Angel investment has become a smart way for individuals to invest in potential startups before they become mainstream. Unlike traditional investment options like stocks or bonds, angel investment is funding early-stage companies directly—most times when they're at the most pivotal phase of expansion. Not only does it promise lucrative financial gains, but it also gets investors on groundbreaking ideas from the very start.

Angel investing is on the rise as a top alternative investment sector in America. Greater access to angel networks and online platforms is causing more investors to enter this space for portfolio diversification and early exposure to emerging markets, industries, and technologies.

Suppose you want to find out about how to begin as an angel investor or how to expand your alternative investment approach. If so, this guide will lead you through the fundamentals.

Quick Insight

Angel investing commonly serves as the entry point for high-growth startup opportunities prior to the general public's availability.

Being a type of alternative investment, angel investing is one way in which non-traditional assets such as private equity or commodities can be complemented. Angel investment is a situation where rich individuals known as angel investors invest their own funds in early-stage companies in return for equity or convertible debt. Investors usually come in very early, in some cases at the proof of concept stage or the prototype stage.

They are different from venture capitalists, who invest large pools of someone else's money from institutions and groups, investing their own money and sometimes alone or through angel groups. Since they're typically the first non-friend, non-family source of capital, their money is essential to a startup's existence and growth.

Along with the capital investment, angel investors also often bring startups valuable advice, strategic guidance, and access to professional networks—all investments that can make a business's prospects of success quite high.

Being an engine of innovation and entrepreneurship, angel investing is an important contributor to the startup ecosystem and economy at large.

Angel investing is no longer the preserve of a select few insiders. Over the last decade or so, it has made great strides in the U.S. owing to a thriving startup environment, changing fintech platforms, and increasing demand for alternative investments with greater potential for returns.

As more and more people start to diversify their investments away from usual asset classes, angel investing offers a fascinating way of investing in next-generation innovation, whether in tech, medical, clean technology, or consumer goods. Platforms such as AngelList and SeedInvest have lowered the barriers for fresh investors to enter into early-stage transactions, with lower minimums and curated deals.

It is not only about the very act of angel investing, which has always been traditionally seen as an opportunity to put some money behind visionary entrepreneurs and thus to tangibly influence the shape that industries and communities may take in the future.

Angel investing offers U.S.-based investors a high chance of considerable financial gain and personal satisfaction as an alternative investing route. Although this form of investing during a start-up stage is a risk, the successful company has the capability of providing a spectacular payoff of 10, 100, or even 1000 times more.

Angel investing allows diversifying into emerging industries such as recent technologies, biotechnology, and climate technology, thus helping to create employment and develop economies. Angel investing will also be an attractive investment by arming the investor with tax gains, including Section 1202 exclusions and Section 1244 deductions.

The process of angel investing has gotten less abstract in terms of access and education. One has to know the fundamentals of startups, find good deal flow, and have proper, disciplined investing processes.

Steps to Start Angel Investing:

Build Foundation Knowledge

Establish Investment Criteria

Access Deal Flow

Develop Due Diligence Process

Execute Investment Strategy

The emergence of internet angel investor platforms has revolutionized access to early-stage startup opportunities, making it easy for individual investors to access what used to be a closed domain. The platforms have massively democratized alternative investments by enabling accredited investors and, in some cases, non-accredited investors to seek opportunities, undertake due diligence, and enter with a lower level of capital.

Such platforms provide an organised and professional introduction to angel investment, even to first-time investors. They usually run with advanced company profiles, investor education services, and infrastructure so that users can analyse the investment opportunities. Others even allow connections to expert syndicated funds or expert-facilitated deals, which again lowers the learning curve and risk dimension.

They also utilize such places to develop diversified portfolios, monitor results, and invest in new innovative start-ups in multiple spheres such as fintech and healthcare, sustainability, and consumer goods.

