Private equity investment has the potential for high returns, but with intricate risk and long-term exposure. This handbook explores dominant strategies, expected returns, and principal risks in discussing how U.S. investors can get involved in private equity and decide whether it is the right vehicle for their portfolio.

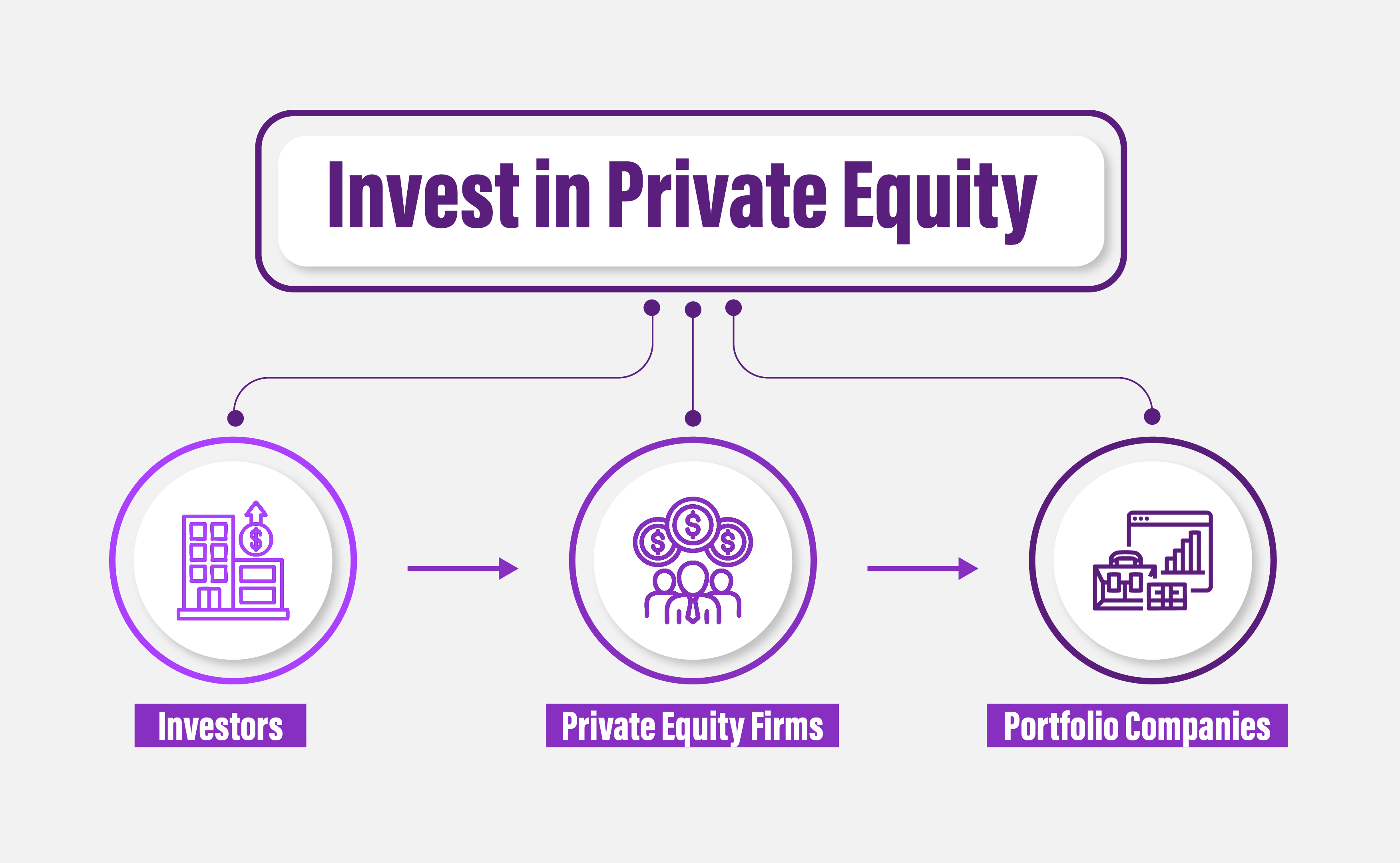

Private equity investment is the process of investing capital in privately owned companies—companies that are not publicly traded on a stock exchange—aiming at gaining long-term return on investment. The investments are, most of the time, purchasing equity stake in startups, existing companies, or rescuing struggling companies. The money invested is usually employed to invest in growth, enhance operations, or restructure ownership.

As opposed to public markets, private equity investments are illiquid and involve a longer investment tenure of 7 to 10 years. The investors directly hold the risk in the form of buying the shares of firms or indirectly by investing in private equity firms. The investments are typically restricted to accredited or institutional investors for reasons of their sophistication and risk-holding nature.

