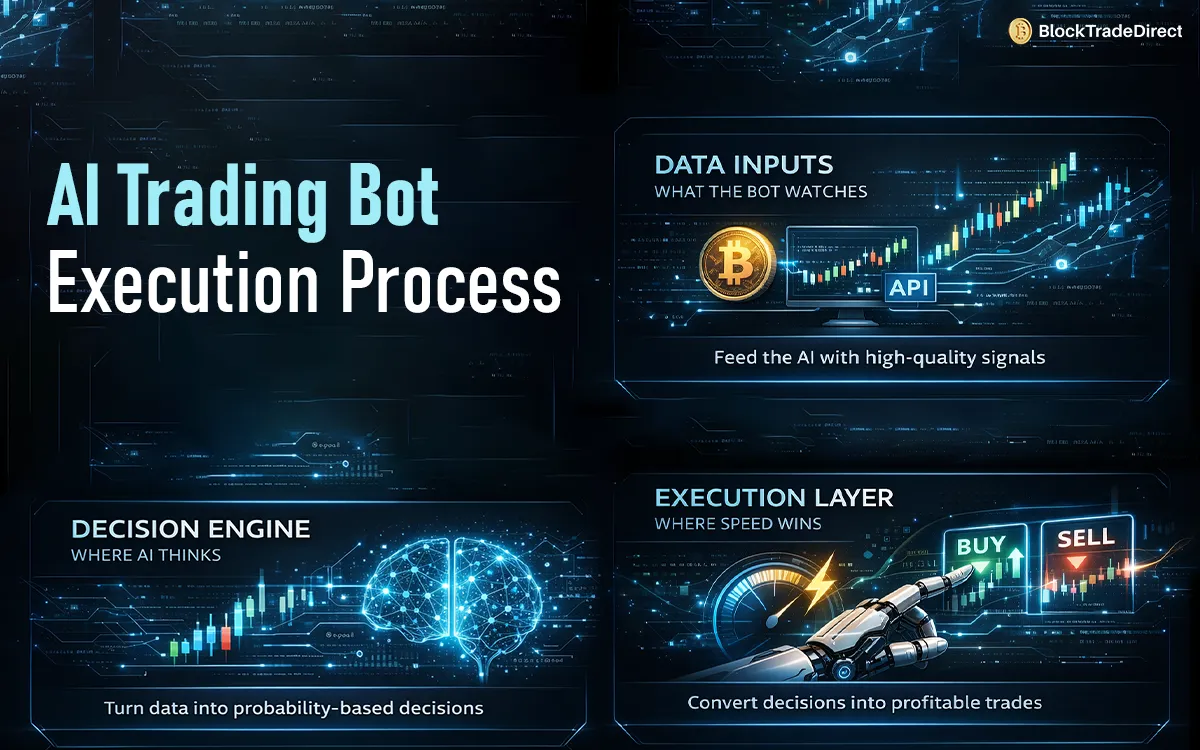

AI trading bots may look complex from the outside, but their structure is surprisingly logical. Most systems follow the same three-layer flow: data intake, decision-making, and execution. The intelligence comes from how well these layers talk to each other.

AI bots feed on data. The quality and variety of inputs often matter more than the strategy itself.

Common data sources:

In 2026, advanced bots will increasingly blend market data with behavioral and on-chain signals to reduce blind spots.

This is where AI separates itself from basic automation. Instead of checking simple conditions, the bot evaluates probabilities.

How decisions are formed:

Rather than asking “Did price hit this level?”, AI asks “What is the probability this move continues or reverses?”

Once a decision is made, speed matters.

Execution features:

A strong execution layer ensures the strategy’s edge is not lost between signal and trade. In fast crypto markets, that difference can define profitability.

AI trading bots are not built around one magic strategy. They apply intelligence to strategies traders already understand, then execute them faster, more consistently, and with better risk control. In 2026, a few approaches dominate real-world usage.

AI scalping focuses on capturing very small price movements, often dozens or hundreds of times per day.

How AI improves scalping:

This strategy depends heavily on execution speed and low fees, making AI a natural fit.

Trend-following bots aim to stay in profitable moves for as long as the trend remains intact.

Key advantages:

Unlike rigid indicator-based systems, AI models learn when trends are likely to fail.

Price differences across exchanges still exist, but they close quickly.

Why AI matters here:

Most modern arbitrage bots combine automation with predictive modeling to avoid unprofitable trades.

These bots focus less on frequent trades and more on long-term risk control.

Common features:

For many traders in 2026, this is the quiet workhorse strategy that prioritizes survival over excitement.

The appeal of AI trading bots is not just higher speed. It is consistency. In markets that never sleep, the ability to execute the same logic without fatigue or emotion becomes a real advantage.

Key benefits:

For retail traders, bots reduce the mental load of active trading. For institutions, they provide scale and discipline. In both cases, automation turns trading into a process rather than a series of impulses.

That said, these benefits only hold when the system is understood and monitored. Bots amplify discipline, but they also amplify mistakes if left unchecked.

AI trading bots are powerful, but they are not self-correcting money machines. Most losses linked to bots come from misunderstanding their limits rather than technical failure.

One of the biggest risks is overfitting. A model that performs perfectly on historical data may collapse in live markets because it learned noise instead of real patterns. Crypto markets change structure quickly, and yesterday’s edge can disappear without warning.