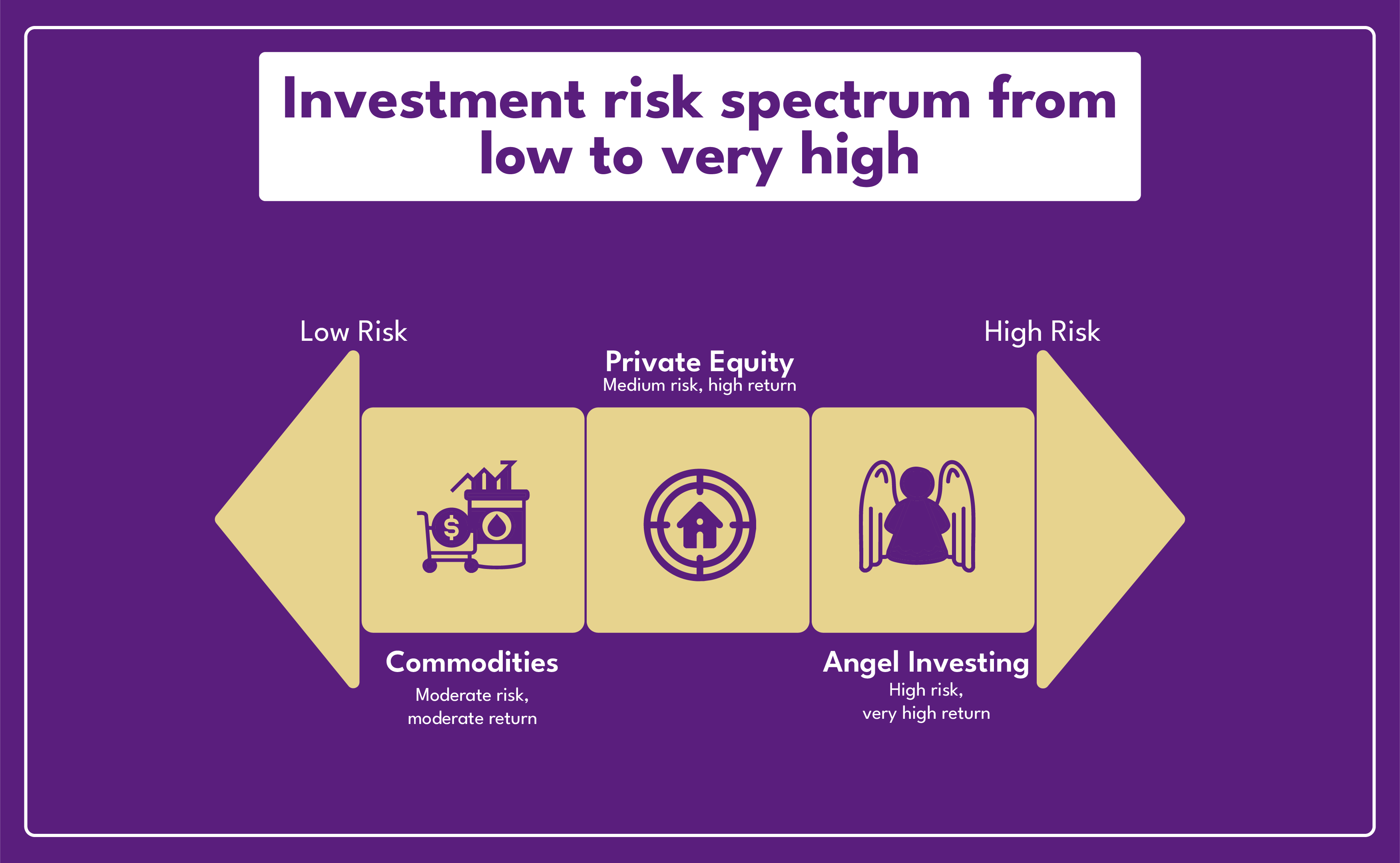

Angel investing is a form of very interesting alternative investments that U.S. investors can see today. While it may be a paradise of early payoffs and accessibility, it is interesting to know how it fares relative to other options such as private equity, venture capital, and commodities, each with their respective risk profile, liquidity, and investment horizon.

Whereas angel investing provides early-stage access to disruptive firms, other alternatives, such as private equity, might target more mature firms. Private equity would invest in mature firms with entrenched business models; it involves relatively minimal risk relative to high levels of capital required and longer fund lock-in times.

In contrast to venture capital, which is institutionally funded, angel investing is frequently accomplished through individual use of personal funds. Commodities are more liquid, but usually provide lower returns than high-growth startup investments.

Conversely, angel investing is defined primarily due to its exposure at early stages, capacity for innovation, and exponential potential returns on investment, particularly on disruptive startups, but it entails greater due diligence and risk tolerance.

Prior to entering angel investing, it's important that U.S. investors be familiar with both the regulatory environment and the strategic considerations for success. In nearly all instances, investors need to qualify as accredited investors, a classification set forth by the SEC on the basis of income or net worth. This would enable those coming into high-risk, private investments to be in a position to absorb losses.

Equally critical is the capacity to analyze a startup's fundamentals. A fantastic concept is not sufficient—investors must review the background of the founding team, the size and potential of the target market, revenue or traction so far, and how the company distinguishes itself from others.

Exit strategies are also essential. As angel investments are extremely illiquid, knowing when and how returns would be achieved—most commonly through an acquisition or IPO—allows for realistic expectations to be set.

The angel investing environment is changing at a fast pace, fueled by technology innovation, regulatory shifts, and increased emphasis on inclusive innovation. With industries such as AI, clean tech, and fintech speeding up even further, angel investors are increasingly contributing to fueling early-stage innovations that can transform industries.

Crowdfunding and broader retail investor involvement are also tapping into the pool of angel investors, bringing aboard new individuals who were formerly locked out of private markets. Technology and data analysis, meanwhile, are allowing individuals to look for and research high-growth potential startups in America and globally with greater ease.

In the future, angel investors will not just be money providers but also stakeholders in building a more equitable, sustainable, and technology-enabled economy.

If you’re new to this space, exploring how angel investing fits into the broader U.S. market is a great place to start. Angel investing is likely the most exciting and fulfilling alternative investment option today.

For American investors in search of high-growth potential, portfolio diversification, and the ability to drive innovation, it is financially and personally rewarding. There is a risk involved, but the ultimate benefits—financial return, tax advantage, and direct contribution—make it an appealing option for those able to look beyond traditional markets.

If you want to venture into the early-stage investment arena, the time is never better than it is today to learn, network, and start. Still comparing options? Here’s a deeper look at the difference between angel investing and venture capital.