Involves buying a dominant stake in a business. Private equity companies usually restructure management and operations to improve profitability before selling the business at a valuation higher than what was paid.

Capital is infused in successful businesses that are profit-generating but require capital to expand operations, penetrate new markets, or broaden product lines.

They concentrate on early-stage or startup firms that have a high growth perspective. Although risk is great, so too is the potential for huge returns if the firm performs.

Money is invested in underperforming or insolvent firms with the target of reviving them. They are risky but can yield huge returns if revival is successful.

Provides diversification by combining investor capital to invest in several private equity funds to cut risk by gaining wider exposure.

Prior to now, only institutional investors and the wealthy could access private equity investments in the US. But with changing regulations and online platforms, there are now more people who can invest in this asset class.

However, a majority of opportunities still demand accredited investors, implying that they are above some income or net worth levels.

Below are four usual ways U.S. investors have access to private equity:

This is the acquisition of ownership equity in a privately held company directly. It entails extensive due diligence, familiarity with the industry, and the ability to accept greater risk—implying suitability for sophisticated investors or those with inside connections.

These collective investment vehicles are handled by professional PE firms. They invest in more than one company to diversify risk. Minimum investments tend to be high (typically $250,000+), and capital is tied up for a few years.

Virtual platforms such as Moonfare, Fundrise, or Yieldstreet have made private equity more accessible. They have lower minimum investments and easy-to-use portals, although choices might still be restricted to accredited investors.

A financial advisor is able to bring investors together with screened private equity opportunities and walk them through the risk, structure, and fit of those investments into their overall portfolio.

One of the main reasons investors are drawn to private equity is the potential for higher long-term returns. Historically, private equity has outperformed public markets, but it's important to understand that these returns aren't guaranteed and come with trade-offs.

Private equity investments historically have tended to offer returns varying from 10 to 15 percent per annum for a decade. Vanilla public markets, like the S&P, on the other hand, typically generate returns of 7–10% annually. These performance discrepancies have set private equity as the choice of anyone seeking better portfolio growth.

The flip side to these higher returns is almost always liquidity and time. So long is short-term private equity, typically forcing you to remain invested for between 7 and 10 years. Early selling is an option for stocks, but you won't get that luxury here.

Key Takeaways:

It is important to understand this trade-off between risk and reward prior to investing in private equity.

While promises of sky-high returns exist, private equity is not risk-free. Know what you are embarking on before taking the leap: private equity is not a liquid asset in that you cannot sell it anytime you want. The other downside: It requires huge commitments and deep pockets, as well as great long-term planning.

Here are some significant risks to note:

Once you invest, your money is locked up. You can't get out cheaply or sell your holding like you can with publicly traded stocks.

Most private equity investments have a lock-up period of 7 to 10 years, so you won't be seeing your capital anytime soon.

Getting into private equity sometimes takes a big upfront investment—sometimes hundreds of thousands of dollars—so it's not as accessible to the average investor.

Private firms are not as obliged to reveal as much information as publicly traded ones, so it's more difficult to gauge performance or risk.

The typical fee structure usually follows a "2 and 20" model, which comprises a 20% charge on profits along with a 2% annual management fee. This arrangement can affect your overall investment returns.

Familiarize yourself with these risks to assess whether private equity is suitable for your financial objectives and comfort with risk.

Private equity is a good diversification to a diversified portfolio—but only for some. If you are an accredited investor with high risk tolerance, a long-term time horizon, and no need for near-term liquidity, private equity can work. It will work best for you if you want higher returns and are willing to invest money for 7–10 years.

But if you need flexibility, lower charges, and transparency, traditional investments are more appropriate for you. Always seek the advice of a financial planner to ensure that private equity is appropriate for your financial needs, risk tolerance, and overall plan.

An investment with the potential to yield sizable long-term returns is private equity. However, this does present some challenges. Illiquidity, very high barriers to entry, and complex operational structures are issues that merit consideration and an adequate financial base when confronting this investment route. If you are an accredited investor who is patient for long-term gains, private equity could be a wonderful diversifier for your portfolio and a big boost to returns.

Before you step in, ask yourself whether you really know about the risks involved and your financial objectives. It often pays to first talk over your plans with a professional advisor. Don't leave without checking out our Beginner’s Guide to Private Equity for an introductory overview

Several online sites now offer access to private equity for non-accredited investors, but options are limited. Most traditional opportunities require accreditation.

Minimums vary from $25,000 on online platforms to more than $250,000 to access funds directly. The figure varies with the firm, platform, or fund.

Many private equity investments typically have a lock-up period ranging from 7 to 10 years. This extended timeline is essential for generating value.

Private equity may pay more than stocks but is riskier, less liquid, and more expensive. It's a better choice for sophisticated or long-term investors.

Private equity profits can be taxed as capital gains, though structures differ. Seek the counsel of a tax professional for advice tailored to your investment.