Key risks to be aware of:

Common problem areas:

|

Risk |

Why It Matters |

|

Overfitting |

Strong backtests, weak live results |

|

Latency |

Missed or poorly filled trades |

|

Model drift |

Gradual loss of performance |

|

Technical failures |

Unintended positions or losses |

AI does not remove risk. It changes where the risk lives. Successful traders treat bots as tools that require supervision, limits, and regular evaluation, not as set-and-forget systems.

As AI tools mature, a new distinction has started to matter in crypto trading. AI trading bots and AI trading agents are not the same thing, even though they are often used interchangeably.

AI trading bots are task-focused. They execute trades based on strategies, signals, or models. AI trading agents operate at a higher level. They can decide what to trade, when to trade, how much risk to take, and sometimes when not to trade at all.

Core differences:

|

Aspect |

AI Trading Bots |

AI Trading Agents |

|

Primary role |

Trade execution |

End-to-end decision making |

|

Autonomy |

Partial |

High |

|

Learning scope |

Strategy-level |

Portfolio-level |

|

Risk management |

Rule or model-based |

Adaptive and contextual |

|

Human input |

Frequent |

Minimal |

In 2026, most retail traders still use AI bots. AI agents are emerging in institutional setups, hedge funds, and advanced platforms where systems manage capital holistically rather than trade-by-trade.

This shift matters because it signals where the market is heading. Trading is slowly moving from automation toward autonomy.

AI trading bots are not just for quants or hedge funds anymore. In 2026, they are used by a wide range of traders, but they still suit some profiles better than others.

AI trading bots make sense for:

For these users, bots reduce emotional mistakes and improve discipline. They turn trading into a repeatable system instead of a reactive habit.

Who should be cautious?

Bots do not replace understanding. They amplify it. Traders with weak strategies tend to lose faster with automation, while disciplined traders gain efficiency and control.

As AI trading becomes standard, regulators and exchanges are paying closer attention to how automation is used. The goal is not to ban trading bots, but to prevent market abuse, instability, and unfair advantages.

Most major exchanges now enforce stricter API controls. These include rate limits, automated trade monitoring, and safeguards against manipulative behaviors like spoofing or wash trading. Bots that operate outside these boundaries risk account suspension or permanent bans.

Key regulatory themes:

Ethical concerns are also part of the conversation. AI systems can unintentionally exploit market inefficiencies in ways that harm liquidity or retail participants. In response, platforms and developers are emphasizing responsible design, clearer disclosures, and stronger risk controls.

For traders in 2026, the takeaway is simple. Using AI is allowed. Using it recklessly is not. Understanding exchange rules and maintaining accountability is now part of automated trading itself.

AI in crypto trading is moving from tactical tools to foundational infrastructure. The focus is shifting away from chasing short-term profits and toward managing risk, capital allocation, and long-term consistency.

In the coming years, trading systems are expected to become more personalized. Bots will adapt not just to market conditions, but to individual risk profiles, time horizons, and portfolio goals. Rather than running a single strategy, many traders will rely on coordinated systems that manage exposure across multiple markets.

Trends shaping the next phase:

The direction is clear. AI will not replace traders, but it will increasingly define how trading decisions are executed, measured, and managed. Those who understand this shift early will have a structural advantage as markets continue to evolve.

Getting started with AI trading bots in 2026 is easy. Doing it safely is what separates long-term traders from quick losses.

Most mistakes happen when traders jump straight into live markets. A bot might look profitable on a dashboard, but real conditions like slippage, fees, and volatility expose weaknesses fast. The goal early on is not profits. It is understanding behavior.

A safer way to start:

Many traders also start with simpler automation before moving into full AI systems. Messaging-based tools are a common entry point, especially bots that execute trades directly from chat platforms. If you are exploring that path, this breakdown on the rise of Telegram trading bots in crypto fits naturally into the learning curve and helps bridge basic automation with more advanced AI-driven systems.

The strongest setups grow slowly. When you understand how and why a bot trades, scaling capital becomes a decision, not a gamble.

AI and automated trading bots have reshaped how crypto markets operate. Speed, consistency, and data-driven execution now define the baseline. What used to be an advantage has become a requirement.

Still, the most important decisions remain human. Choosing the right strategy, setting risk limits, and knowing when to intervene cannot be automated away. Bots execute logic. They do not create judgment.

In 2026, successful crypto trading is less about prediction and more about process. AI helps enforce discipline and reduce emotional mistakes, but it rewards understanding, not blind trust. Traders who treat automation as a partner rather than a shortcut are the ones best positioned to survive and grow as markets continue to evolve.

They can be, but profitability depends on strategy quality, risk management, and market conditions. AI improves execution and consistency. It does not guarantee returns.

They outperform humans in speed, discipline, and data processing. Humans still outperform in judgment, strategy selection, and knowing when to stop a system.

Yes. Most exchanges allow them through APIs. Traders are responsible for complying with exchange rules and local regulations.

Some bots work with small capital, but fees and slippage matter. Many traders start with small allocations and scale only after consistent performance.

Beginners can use them, but only after understanding basic trading concepts. Bots amplify mistakes just as fast as they amplify good strategies.